In this article, we will highlight how target-date funds can be a great way for anyone to prepare themselves for retirement without being paralyzed by the fear of not knowing what to do.

Benefits of a Target-Date Fund

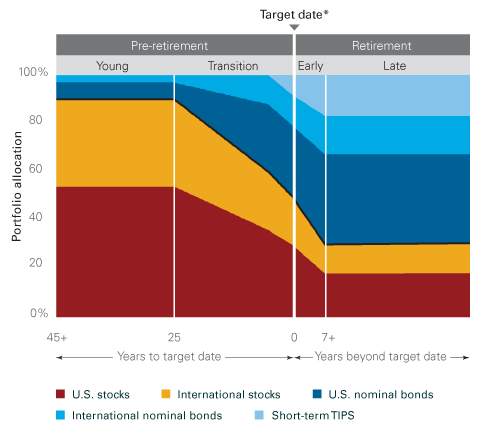

For example, the Vanguard Target Retirement 2050 Fund (VFIFX) gradually shifts from stocks to bonds towards the end of 2050, as evident from the below graph.

Whether you’re covered by a 401(k), 403(b), SEP-IRA, RRSP or saving on your own through an IRA or Roth IRA, target-date funds can be a hassle-free, yet effective, solution for accumulating retirement savings. You can take a look at our Retirement Fund section to learn about various other mutual funds, including some relevant target-date funds.

How Target-Date Funds Can Help Reduce Individual Research

- Initial reliance on equity and bonds in initial and later stages: They allocate heavily to stocks in early years because stocks tend to outperform other types of securities over the long term, and young investors have the ability to ride out waves in volatility. Moreover, they shift more towards bonds in later years as capital preservation becomes the primary goal over growth.

- Significant reliance on overseas instruments: A significant portion of the portfolio is invested overseas. This may appear to be a risky move on the surface, but international funds have the ability to enhance overall returns while actually reducing overall portfolio risk through diversification.

To make peace with this investment strategy, you can read the pros and cons of target-date funds.

It’s a relatively easy strategy to understand and execute. Here are some ways these funds ease out the extent of conducting independent research.

- Ease of fund management: Individuals can simply make an investment into the target date fund and have the portfolio managed to each of these points automatically. It helps, for example, the employee who may want to put his or her retirement savings into a pure stock fund and never make a change.

- Help you avoid rookie mistakes: More importantly, target-date funds can help prevent being overweight in an asset class that makes a portfolio too risky given how close they are to retirement, a time when people can least afford to experience a significant drop in the market value of their investment.

- Suitable for investors believing in active management: Investors who like to take a somewhat more active role in their retirement planning can also take advantage of target-date funds to manage their portfolios. Tweaking the allocation by switching to an earlier or later target date based on personal goals and risk preferences is easy, and it can make the portfolio more personally suited instead of just paying attention to the date.

Key Issues to Consider for Retirement Planning

- Can be expensive relative to the underlying instruments. The Vanguard 2050 Fund (VFIFX) has an expense ratio of 0.16%, but each of the fund’s components has a lower expense ratio than the target-date fund itself. Investors can buy the individual components of this target-date fund and save money compared to investing in the target-date fund itself. Although, buying individual funds doesn’t automatically rebalance the way a target-date fund does.

- Ignores investor’s asset class preference. Target-date funds don’t account for one’s desire to take risk. Someone may target retirement in 2050 but have no interest in investing in stocks. In this case, a target-date fund may not be appropriate.

- Not all target-date funds are created equal. One can assume that VFIFX is essentially equal to the Fidelity Freedom 2050 Fund (FFFHX), but that’s not always the case. The Fidelity fund invests in 95% stocks vs. 90% for Vanguard. Fidelity has 29% dedicated to international equities vs. 36% for Vanguard. Vanguard charges 0.16%, whereas Fidelity carries a 0.77% expense ratio. So, instead of focusing on the date, one must pay attention to the fund composition and fees to decide on suitability.

The Bottom Line

Be sure to follow our Target-Date Funds section to make the right retirement planning decision.