There’s a great deal of literature that talks about the desired frequency of portfolio allocation. After all, rebalancing too infrequently puts your portfolio further away from its original risk-reward profile. But rebalancing too frequently increases transaction, fees, and tax payments.

In general, there are three common approaches to portfolio rebalancing. Any one of these rebalancing strategies is better than not rebalancing at all.

Want to know what is portfolio rebalancing? Click here.

Time-Only Approach

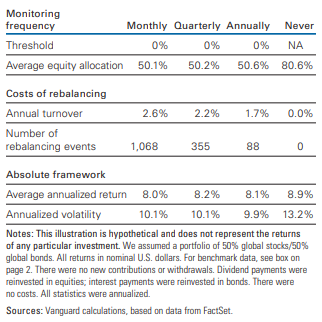

The time-only strategy requires that you rebalance your portfolio in pre-specified time intervals, regardless of how much or how little your asset allocation has drifted from its original target. Research carried out by Vanguard suggests there is no specific rebalancing frequency that consistently outperforms other strategies. Below is a snapshot of risk-adjusted returns based on monthly, quarterly, and annual time-only rebalancing.

Threshold-Only Approach

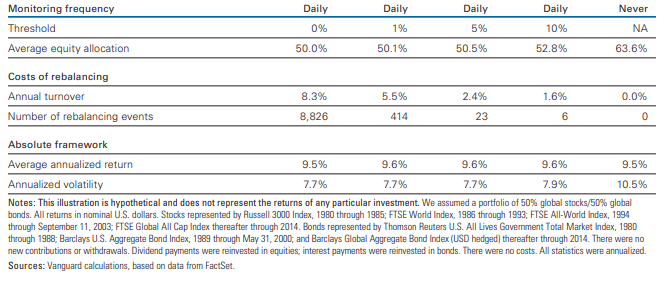

Vanguard has researched threshold rebalancing results for the period 1980 through 2014. As the following chart illustrates, average annual returns and volatility are consistent for threshold strategies that range from 1% to 10%.

Time-and-Threshold Approach

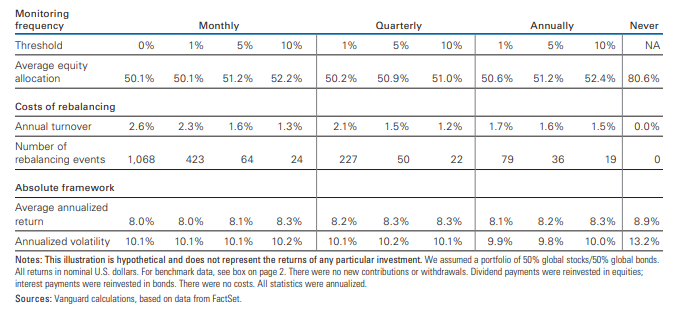

Vanguard analyzed the time-and-threshold between 1926 and 2014. As the following chart shows, rebalancing strategies that required more frequent monitoring at a lower threshold were more costly to implement. For example, a monthly monitoring strategy at a threshold of 1% had 423 rebalancing events. If you monitored quarterly and rebalanced at 5%, the number of rebalancing events plunged to 50. Average annual returns were relatively consistent across various timeframes, so investors with a smaller number of rebalancing events performed better.

Learn about other portfolio management concepts here..

The Bottom Line

Sign up for our free newsletter to get the latest insights on mutual funds.