One of the main tenets and recognized principles of investing comes down to asset allocation. The idea is that having a diverse portfolio of stocks, bonds and other assets helps reduce risk and increase returns. To that end, the numbers “60” and “40” have a very special meaning. Thanks to plenty of academic research, the 60/40 portfolio has become one of the most widely accepted portfolio asset allocation tools.

However, 60/40 may have hit the end of its usefulness.

Thanks to a myriad of factors, holding just 60% of a portfolio in stocks and 40% of a portfolio in bonds may not make sense anymore. Despite the safe nature of the portfolio, investors may be doing themselves more harm in this new environment. With that, it may be time to rethink our allocations and retire the classic 60/40 model.

To learn more about retirement topics, visit our Retirement Channel.

60/40 Works…

At its core, the 60/40 is easy to understand: Invest 60% of your portfolio in equities and another 40% in bonds, hold for the long term, and boom … you have strong returns. The simplicity of the portfolio was first popularized in the 1950s in the early days of modern portfolio theory. Vanguard founder John Bogle took the idea and ran with it, ultimately making it popular with investors. Since then, there has been plenty of academic studies on the allocation method, and the data all points to being an optimal allocation for many investors.

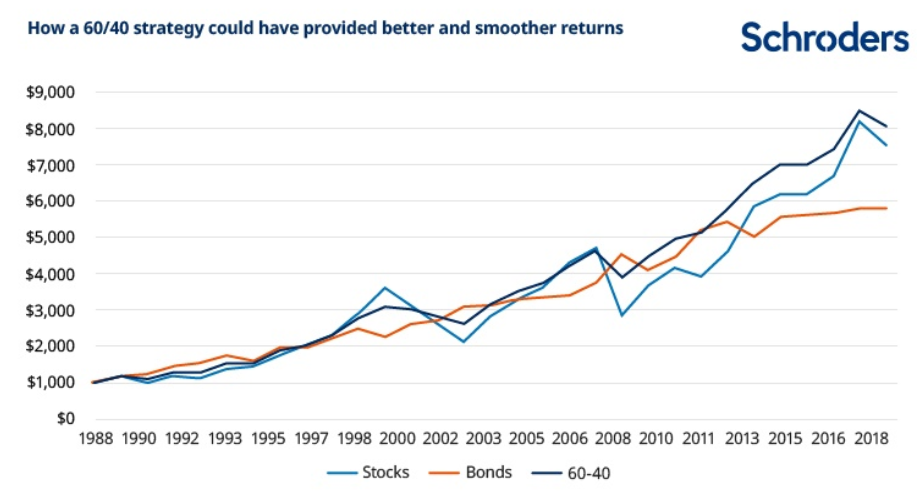

Just take a look at this chart from asset manager Schroders. Looking at the 1980s, a 60/40 portfolio would have not only smoothed out volatility, but provided a better long-term return for portfolios. A 60/40 portfolio over the last 30 years would have provided an average annual return of 7.5% This is versus a 7.2% return for stocks and a 6.2% return for U.S. investment-grade bonds.

Source: Schroders

…Until It Doesn’t

The problem with 60/40 comes down to the bond side of the ratio.

For much of the market’s history, bonds have been yielding much higher than today. In fact, bond yields are at their lowest points, historically. At the time of writing, the benchmark 10-year Treasury yield was only 1.37%. The flipside to this has been the amazing bull market run in the U.S. Treasury bond market since the 1980s. After peaking in September 1981, interest rates have fallen, which helped push up prices for bonds, creating a once in a life-time bull market in bonds and helping fixed income pull its weight in the asset allocation model.

The underlying issue is that with rates so low, the bond side of the equation isn’t keeping up with historical norms, or even rates of inflation. J.P. Morgan estimates show that bonds are now proving a real return of a negative 1.21%.

Secondly, those inflationary forces have perhaps moved from beyond “transitory” and are coming back with a vengeance. As a result, the Federal Reserve will be forced to raise rates, causing the bond side of the equation to fall in price to match the new higher yields. As a result, the bond side isn’t going to act as the cushion investors may be looking for, and thanks to duration risk, its potential could cause losses.

Thanks to these factors, the classic 60/40 may not work in the years ahead.

Enter the 80/20 Portfolio

With bonds not being able to pull their weight, and perhaps inducing losses, investors may need to rethink their asset allocation model. This has many advisors and investment professionals looking at alternatives, with one of the best being an 80/20 portfolio. Just like before, the first number represents the number of equities in the portfolio. In this case: 80%. Conversely, bonds should be limited to just 20% of the portfolio.

The idea is that equities will provide a better real return given the rates of high inflation and the Fed’s need to raise rates over the next few years. Better still is that the portfolio may achieve what the 60/40 did before: decent returns with lower volatility. Research from PNC shows that based on return assumptions, an 80/20 works over the long term and reduces risk; albeit, not in the same magnitude as the previous 60/40 did during its heyday.

The key is that investors need not go gangbusters when reconfiguring their allocation. A focus on dividend stocks could easily do the trick, especially with those that have the ability to raise their payouts. With dividend growth rates historically eclipsing rates of inflation, these sorts of stocks are set to be in high demand as the Fed raises rates. Meanwhile, dividend stocks are overall less volatile than non-dividend payers. Investors can truly have their cake and eat it too.

Secondly, there’s nothing that says the 40% has to be in U.S. Treasuries. Both J.P. Morgan and Goldman Sachs suggest that investors move towards different non-core bonds to help boost returns on the fixed income side. For example, floating rate bonds and U.S. Treasury Inflation Protected Securities (TIPS) make a ton of sense as the bonds include kickers to their coupon payments, allowing them to pay higher yields as the new environment takes hold.

In the end, a combination of more equities and a different focus on bonds could be the best medicine going forward. Thanks to the current market environment, the status quo doesn’t work anymore for the majority of investors.

Check out our Portfolio Management Channel to learn more about managing your portfolio.

The Bottom Line

The classic 60/40 portfolio has worked for a long time. Nonetheless, the forces at be have the concept falling flat for the new decade. Investors need to rethink their allocations – and having more equities could do the trick.

Don’t forget to explore our recently launched model portfolios here.