Let’s look at why large-cap stocks may be a good option and, in particular, why you might want to consider actively-managed large-cap funds.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

A Defensive Approach

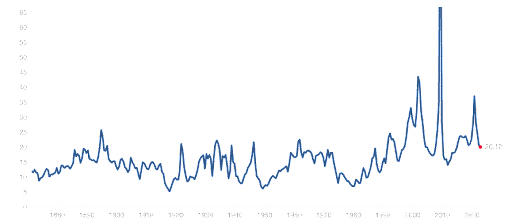

Price-earnings ratios remain historically elevated for large-cap stocks, but they’ve come off their recent highs. Source: Multpl

Higher interest rates have reduced the price-earnings ratios of expensive stocks, particularly large-cap equities in the tech sector. But with the economy slowing, central banks could be reaching the end of their hawkish surprises. And the price-earnings ratios of these companies could stabilize over the remainder of the fourth quarter.

As a result, U.S. large-cap stocks could be an attractive option. With overweight exposure to defensive sectors, like healthcare and software, they are less sensitive to changes in the economic cycle. The strong U.S. dollar has also helped these stocks outperform global averages in local currency terms (e.g., translating foreign returns into U.S. dollars).

Active Could Outperform

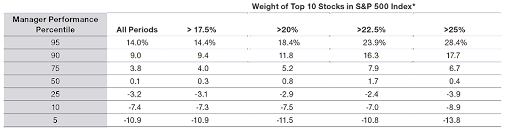

Active managers tend to outperform when benchmark indices are more concentrated. Source: Investment Executive

Over the past several years, the S&P 500 index has become more concentrated in a handful of stocks. In fact, the 10 largest stocks account for more than one quarter of the index. According to a T. Rowe Price analysis (above), excess returns were significantly higher for managers in the top quartile following higher index concentration.

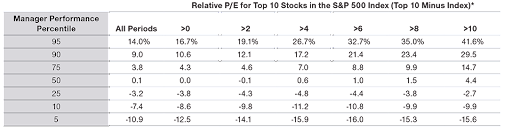

Active managers also tend to outperform when valuations are high. Source: Investment Executive

A similar analysis (above) found that U.S. large-cap active managers generated more substantial excess returns when valuation levels were high. After all, they can underweight large and expensive index components and overweight undervalued ones. Or they can at least selectively overweight large components and act as a filter.

Active Funds to Consider

| Name | Ticker | AUM | Expense Ratio |

| Dimensional U.S. Equity ETF | DFUS | $5.58 billion | 0.11% |

| Avantis® U.S. Equity ETF | AVUS | $2.16 billion | 0.15% |

| Principal U.S. Mega-Cap ETF | USMC | $1.49 billion | 0.12% |

Data as of November 1, 2022.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.