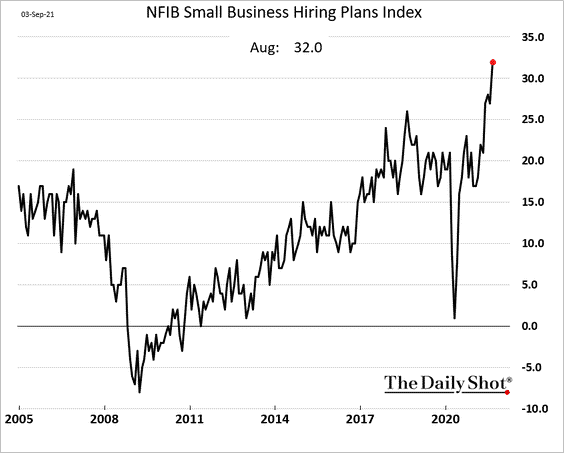

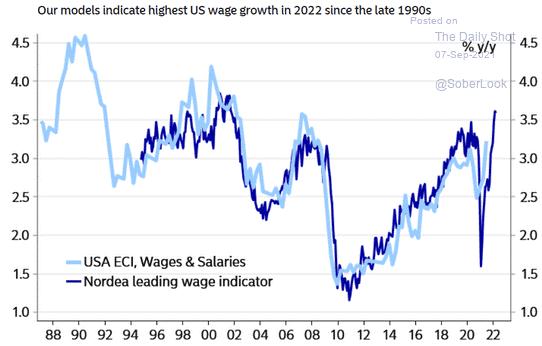

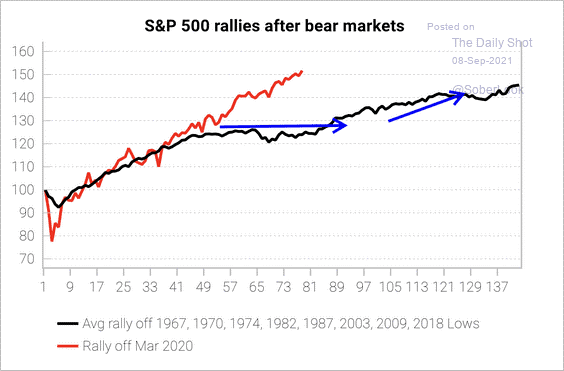

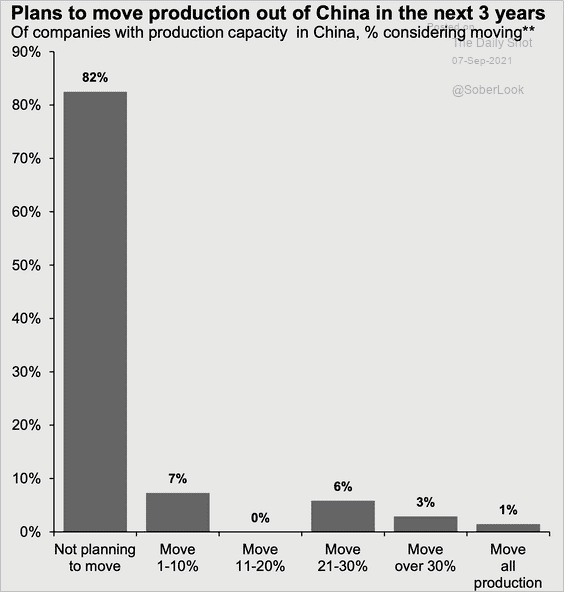

Though conditions have tightened, small businesses in particular still have ambitious plans for hiring, which may help push down unemployment numbers and provide a boost to already-well-above-trend wage gains. Could the expiration of the pandemic-era boost to unemployment benefits earlier this week potentially add some fuel to the fire? Meanwhile, equities have staged a record-breaking recovery from the March 2020 bear market; will they be able to avoid a repeat of last September when the S&P 500® Index clocked a 3.9% loss after five consecutive months of gains? Finally, though there’s been speculation of significant backlash to increased regulation in China, the majority of companies surveyed are not interested in withdrawing production in the near term. Will it be enough to sustain China’s already-slowing business activity?

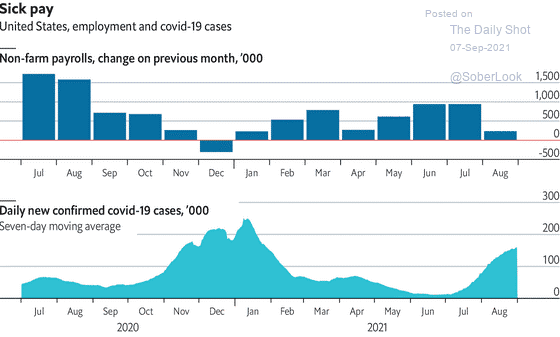

1. The recent surge in covid cases is impacting job growth:

Source: The Bureau of Labor Statistics, from 9/7/21

2. But hiring plans for small businesses have remained strong:

Source: The Daily Shot, from 9/7/21

3. High demand for labor and apprehensive supply will likely lead to further wage growth:

Source: The Daily Shot, from 9/7/21

4. The S&P 500’s performance from March’s lows has remained much stronger than the average of past recoveries:

Source: The Daily Shot, from 9/7/21

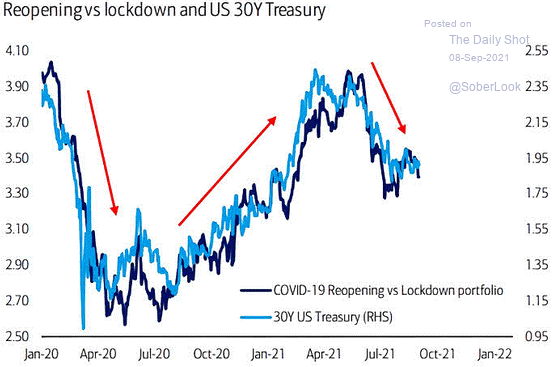

5. The “reopening” trade remains one of the market’s main themes:

Source: BofA Global Investment Strategy, from 9/8/21

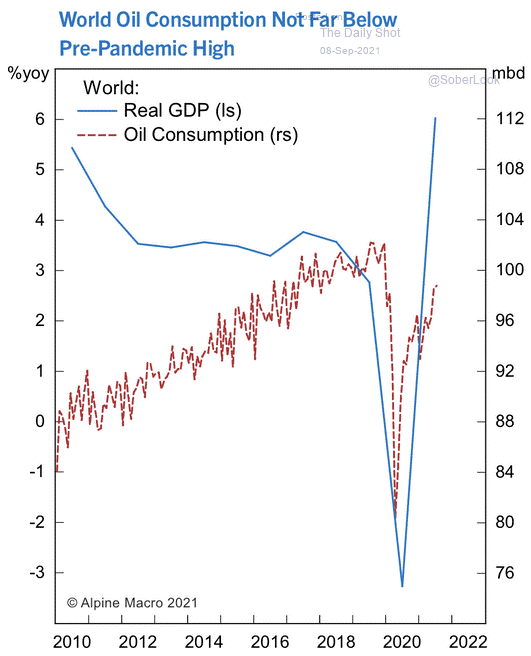

6. Oil consumption continues to recover, nearing pre-pandemic levels:

Source: The Daily Shot, from 9/8/21

7. Eurozone inflation expectations continue to rise, unlike U.S. inflation expectations which have leveled off:

Source: The Daily Shot, from 9/7/21

8. Despite recent increases in regulation, businesses have no plans to decouple from China in the near future:

Source: J.P. Morgan Asset Management, from 9/7/21

Disclaimer

The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

David M. Haviland a Managing Partner of the firm and Lead Portfolio Manager of Beaumont Capital Management (BCM). Check out his full bio here.