We’re talking about concentration risk.

Thanks to the fact that tech has led for so long, many of the major indices are now very overweight in the sector, which is a huge issue now that tech has begun to lag. And it’s not just tech; there have been plenty of periods of time when other sectors have gotten out of hand. For investors, managing concentration risk is key to keeping all their gains.

Be sure to check out our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

Concentration Risk: The Basics

Index funds are wonderful vehicles for investing, because with a single ticker, you get exposure to the entire stock market. There’s a major diversification benefit that happens when buying the S&P 500. However, when a certain sector or a few stocks account for the bulk of an index or fund, the diversification benefit goes out the window.

This is concentration risk in a nutshell and can cost investors big time.

The problem is that markets always eventually revert to the mean. Shifts in policy, over-stretched valuations, changes to the business cycle, etc., make yesterday’s winners into tomorrow’s losers. In a normal market scenario, this isn’t so bad. But when things get out of whack and concentration is high, this can result in heavy losses for portfolios.

Tech’s Accession

As if that wasn’t bad enough, the concentration is even more prevalent when looking at who is making up that percentage.

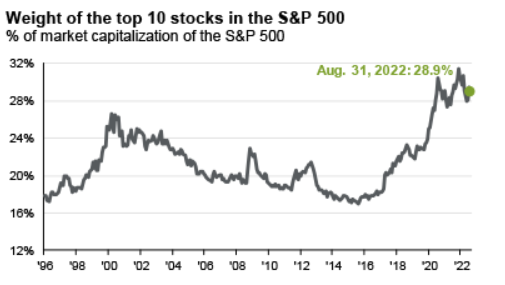

As investors have flooded shares of the so-called FAANGS and pushed market-caps to above the $1 trillion mark, names like Microsoft (MSFT), Amazon (AMZN), Apple(AAPL), and Google (GOOG) form the bulk of the index. Today, the 10 largest names in the S&P 500 Index make up nearly 30% of its market capitalization. This is up from just 18% five years ago. This chart from J.P. Morgan shows the surge higher.

Source: JPM Asset Management

You can see why this concentration risk is an issue.

For starters, the top ten stocks have been the major return’s driver for the S&P 500 Index over the last five years. Taking out these stocks, returns for the benchmark would actually be paltry and even negative in a few years. Moreover, these stocks have contributed to the bulk of the earnings of the index as well. At the same time, the top ten stocks in the index can be had for an average forward P/E of 24.7, as compared to a P/E of 16 for the index and 14.6 for the remaining stocks not in the top ten.

So, as the Fed changes rate policy and economic conditions shift, you can see why the S&P 500 has fallen hard this year. Too many big stocks have too much pull on the index.

Regulating Concentration Risk In Your Portfolio

Actually, digging into a major index and seeing what your ETF or mutual fund owns is a great starting point. In the case of the here and now, if you already own a major index like the S&P 500 or Russell 1000, you probably don’t need to own individual shares of MSFT or AMZN. You’re doubling up for no reason and only increasing concentration risk factors.

Flipping the script and taking a look at the smallest weights could be the best place for new money. As we revert to mean, these smaller-weighted sectors tend to start to outperform. And that’s just what is happening – both energy and materials have been major winners over the last year. Or you could use managed funds that don’t have to stick to what an index is buying.

And if you’re really concerned with concentration risk, owning a dedicated sector short ETF or buying put options could be used to create downside protection for their long-concentrated positions.

The bottom line is that concentration risk is a real problem for investors and lurks within the shadows. Buying an index fund isn’t a set-it-and-forget-it choice. It’s something that needs to be managed.

Make sure to visit our News section to catch up with the latest news about income investing.