Asset allocation is the single most important decision that investors can make. In fact, Vanguard found that it accounts for 88 percent of volatility and returns. This means that two investors with similar asset allocations will have very similar performance and risk levels — even if they hold totally different securities in their portfolios.

Rebalancing is the process of maintaining asset allocation by buying and selling assets. While it’s possible to rebalance at any time, there are several best practices that can minimize costs and risk while maximizing returns.

Let’s take a look at five best practices that you should use when rebalancing your portfolio.

Keep track of stocks going ex-dividend by using our free Ex-Dividend Date Search tool.

Best Practices

Here is a list of five best practices.

1. Set a Rebalancing Trigger

Emotions have a significant impact on investment decisions. For example, you may be hesitant to sell stocks and buy bonds during a bull market to limit deviations from your target allocations. The fear of missing out on stock returns makes it tempting to put off portfolio rebalancing until a later date — but it could be too late!

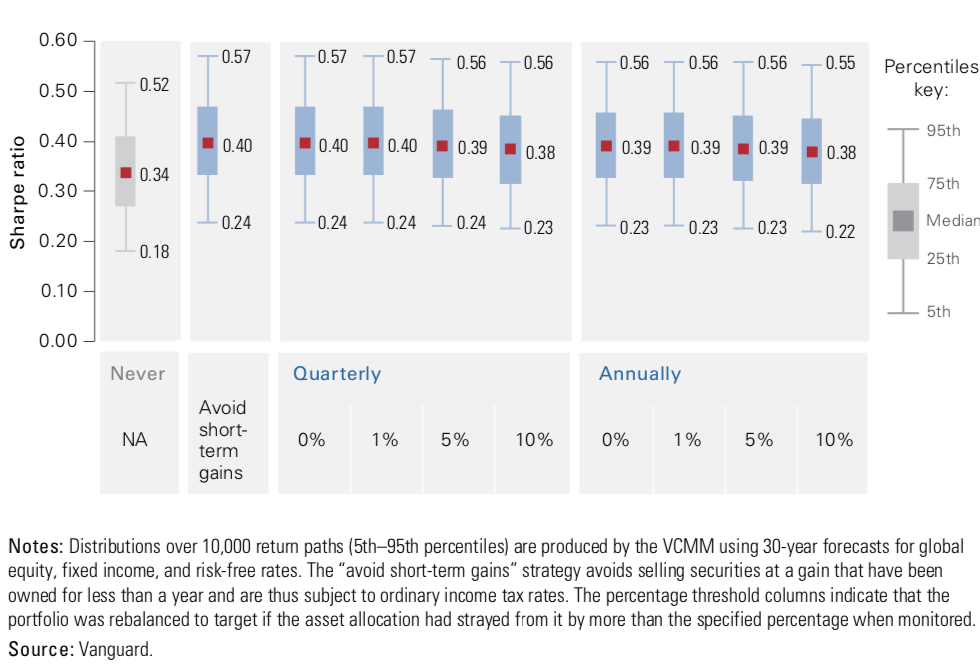

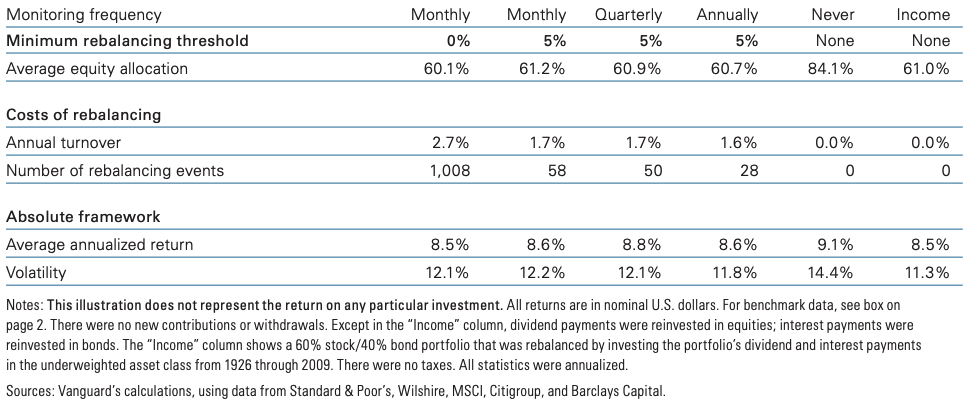

Rebalancing triggers remove emotion from the process. For example, you may decide to rebalance a portfolio twice per year and/or when the portfolio drifts more than five percent from the target allocation. Vanguard’s research found that there’s little difference between different rebalancing times and thresholds — the important thing is having a schedule.

2. Rebalance with Portfolio Cash Flows

Rebalancing involves selling some assets to purchase other assets. This process involves two sets of transaction costs: the cost of selling assets and the cost of buying assets. One way to lower rebalancing costs is to finance the purchase of assets with existing portfolio cash flows — like dividends or new contributions — to eliminate the cost of selling assets.

Track how your portfolio’s dividend income changes when stocks increase or decrease their dividend by using our Free Dividend Assistant tool.

For example, suppose that your portfolio is underweight in bonds and overweight in stocks. Rather than selling stocks to buy bonds — generating two transaction costs — you may use the dividends generated by stocks to buy bonds. That way, you’re only paying the transaction costs to buy bonds rather than the costs of selling stocks and buying bonds.

3. Rebalance to the Right Allocation

Suppose that your portfolio experiences a significant drift over the course of a quarter. You could rebalance to the target portfolio allocation, but that could involve a significant cost. On the other hand, you could rebalance to an intermediate allocation that’s within an acceptable drift, but doesn’t completely restore the target portfolio allocation.

The optimal asset allocation depends on transaction costs. When transaction costs are proportional to trade size (e.g., commissions), then an intermediate asset allocation makes sense. When transaction costs are independent of trade size (e.g., cost of time), then it’s best to rebalance to the target allocation to eliminate the need for further transactions.

Click here to learn about the different types of portfolio rebalancing techniques.

4. Focus on Tax-Advantaged Accounts

Rebalancing in tax-advantaged accounts is tax-free, which means that it’s best to focus on these accounts. For example, suppose that you have a mix of asset classes in your tax-advantaged account along with one or more taxable accounts. If your total portfolio drifts from a target allocation, you may want to focus on making changes in the retirement account.

Vanguard found that after-tax returns increased by 44 basis points on an annualized basis without increasing risk exposure when focusing on tax-advantaged accounts. Of course, you must ensure that the portfolio allocations in tax-advantaged accounts are suited for your withdrawal strategy, depending on how close you are to retirement age.

Learn about other portfolio management concepts here.

5. Gift Shares to Maximize Tax Benefits

Gifting shares rather than cash is a great way to minimize tax exposure. You can gift shares from taxable accounts or take a qualified charitable distribution (QCD) from your traditional IRA to support charities or other causes, avoid capital gains tax and write off the value of the shares on your taxes — it’s one of the most tax-efficient ways to give.

Gifting shares is also a great way to rebalance in a way that maximizes your tax benefits. For instance, suppose you need to sell stocks and buy bonds to maintain a target portfolio allocation. You could gift stock as part of your giving strategy to avoid paying capital gains tax and eliminate the need to pay (e.g., the cost to sell) two transaction costs to rebalance.

The Bottom Line

Rebalancing is a critical component of portfolio management. By following these best practices, you can minimize tax exposure and risk, while maximizing returns in your portfolio.

Check out our Best Dividend Stocks page.