Let’s take a look at two common mistakes to avoid during a downturn and three steps that you can take to safeguard your retirement portfolio.

Find out more about retirement planning topics under our Retirement Channel.

Common Mistakes To Avoid

1. Timing the Market

A common knee-jerk response to a downturn is to cease contributions to a retirement plan or move into cash – you don’t want to throw more money into the market only to see it decline and you want to ensure that you have enough cash on hand. You may have even heard stories from individuals that managed to avoid past recessions, such as the 2008 financial crisis.

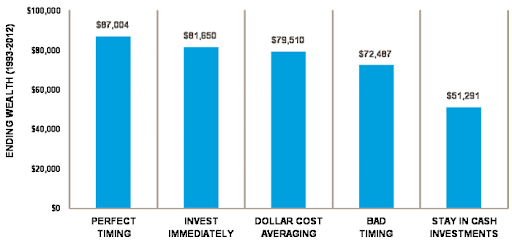

The problem is that missing a bull market is much more costly than avoiding a bear market. Research shows that the average bull market return is around 180% compared to a mere 37% loss during a bear market. Missing just 90 of the best performing days over a 40-year period could reduce performance from 11% to just 3%, and few of us are that accurate in our predictions.

Investors should focus on time in the market rather than timing the market since it’s impossible to predict the 1.2% of trading days that produce 95% of market returns, according to Betterment’s research conducted here. By continuing contributions and avoiding cash, you can average into the market and even out the prices that you pay for assets over time, creating more consistent long-run performance.

2. Borrowing to Invest

The opposite tendency can also be dangerous: Many financial experts advertise ‘fire sale’ prices for stocks during a downturn in an attempt to reassure investors – and those sentiments can encourage investors to throw more money into the market. The problem is that some of these investors may be borrowing money in order to invest more.

There’s a popular saying among investors and traders, “The market can remain irrational longer than you can remain solvent.” In other words, trying to time a market rebound is just as dangerous as trying to time a market decline. Investors using dangerous levels of leverage could end up going bust before the market eventually recovers.

Investors should maintain their long-term contributions or consider adjusting their contribution schedule if they’d prefer to invest more, but it’s rarely a good idea to borrow money to invest. Leveraged positions are best left to hedge funds or other financial experts who have the knowledge and risk tolerance necessary to execute these strategies.

Safeguard Your Portfolio

1. Rebalance Your Portfolio

Significant market movements often create the need to rebalance a portfolio. For example, a sharp increase in bond prices and a sharp decline in stock prices can result in bonds accounting for too much of a portfolio. Rebalancing would involve selling bonds and using the proceeds to buy stock in order to maintain a desired asset allocation.

According to Vanguard, nearly 90% of a portfolio’s volatility and returns can be traced back to asset allocation, making it one of the most important considerations for investors. Diversified investors with a similar asset allocation will experience similar risk and returns regardless of the specific investments that they choose within their portfolio.

2. Adjust Your Long-term Plans

You may find that you’re not as willing to risk money as you once were during a downturn, which means it may be time to rethink your asset allocations. For instance, you may decide that you want to move further into fixed income investments and reduce exposure to stocks if you find that market volatility is too extreme with your current allocations.

3. Harvest Tax Your Losses

Investors with taxable accounts can take advantage of market downturns by harvesting their tax losses. By selling investments for a loss and using the proceeds to repurchase similar investments, they can realize a loss during the current tax year that can be used to offset other capital gains.

Explore portfolio management topics here.

The Bottom Line

Keep track of the latest news in our News section, where we regularly publish the latest on dividend investing.