A leading factor behind wealth inequality is the lack of retirement savings among a large share of workers—the median retirement savings balance for the bottom half of American families is $0.

Let’s take a look at how the Thrift Savings Plan, designed for government employees, could provide a blueprint for the rest of America and redefine retirement as we know it.

Learn more about retirement planning strategies on our Retirement Channel.

What Is the Thrift Savings Plan?

The TSP provides several investment choices:

- Lifecycle Funds are essential target-date funds.

- The G fund invests in government securities.

- The F fund invests in fixed income.

- The C fund invests in common stock indexes.

- The S fund invests in small cap stock indexes.

- The I fund invests in international stock indexes.

TSP participants are able to choose and allocate any percentage into each desired fund. Contributions are matched up to 5% of a participant’s annual salary and are tax-deferred until retirement along with earnings in the account. The accounts can also be rolled over into a new employer’s plan or to a traditional IRA when the participant leaves the government.

Opening Access to Low-Wage Workers

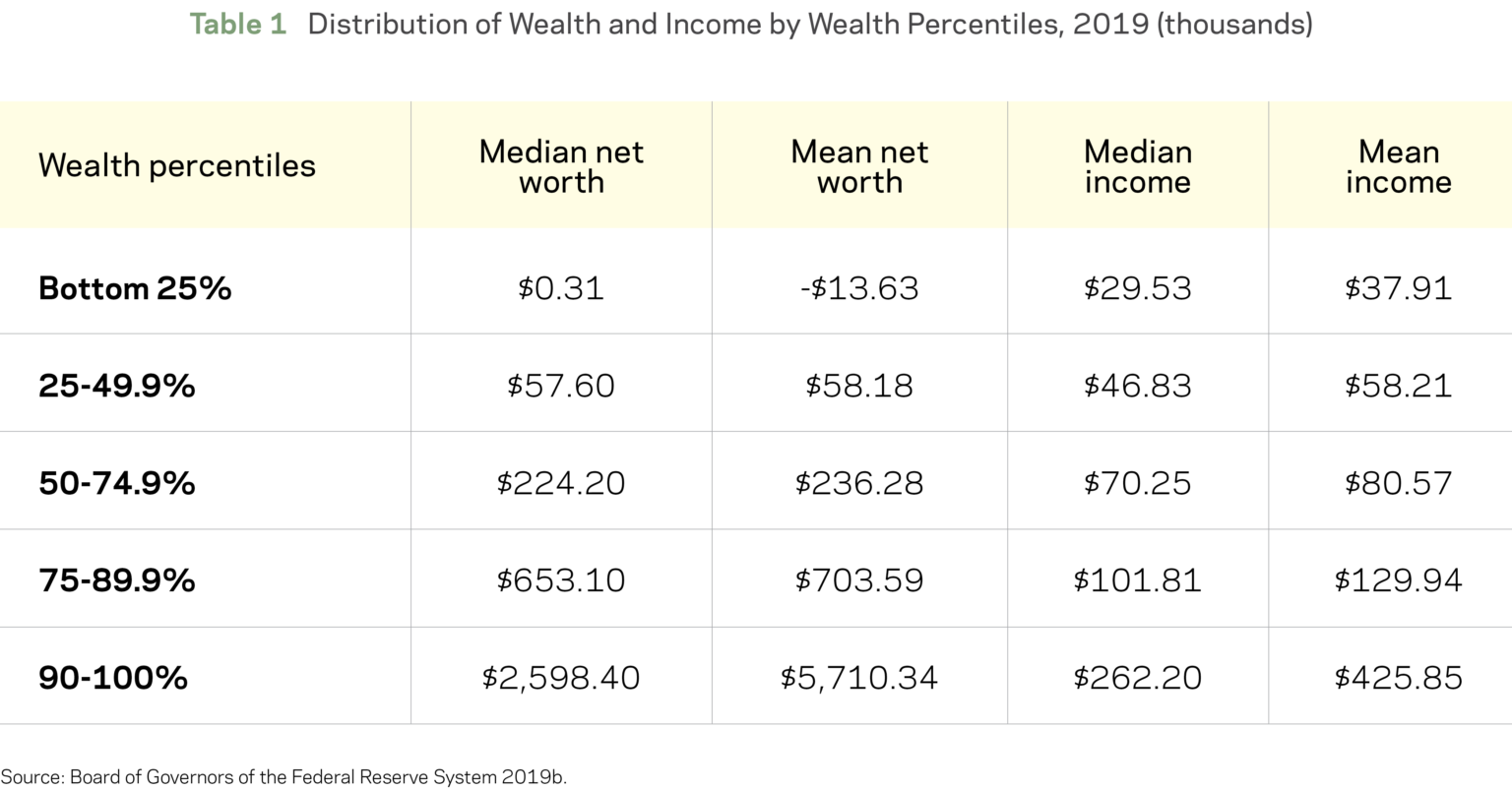

Source: EIG (Wealth distribution in 2019)

Authors Teresa Ghilarducci and Kevin Hassett argue for a TSP-like program whereby employees would be automatically enrolled and the government would provide matching contributions. Assuming a 7% return and a 5% match, the program could help increase median retirement savings by $43,000 in just ten years and help bottom-quartile 25-year-olds save upwards of $600,000.

While taxpayers would be on the hook for these contributions, the government currently borrows money at close to zero percent and the retirement savings would be taxable upon withdrawal. The government would essentially be borrowing at near zero percent and investing it in higher-returning private capital to create a net gain for society.

Potential Consequences to Consider

Government control over a large amount of capital—even larger than the $723 billion existing TSP program—could create a range of issues. In addition to wiping out much of the wealth held at private investment firms, the move would provide the government—which is inherently political—with a lot of influence over the stock and bond markets.

Any drop in the value of the TSP-like program could also spark unrest and accusations of mismanagement. These dynamics could lead the program to invest in more G Fund securities, which may even out return, but also lower earning potential. The high returns that current TSP participants enjoy could become much more mundane.

Be sure to check out our Portfolio Management Channel to learn more about different portfolio management techniques.

The Bottom Line

While there is no legislative proposal in Congress at the moment, experts believe that any plan would have the Federal Retirement Thrift Investment Board (FRRIB) run the program that would be administered by the Social Security Administration, which already plays a similar role in the life of retirees.

Investors should keep an eye on these developments over the coming years as they could have a significant impact on both equity and fixed income markets if they materialize.

Keep track of the latest news in our News section, where we regularly publish the latest around investing.