Despite these long-term benefits, emerging markets fell sharply during 2022 as inflation and geopolitical tensions took their toll. The iShares MSCI Emerging Markets ETF (EEM) has fallen more than 20% since January, which is about 3% worse than the SPDR S&P 500 ETF (SPY) and 4% worse than the Vanguard FTSE All-World ex-US ETF (VEU).

Let’s take a look at why you should keep your allocation to emerging markets and why they’re still an essential part of a diversified portfolio.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

What’s Considered an Emerging Market?

Of course, emerging markets change and evolve, and not every lower-middle-income country should be grouped into the same bucket. For example, China has a highly industrial economy (like many emerging markets), but its economy is among the largest in the world. Therefore, many argue that it should be separated from other emerging markets.

So, investors should look at each fund’s country-level exposure when investing in emerging market funds. For example, EEM has significant exposure to China (30.45%), India (14.93%), Taiwan (14.54%), South Korea (11.72%), and Brazil (5.32%). In contrast, iShares MSCI Frontier and Select EM ETF (FM) has exposure to Vietnam (25.75%), Romania (6.92%), and other smaller markets.

Improving Resilience to Global Stressors

The Asian Financial Crisis in 1997 is a prime example of a meltdown. High levels of foreign debt, currency speculation, and over-investment in real estate led to financial turmoil across Thailand, Indonesia, South Korea, and Malaysia. While the IMF and other organizations bailed out affected countries, these efforts came with high unemployment and social unrest.

These days, inflation has been more challenging for developed economies than for emerging markets. Meanwhile, robust commodity prices have helped boost the GDP of export-driven economies, and strong U.S. consumer spending has increased demand for manufactured goods. As a result, emerging markets have been structurally sound.

Smart Diversification for Any Portfolio

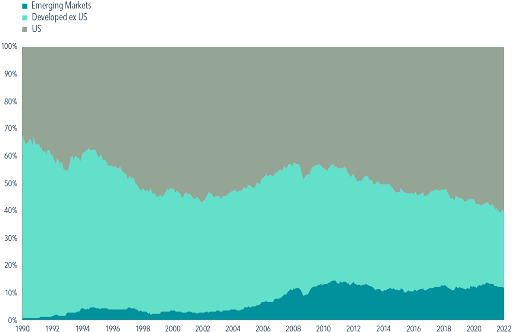

Source: Dimensional

In addition to building a more representative portfolio, emerging markets don’t typically move in lock-step with developed markets, like the U.S. and Western Europe. As a result, U.S. investors can benefit from diversification when domestic assets experience a shock. For instance, China was one of the best performing markets in 2020, during the depths of the COVID-19 pandemic.

Investors may also want to consider active ETFs to capitalize on emerging markets. Using fundamental analysis, fund managers can intelligently diversify a portfolio by accounting for geopolitical risks and other factors that could negatively impact some countries. And historically, active international ETFs have done relatively well compared to their passive peers.

Make sure to visit our News section to catch up with the latest news about investing.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.