With the rout in emerging market equities, investors largely have ignored these positive economic signs, and sold off Indian equities. These dynamics could reverse over the coming quarters, as Prime Minister Narendra Modi and Central Banker Raghuram Rajan work to implement key economic reforms and drive the country’s economy higher in the face of increasing global economic headwinds caused by China and Russia.

Potential Catalysts

Prime Minister Modi has taken dramatic steps to increase foreign direct investment across many different sectors. Earlier this year, he announced plans to allow 100% investment in completed construction projects, some plantation sectors, cable networks, direct-to-home services and some air transport activities, which enables foreign capital to help accelerate growth and improve infrastructure for private sector businesses.

Central Banker Rajan’s disciplined monetary policies also have helped reassure the market that the country is perfectly capable of managing inflation. Earlier this year, the central bank cut interest rates to boost growth, which led to a brief jump in equity prices. The government’s reduction of subsidies to several areas of the economy also could help reduce twin fiscal deficits that represent an overhang on the economy.

Mutual Funds to Buy

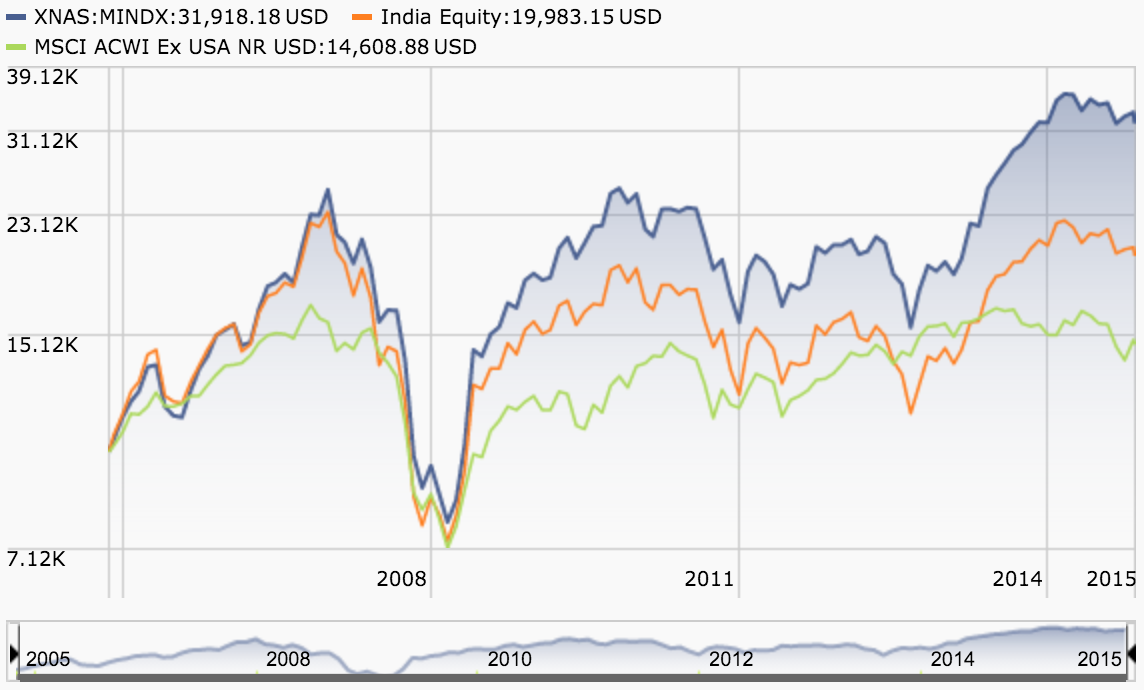

The most popular mutual fund is the Matthews Investor India Fund (MINDX), which has about $1.5 billion in assets under management, with a $2,500 minimum investment and 1.12% expense ratio. With broad exposure to the Indian economy, the mutual fund provides investors with a convenient way to access the emerging market, while significantly outperforming its benchmark indexes and competing funds over the past several years.