The International Equity Fund (RSQVX) currently has $48.2 million in AUM and is focused on European holdings. We had the pleasure of speaking with Riad Younes about his opinions regarding the international markets, including the potential opportunities and risks.

Insights from Riad Younes

Yes, we definitely see value in Europe, particularly in the banking, telecom and pharmaceutical sectors. The areas to avoid for us are commodities and geographies that are dependent on commodity prices to remain high. We also have a preference of value over growth, especially avoiding the high multiple/momentum areas.

What are the catalysts that you see that should drive investor interest? Is the tightening of the ECB part of the overall reason investors should be focused on putting money to work?

Over the medium term, valuations and fundamental improvement in Europe will drive investor interest. In the near term, markets will be more driven by central bank policy, particularly the Fed, which has a tightening bias, and the ECB and Bank of Japan, which still have easing bias.

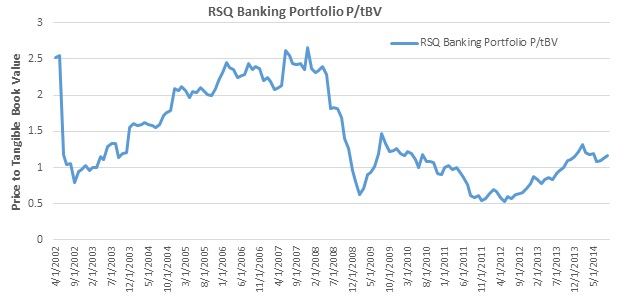

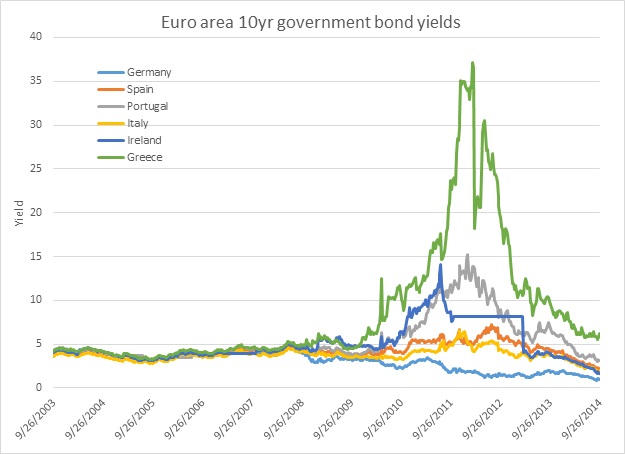

In our opinion, there are three key anchors for our European Banking investment thesis: low valuations (Chart 1), the easing of structural fault lines in the eurozone, which are supported by the decline in spread between periphery nations’ debt and those of Germany (Chart 2), and the establishment of the European banking union along with the completion of the banking stress test and asset quality review, which will help further restore confidence in the banking sector.

This should definitely help the European exporters and as a result also positively impact the domestic economy. Given the fiscal side of the economy is relatively rigid, a boost from the export sector with a weakening euro will be welcome.

What areas of the market do you feel will outperform?

In the short term, we continue to expect volatility in the markets, especially with the Fed tightening over the course of the coming year. We believe that value and defensive will outperform growth and cyclicals, which is reflected in our overweight towards European banking, pharmaceuticals and telecom.

We continue to view the appeal in growth stocks as limited and challenging. Growth opportunities tend to be overly concentrated in the technology sector and in emerging countries. While valuation seems to be the main challenge in many internet/high-tech names, domestic imbalances and structural reforms are the main challenges in the structurally attractive emerging markets. Our underweight thesis on emerging markets and commodities is based on the following factors:

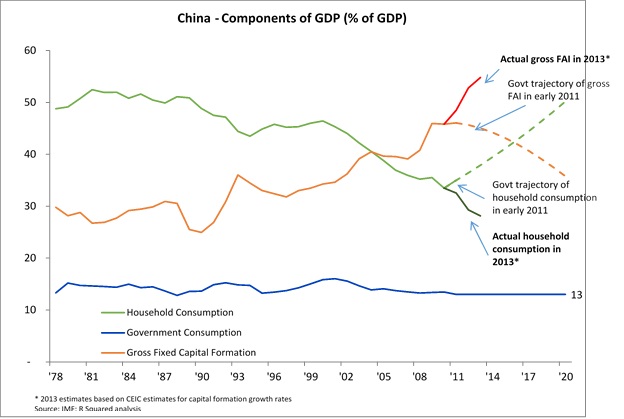

- China’s struggle to rebalance its economy away from fixed asset investment (FAI) towards consumption: Though the Chinese government has acknowledged that FAI as a percentage of GDP is too high and consumption as a percentage of GDP is too low (Chart 3), it has failed to steer these ratios in the right direction. Instead, it has allowed them to accelerate in the wrong direction – a sign that the adjustment and rebalancing of China’s economy is not likely to occur smoothly.

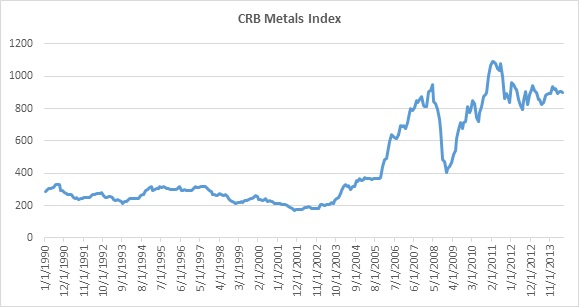

- Shifting commodity prices: Over the past decade, many emerging market economies benefitted from surging commodity prices, which have appreciated more than 400% on average since China’s entry into the World Trade Organization (WTO) in 2002 (Chart 4, base metals commodity prices example). Our prognosis is that commodity prices will decline steadily this decade as the belated supply to China’s demand shock brings the market closer to equilibrium.

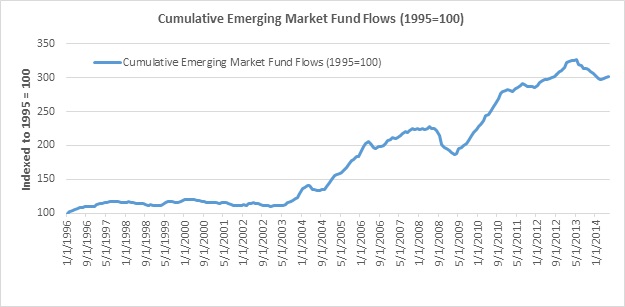

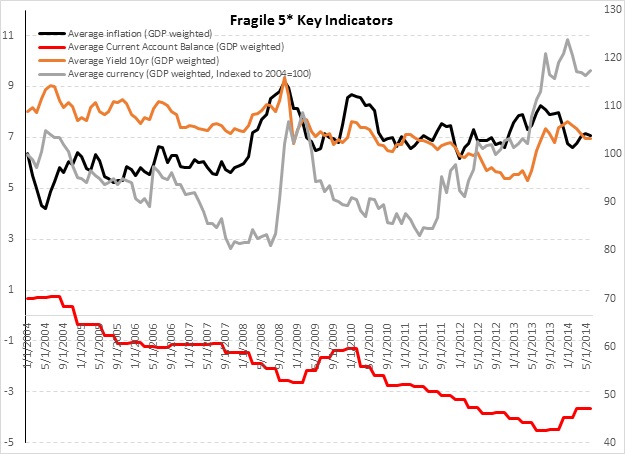

- Currency appreciation: Over the past decade, foreign capital flows into emerging markets seeking growth and yield have strengthened their currencies and lowered their interest rates (Chart 5), creating a virtuous circle of strong consumption and credit growth. The overshooting of currencies has created a wealth effect and a surge in purchasing power, but it has also simultaneously rendered many companies uncompetitive, as evidenced by the deterioration of their trade balance.

The recent Treasury rules will probably have some dampening effect on the pricing of such deals. M&A will continue, but if it becomes more difficult to invert or repatriate cash without paying U.S. taxes, then the tax arbitrage premium from such deals will come out. If the logic of some deals relied solely on tax inversion then these will probably not happen. Deals that have fundamental rationale to them will continue to happen, especially given that we expect rates to remain lower for longer.

The Bottom Line

While others remain cautious on international stocks, Younes’ firm remains bullish on the region – seeing it as a great opportunity, while still recognizing its risks.

DISCLOSURE: The views and opinions expressed in this article are those of the authors, and do not represent the views of MutualFunds.com. Readers should not consider statements made by the author as formal recommendations and should consult their financial advisor before making any investment decisions.