Dividends will matter in a big way.

According to Goldman Sachs, this year could be the year of dividend growth and investors should focus their attention there. With buybacks set to slow down, dividend growth could be the best way to get a solid total return out of your portfolio. And luckily, there are plenty of ways to add a touch of dividend growth to do just that.

Goldman’s April Note on Dividends

That’s the gist of a new research note published in April from the investment bank. According to the bank, stocks that prioritize their payouts and growing those dividends will do better than those that focus on buying back stock. The reason comes down to the macro-economic environment, earnings, and cash flows/balance sheet strength.

It’s no secret that the economic picture in the U.S. is getting a bit hazier, while rising rates have curtailed spending. That plays a part in how firms distribute excess cash to shareholders. Already, reported earnings for the fourth quarter of 2022 and first quarter of 2023 have shown that cash flow growth has slowed, while cash balances on average have decreased. With economic conditions becoming mixed, firms have a penchant for strengthening balance sheets.

This affects shareholder rewards. Dividends are sort of set in stone and most firms will not try to cut or suspend them unless they have to. In addition, dividends are paid out in installments. This requires less cash on hand or allows firms to still hold cash on their balance sheets. However, buybacks tend to be large sums of money at once. For a buyback to be effective, a company needs to buy a bunch each quarter, often much more outlay that it would to pay a dividend.

According to Goldman, the switch is already on. Looking at dividend and buyback data, for Q1 of 2023, dividends paid by companies in the S&P 500 grew by 8% year over year. However, buybacks have started to slide. First quarter data isn’t available yet, but the number of buybacks fell by 11% in Q3 of 2022 and by 21% in Q4.

To quote the report, “The difference in outlooks for dividend and buyback growth suggests firms focusing on dividends will continue to outperform buyback stocks.”

Supporting That View

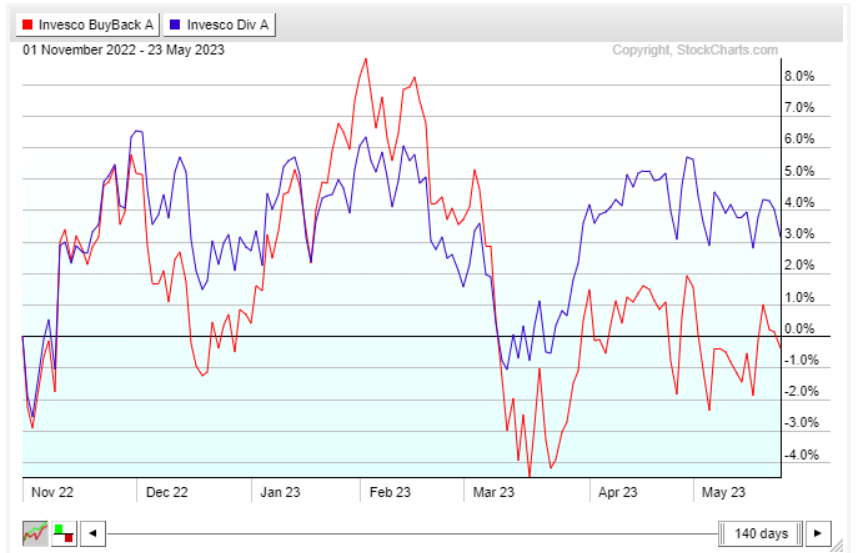

Looking at the Nasdaq U.S. Broad Dividend Achievers Index and NASDAQ U.S. BuyBack Achievers Index, the dividend payers have outperformed since the end of the third quarter last year. This chart highlights the difference. Just focusing on this year has shown a similar result, with dividend payers providing a positive return, while buyback-heavy stocks have trended sideways and down.

Source: StockCharts.com

With Goldman predicting more buyback cuts, but dividend growth to average 5% for the rest of the year, the potential for continued outperformance is there.

Focusing on Dividends Over Buybacks

Passive Dividend Growth Funds

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

| Vanguard Dividend Appreciation ETF | VIG | ETF | No | $76 billion | 5.8% | 0.06% |

| Invesco Dividend Achievers™ ETF | PFM | ETF | No | $723 million | 3.3% | 0.53% |

| ProShares S&P 500 Dividend Aristocrats | NOBL | ETF | No | $10.2 billion | 2.4% | 0.35% |

| iShares Core Dividend Growth ETF | DGRO | ETF | No | $23.3 billion | 2% | 0.08% |

Another choice? Go active. With active management, investors can find higher rates of dividend growth, strong initial yields or top/better performing sectors. You can certainly run our screener to find top stocks that fit your criteria. Or let a professional do it. Both the T. Rowe Price Dividend Growth and Fidelity Dividend Growth offer strong management, low costs, and long-term sector-beating returns. Goldman’s own GS Rising Dividend Growth Fund could also be a strong bet on dividend growth, expanding the theme to include MLPs, REITs, and other ‘non-stock’ stocks.

Actively Managed Dividend Growth Funds

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

| T. Rowe Price Dividend Growth | PRDGX | Mutual Fund | Yes | $20.2 billion | 2.1% | 0.62% |

| GS Rising Dividend Growth Fund | GSRAX | Mutual Fund | Yes | $499 million | -6.1% | 1.03% |

| Fidelity® Dividend Growth | FDGFX | Mutual Fund | Yes | $6.3 billion | -6.5% | 0.49% |

Don’t forget to check out all dividend-focused mutual funds and ETFs here.