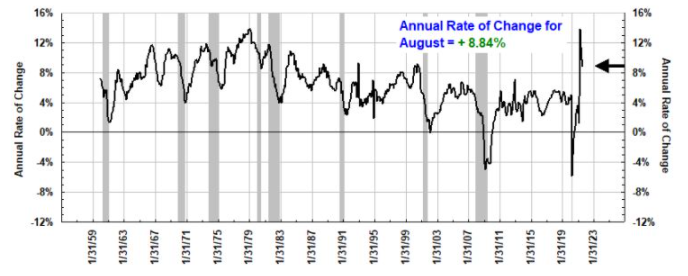

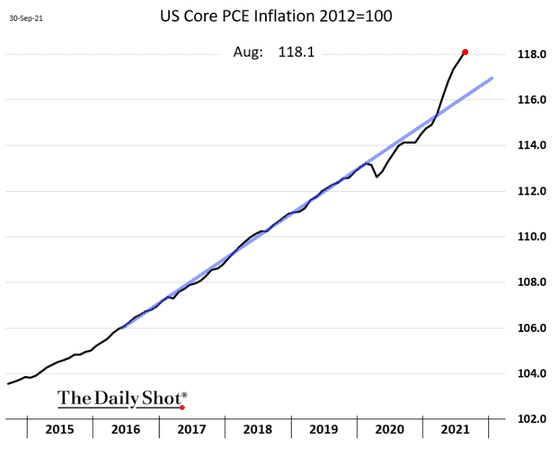

Already facing significant wage inflation (8.84% year-over-year in August), business owners and economists alike are hoping for more insights in Friday’s jobs report. Consumer spending climbed in August as the recovery in services spending finally gains some traction, driving growth in PCE inflation and keeping it well-above its pre-covid trend. Meanwhile, tech stocks took a hit on a combination of inflation fears and some high-profile bombshells, congressional testimony, and service outages—and much of the broader market followed its lead. High-yield bonds though have remained resilient in the face of a rising rate environment, but what happens when repayments come due? Finally, as those rising rates push the USD higher, commodities rally, and Eurozone inflation accelerates, Asian manufacturing activity has rallied to straddle a critical juncture between growth and contraction. What effect could the outcome have on what’s sure to be a unique holiday spending season?

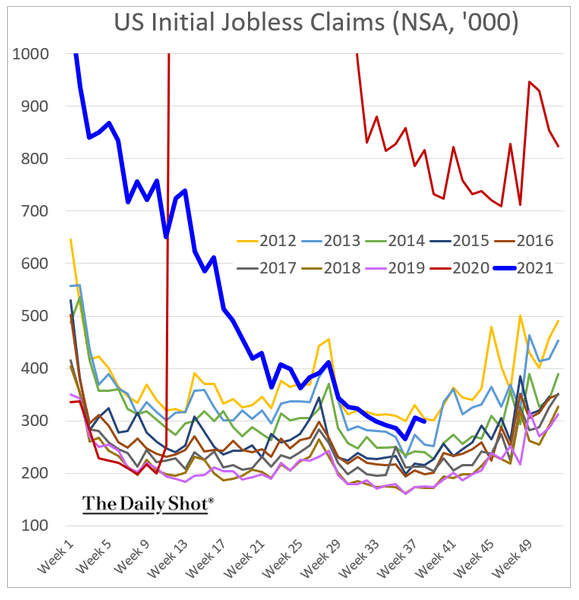

1. While the current jobs picture is still over 2.5 times pre-pandemic levels…

Source: The Daily Shot, from 10/4/21

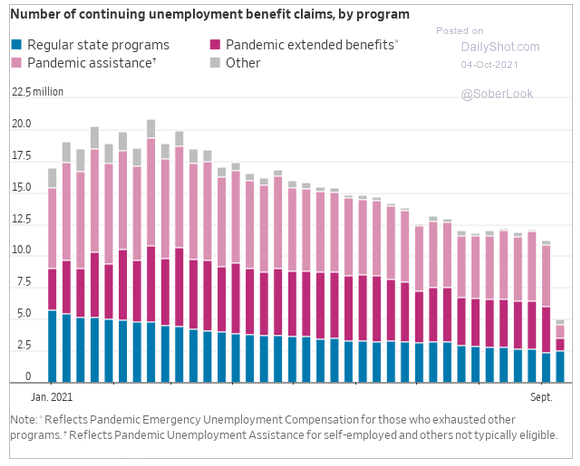

2…Even after the extra unemployment payments end, there are still ~5 million continuing claims with no guarantee that the ~6 million who lost benefits will go back to work:

Source: Labor Department, from 10/4/21

3. Wage increases are at levels not seen since the 1970’s:

Source: The Chart Store, from 10/3/21

4. The Fed’s “favorite” measure of inflation is way above its pre-pandemic trend:

Source: The Daily Shot, from 10/4/21

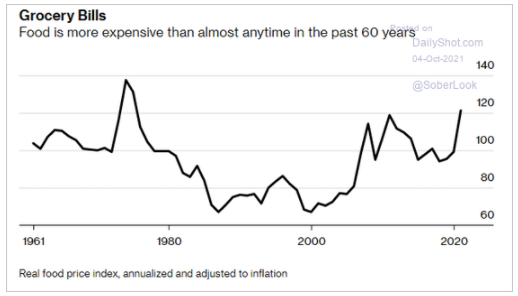

5. What a trip to the grocery store tells us:

Source: The Daily Shot, from 10/4/21

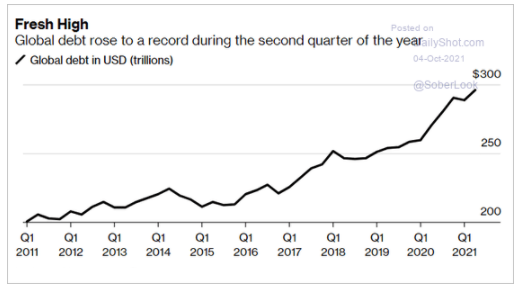

6. The amount of personal, government and corporate debt is approaching $300 TRILLION:

Source: The Daily Shot, from 10/4/21

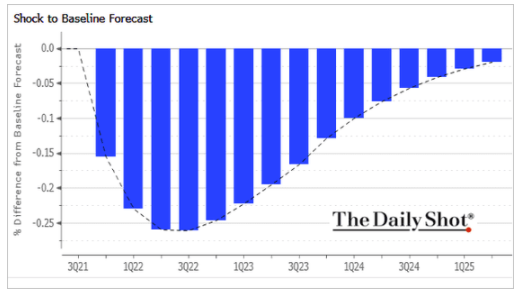

7. Each 5% rise in the USD will subtract about .25% of GDP over the following year:

Source: Bloomberg, from 10/5/21

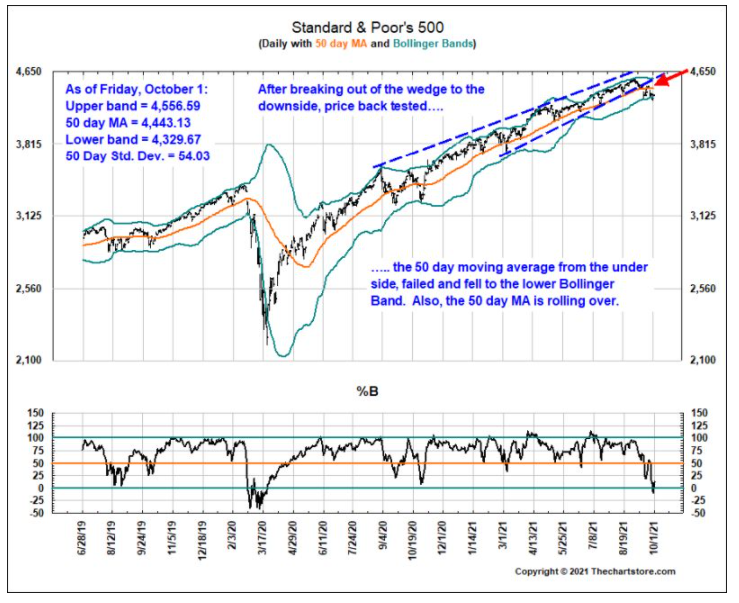

8. The S&P 500 has broken down versus its 21- and 50-day moving averages. Just a seasonal blip?

Source: The Chart Store, from 10/3/21

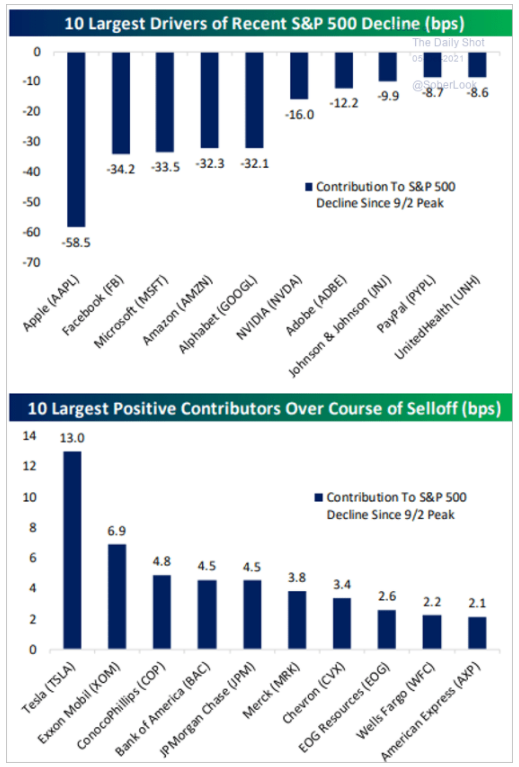

9. It may be an index of 500 stocks, but the S&P 500’s capital weighted structure means just a dozen or fewer stocks can drive the market:

Source: The Daily Shot, from 10/5/21

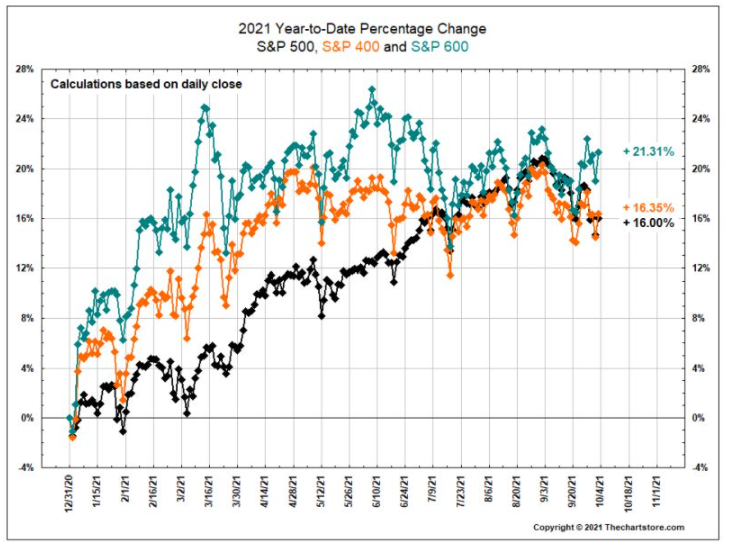

10. One of the rare winners in September was Small Caps which tend to outperform in inflationary times:

Source: The Chart Store, from 10/3/21

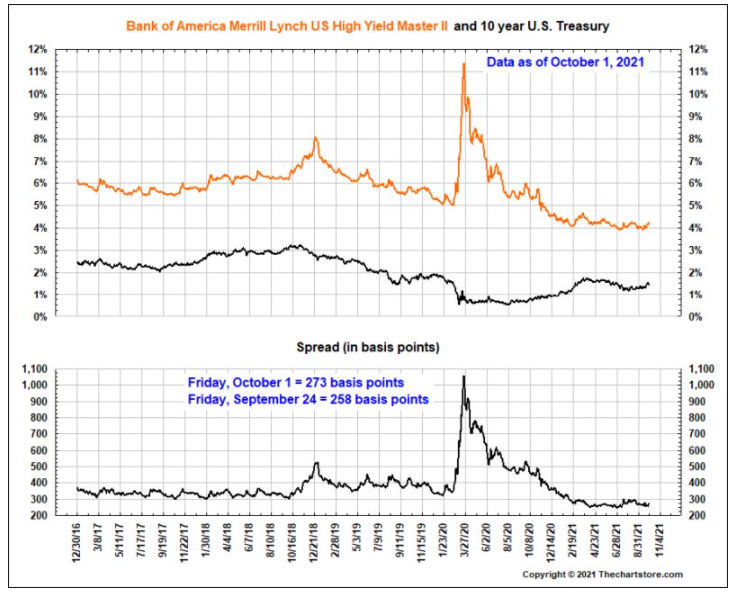

11. High yield bonds, despite the Chinese defaults and rising U.S. rates, are showing little signs of stress:

Source: The Chart Store, from 10/3/21

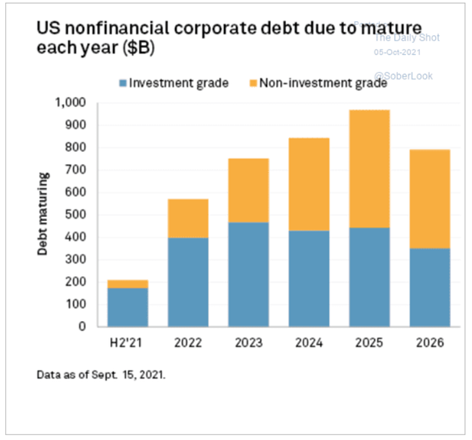

12. Are junk bonds and their issuers overly susceptible to rising rates?

Source: S&P Global Market Intelligence, from 10/5/21

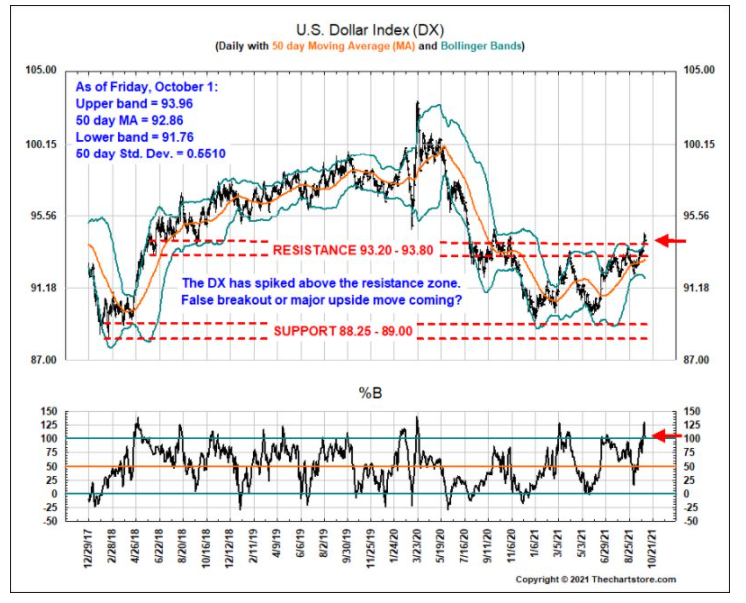

13. Higher U.S. interest rates are giving a bid to the USD:

Source: The Chart Store, from 10/3/21

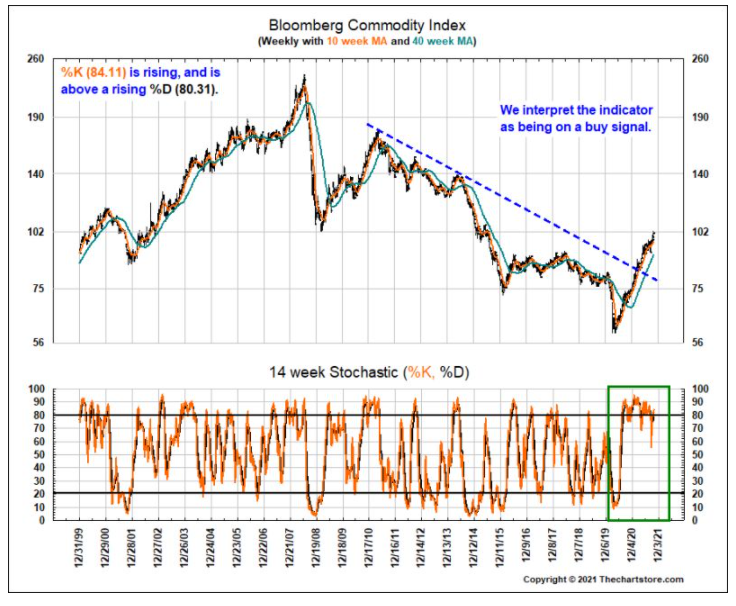

14. Albeit with massive dispersion amongst individual commodities, as a whole they are surging despite USD strength:

Source: The Chart Store, from 10/3/21

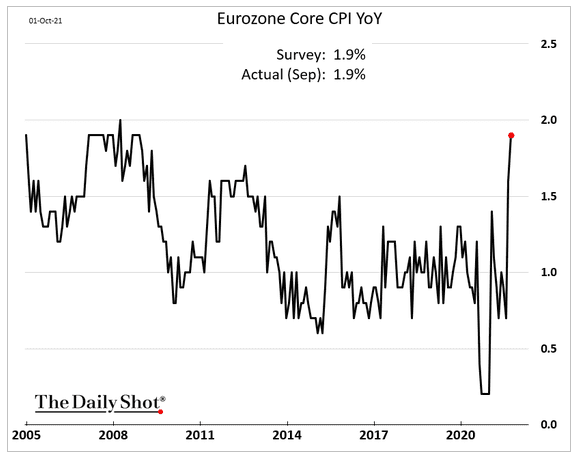

15. Inflation is picking up in the Eurozone as well:

Source: The Daily Shot, from 10/4/21

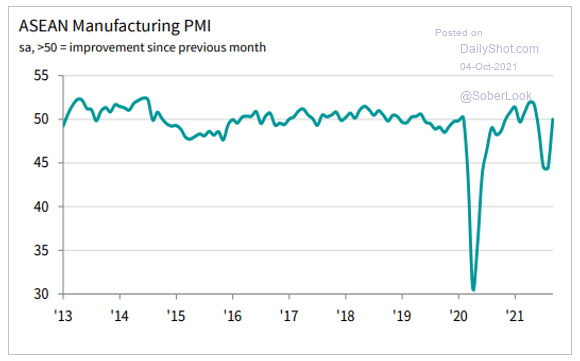

16. As a whole, Asian economies are at 50, the line between growth or declining manufacturing output:

Source: IHS Markit, from 10/4/21

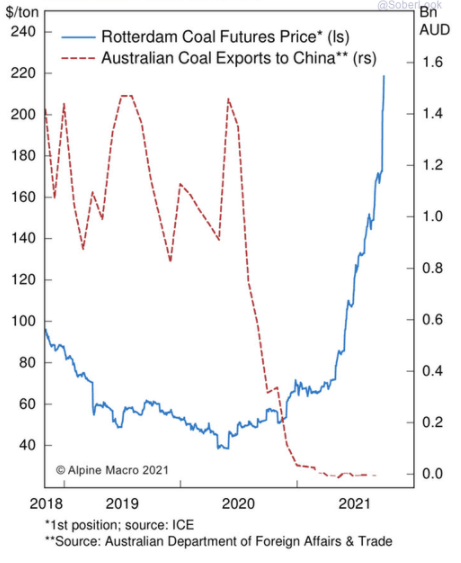

17. Despite China’s ban on coal from Australia, Australian exports hit a new record. Trade wars most often do not work:

Source: The Daily Shot, from 10/5/21

Disclaimer

The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

David M. Haviland a Managing Partner of the firm and Lead Portfolio Manager of Beaumont Capital Management (BCM). Check out his full bio here.