Interestingly, in the wake of COVID-19, investors are starting to revisit whether China still meets these characteristics 20 years later.

Let’s take a look at what sets China apart from other emerging markets, why investors are increasingly drawn to the country and risk factors to consider.

Learn more about portfolio management on our Portfolio Management Channel.

Not a Typical Emerging Market

China began its economic reforms in the 1970s with a per capita income of $120, but those figures surpassed $18,000 in 2018, putting it firmly in middle-income territory. The country’s economic growth has also stabilized at about six percent per year, while market reforms have yielded deeper and globally integrated financial markets.

Many investors see China as an economy in transition from middle- to high-income with growth driven by domestic consumption and high-tech manufacturing rather than commodities or commoditized services. With steady economic growth and stable institutions, the country has begun to attract significant levels of investment from around the world.

The COVID-19 pandemic further underscored these differences.

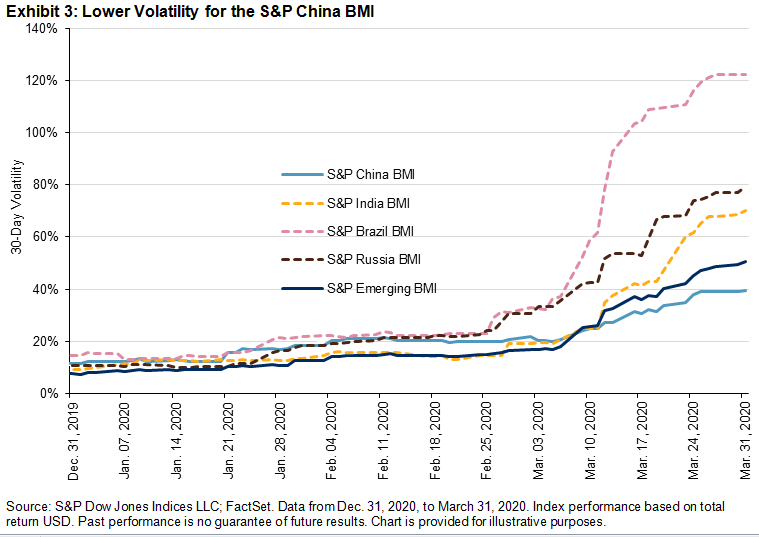

While many emerging market economies experienced significant volatility, China’s markets quickly stabilized with limited volatility following its successful lockdown. The country’s lack of reliance on commodity prices and diverse export markets helped insulate it from the effects of the pandemic.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

Attractive Market for Investors

The International Monetary Fund (IMF) projects that China’s gross domestic product will grow by 8.2% this year after outpacing its emerging markets peers last year by the most since 2009. In addition, the country’s benchmark stock market rose about 20% last year and the yuan gained more than six percent against the U.S. dollar, outperforming most other emerging markets.

Apart from its domestic growth and performance, foreign investors bought more than three trillion yuans’ worth of Chinese bonds last year through September 2020. Foreign investors also bought US$10.4 billion worth of Greater China equity funds last year through October 2020, which compares to a nearly US$24 billion in equity fund outflows from other developing countries. These trends mark the biggest outperformance since 2007 and signal that international investors are increasingly comfortable with the country.

China’s economy is diversifying away from low-value manufacturing and infrastructure spending toward cutting-edge technology, services and domestic consumption. These trends could make the country’s economic growth much more stable over the long run as frontier markets start to replace the manufacturing base and move into other areas.

Be sure to explore our China-focused mutual funds and ETFs section to explore funds that can provide you an exposure to China.

Keep in Mind: Risks Remain

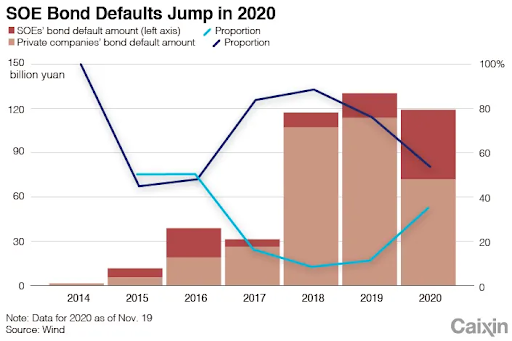

The country continues to struggle with debt at state-owned enterprises, which defaulted on a record $6.1 billion worth of bonds between January and October. Many investors are starting to question the credibility of government guarantees given these defaults, and further problems could lead to reduced credit and liquidity among their equity and bond issues.

China’s Communist Party also continues to play a role in its financial markets. For example, the country’s regulators sidelined the initial public offering of Ant Group late last year in what would have been the largest public listing in history. The move came weeks after Ant Group leader Jack Ma criticized the Communist Party in a speech about the banking industry.

Finally, in the shorter term, the country may have outperformed other emerging markets during the COVID-19 pandemic, thanks to its strict lockdowns and lack of reliance on commodities for income, but the global vaccine rollout and eventual end to the pandemic could help other emerging markets outperform as their economies normalize.

The Bottom Line

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.