That said, the Russell 2000 Index has been trading lower than the S&P 500 since January amid the broad market sell-off. With a recession on the horizon, many investors are understandably hesitant to invest in small-cap companies that may not have as much cash in the bank to weather a higher interest rate environment and slower consumer demand.

Let’s examine whether small-cap stocks represent a good opportunity in today’s market and where to find opportunities.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

What’s Coming Up?

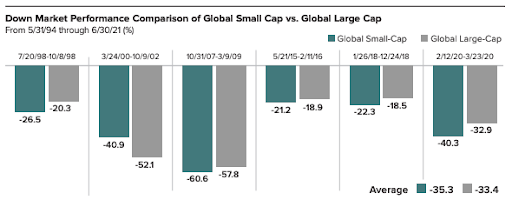

Small-cap stocks fall further than large-cap stocks in a down market. Source: Royce Funds

That said, global small-cap stocks experience stronger recoveries than large-cap stocks one year after market troughs. And the magnitude of these recoveries tends to offset the sharper declines during down markets. Those lucky enough to buy small-cap stocks near the market trough could benefit from these more considerable recoveries.

Moreover, global small-cap stocks had fewer negative or flat return periods than global large-caps over a rolling five-year period – and no negative returns over 10-year holding periods. So, on the whole, they tend to offer a superior risk-adjusted return than large-cap stocks – particularly when buying after a substantial market decline.

Betting on a Rebound

The Russell 2000’s three-year and five-year monthly rolling averages, since inception in 1978, have been 10.8% and 10.5%, respectively. By comparison, the three-year and five-year annualized returns leading up to September 30, 2022, have been just 4.3% and 3.6%, respectively. These data suggest that the index is performing well-below average.

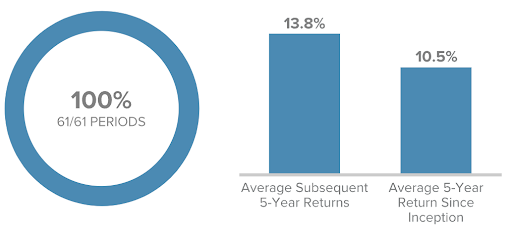

100% of the Time, Positive 5-Year Returns Have Followed 5-Year Low Return Markets – Source: Royce Funds

Interestingly, a Royce Funds analysis found that the Russell 2000 tends to significantly outperform after a period of underperformance. As seen above, the index averaged a 13.8% five-year annual return following a five-year period with annualized returns of 0% to 5%. As a result, investors could see a strong rebound from current levels over the long term.

Small-Cap ETFs to Consider

| Name | Ticker | Expense Ratio | AUM |

| Vanguard Small-Cap Value ETF | VBR | 0.07% | $24.7 Billion |

| Schwab US Small-Cap ETF | SCHA | 0.04% | $14 Billion |

| Vanguard Small-Cap Growth ETF | VBK | 0.07% | $12.7 Billion |

| iShares Russell 2000 Growth ETF | IWO | 0.23% | $9.8 Billion |

| Schwab Fundamental US Small Company ETF | FNDA | 0.25% | $6 Billion |

Data as of November 14, 2022

Make sure to visit our News section to catch up with the latest news about income investing.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.