From dramatic lockdowns to soaring unemployment, large and small companies have struggled to preserve liquidity and survive until a vaccine or other long-term solution emerges. Developed markets experienced the initial shock, but emerging markets are starting to experience their own issues in recent months.

Let’s take a look at how COVID-19 has impacted emerging markets and how investors should position their portfolio as the crisis unfolds.

Emerging Market Discount Widens

The latest case load data, as of July 23, 2020, include:

- Russia’s case load reached 15.3 million with 624,000 deaths.

- Brazil’s case load hit 2.23 million with 82,890 deaths.

- South Africa’s case load reached 395,000 with nearly 6000 deaths.

- India’s case load reached 60,000 with nearly 2,900 deaths.

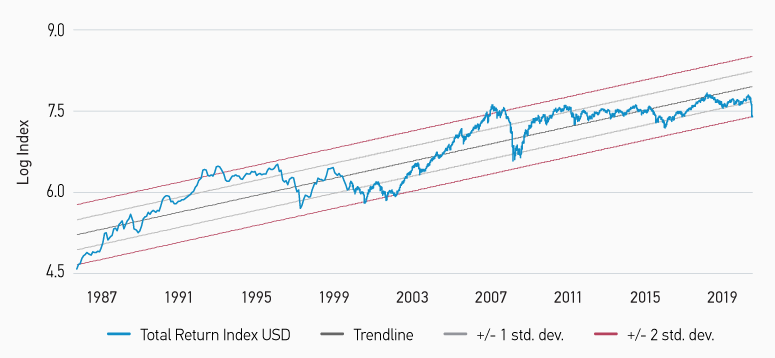

The combination of worsening domestic conditions and reduced export demand for emerging market goods, namely commodities, has pushed equity valuations to extreme lows. For example, Morgan Stanley found that emerging market equities were about 44% below their long-term nominal return trendline, representing a two standard deviation low only matched during the 1980s and the 2001/2002 recession.

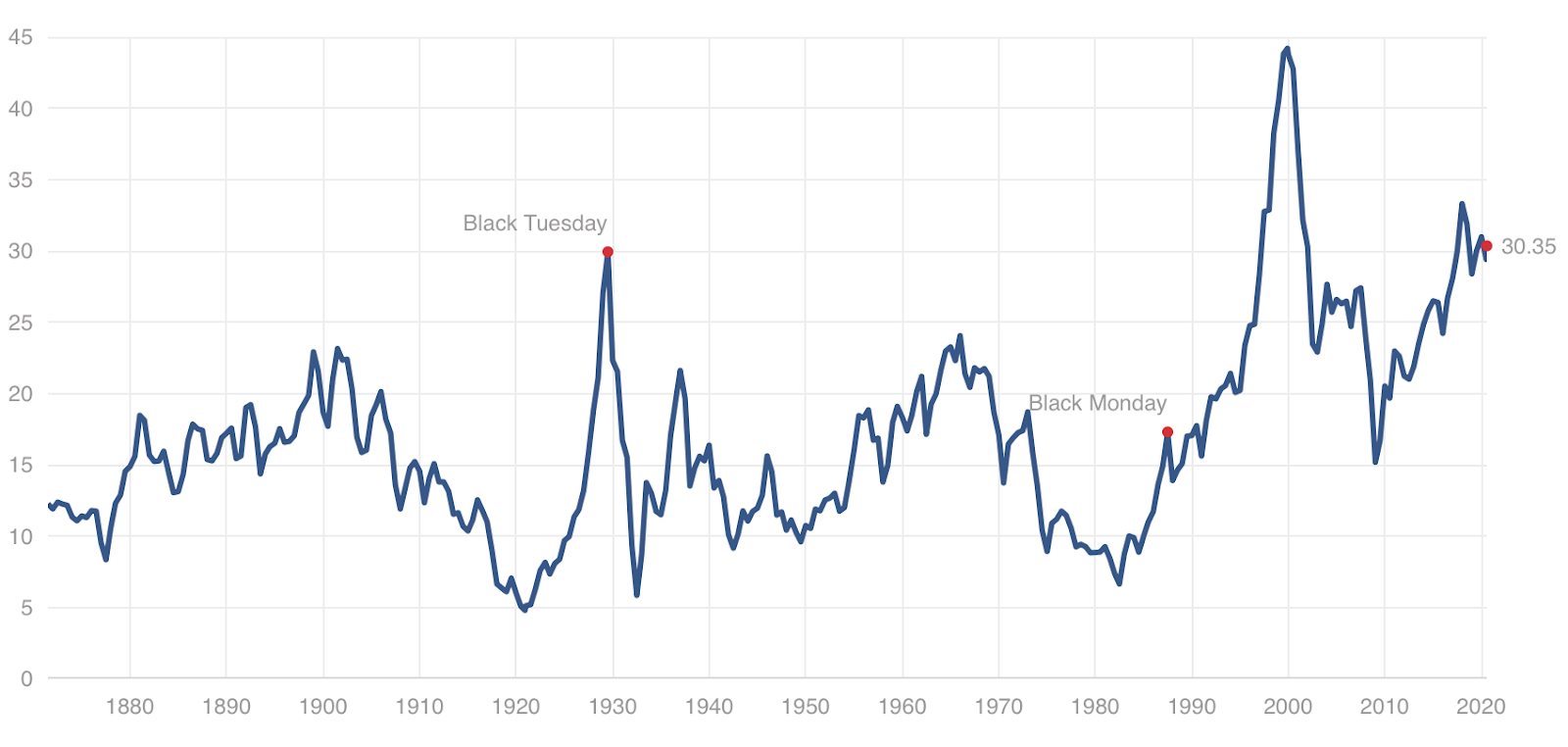

Emerging market forward price-earnings ratios remain well-below 22.8x for the U.S. and 17.8x for the E.U., according to Yardeni Research. While Asian P/E ratios averaged 15.4x and Latin American P/E ratios averaged 15.9x, Eastern European P/E ratios averaged just 8.7x with Russian equities averaged at 8×. Worsening public health outcomes could further depress P/E ratios over the coming months.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

How to Position Your Portfolio

China has become a potentially attractive emerging market opportunity thanks to its modest equity valuations and success in containing COVID-19 after an initial outbreak. While the country has seen an escalating trade war with the U.S., it’s a key supplier to countless other markets around the world and has a growing domestic consumption base that could fuel its recovery.

Other emerging markets may be riskier. For example, Indian equity valuations stand at 22.2x, which is higher than other major emerging markets, despite an accelerating domestic COVID-19 outbreak. Investors may want to consider reducing their exposure to Indian equities, while increasing their exposure to other key emerging markets with more reasonable valuations.

Mutual Fund Opportunities

| Name | Ticker Symbol | YTD Performance |

| Vanguard Emerging Markets Stock Index Fund | VEIEX | -3.00% |

| Fidelity China Region Fund | FHKCX | 21.2% |

| Wasatch Emerging India Investor Fund | WAINX | -10.90% |

| Voya Russia A Shares Fund | LETRX | -14.40% |

| T. Rowe Price Latin America Fund | PRLAX | -23.10% |

- YTD is January 1 – July 23, 2020.

When evaluating mutual funds, investors should take into account both fundamental criteria, such as P/E ratios, and expense ratios, turnover, liquidity and other more technical concerns.

Don’t forget to check out emerging market funds here.

The Bottom Line

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.