Let’s take a look at why dividend stocks might fall out of favor and five alternatives that you may want to consider to diversify your portfolio income.

Learn more about portfolio management on our Portfolio Management Channel.

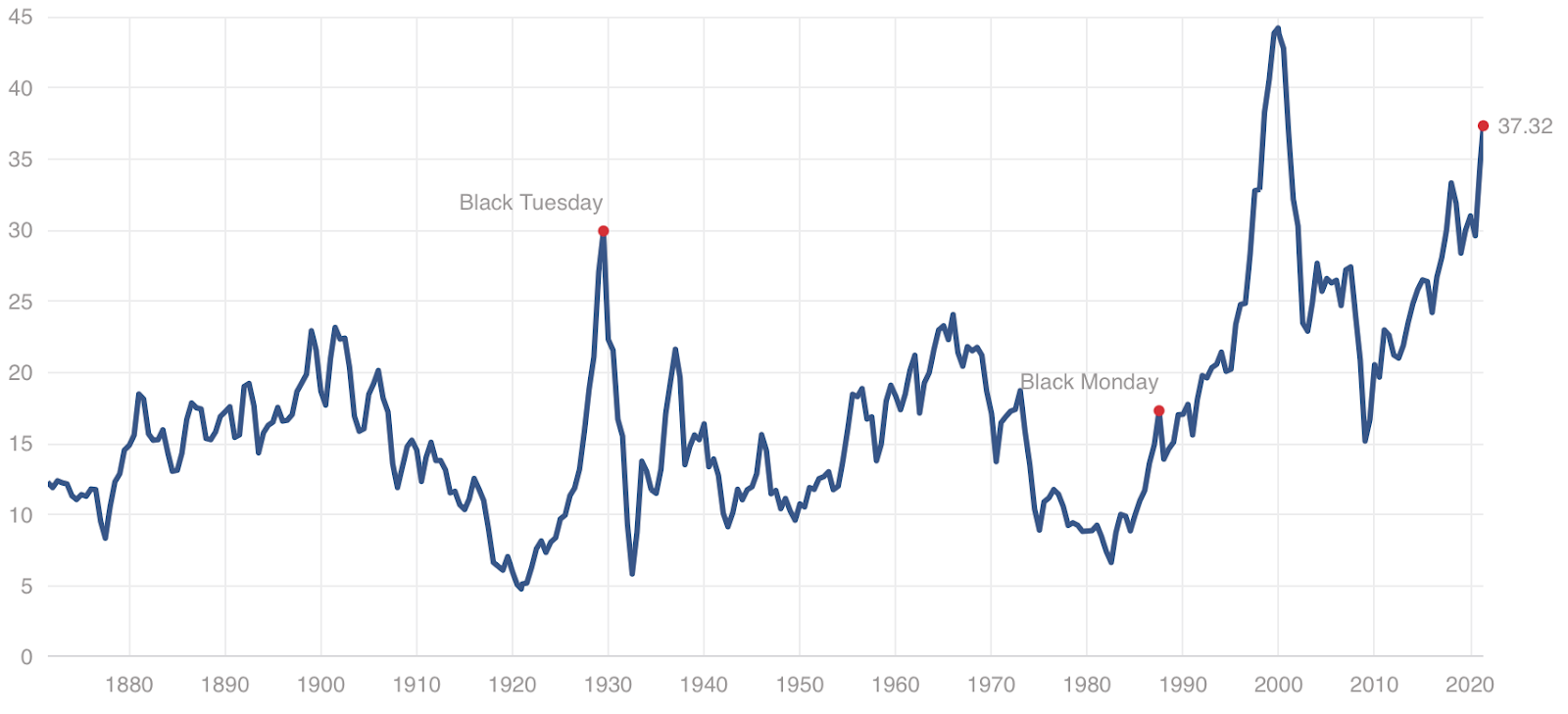

Stock Valuations Aren’t Cheap

In recent months, the stock market has seen valuations soar to fresh highs. The S&P 500 index’s Shiller price-earnings ratio is nearly 40x, which represents the highest levels seen since the 2000 dotcom bust. If interest rates rise in response to spending-driven inflation concerns, the market could see a contraction over the coming years from their current levels.

Of course, fixed income investments aren’t a very good alternative for those seeking safer sources of income. The same concerns over rising inflation and interest rates could push bond yields higher and prices lower, which creates a risk for those that were already holding bonds. In fact, Warren Buffett recently underscored these concerns in a note to his shareholders that you can read here.

1. Real Estate Investment Trusts

Of course, the performance of REITs depends on the wider real estate market. Residential REITs have soared with the combination of low mortgage interest rates and stimulus checks, whereas commercial REITs have struggled due to COVID-19-related shutdowns. Rising interest rates could also have a negative effect on real estate prices by increasing the cost of mortgage loans.

Be sure to check our REIT funds and ETFs section to know more about different ways to invest in this asset class.

2. Closed-end Funds

The ability to purchase CEFs below NAV is also their greatest drawback. If you purchase a CEF, there’s a chance it will drop below its NAV for a prolonged period of time, which means you may have to sell for less than the underlying assets are worth. Many CEFs also have less trading volume than more popular funds, which introduces some liquidity risk.

3. Master Limited Partnerships

MLPs tend to react less to energy prices than companies involved in oil and gas exploration, but they are still vulnerable to long-term trends in the industry. A prolonged drop in crude oil or natural gas prices could lead to lower dividends. In addition to these risks, higher interest rates could reduce capital inflows into the space and jeopardize expansion plans for many issuers.

Check out MLP industry funds and ETFs to know more about different investment options.

4. Preferred Stock

The biggest risk of preferred stock is that they are callable. If interest rates fall, issuers might redeem preferred stock shares for the price specified in their prospectus and reissue new shares with lower dividend yields. If interest rates rise, the price of preferred stock tends to fall as investors sell and seek better opportunities to generate income.

5. Income ETFs

Like any ETF or mutual fund, income funds have expense ratios that can impact long-term performance. Investors should also carefully consider a fund’s portfolio, liquidity, turnover, and other risk factors before making an investment. Low-cost index funds tend to offer the best performance and the lowest cost of ownership.

The Bottom Line

REITs, CEFs, MLPs, preferred stock, and income funds are potential options to consider with various benefits and drawbacks. When choosing an option for your portfolio, it’s important to consider both the yield and the unique risk factors involved with each one.

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.