Perhaps the hardest part of retirement is turning decades of savings into potentially decades worth of income. And while that task has gotten a bit easier with higher interest rates and yields on bonds/cash producing more, the risk of outliving your money and having enough to last is very real. For many investors and advisors, this fear is an omnipresent issue.

But it doesn’t have to be.

Annuities have continued to become a top draw for many pre-retirees and those already in their golden years. And according to investment bank UBS, there are three key reasons why every portfolio should have some exposure to annuities and their benefits.

Two Big Risks

By nature, saving is the easy part of building a retirement nest egg. Place some money consistently into a few key accounts, build an asset allocation, and let compounding work its magic. The hard part continues to be what comes next: turning that pool of savings into a paycheck in retirement.

There are numerous strategies to do just that. But nearly all of them expose investors to two major risk factors: sequence of returns risk and longevity risk.

Longevity risk is the risk that you will outlive your money. Thanks to modern medicine and lifestyles, a retirement portfolio needs to be able to last nearly as long as—and potentially longer than—a person’s working life. Data backs this up. For a married couple in the U.S., there’s a 72% chance that one of them will live to age 85 and a 45% chance that one will live to age 90. There’s even an 18% chance that one of them could live to 95. Moreover, some analysts are projecting that Americans born today could live to well into their 100s thanks to medicine and high-tech medical devices.

Sequence of withdrawal risk has to do with the timing of withdrawals from a retirement portfolio. It turns out that the first few years of retirement are critical to building a lasting nest egg. Starting retirement in a downward trending market impacts the ability of a portfolio to fund a full retirement. In a downward market, investors in retirement are essentially locking in losses, and those losses get compounded even if the market rebounds over the next few years. It’s a real issue that can significantly reduce the ability of a portfolio to last.

However, there is one way investors can remove both of these risks from their retirements. And that’s annuities.

Three Big Reasons to Consider Annuities

Annuities have become a very popular choice for investors over the last few years as they try to navigate many of the market’s trends and issues. But many advisors and investors still seem gun-shy. According to investment bank UBS, there are three big reasons why investors may want to include an annuity in their portfolio to manage these risks.

Annuity Yields Have Improved

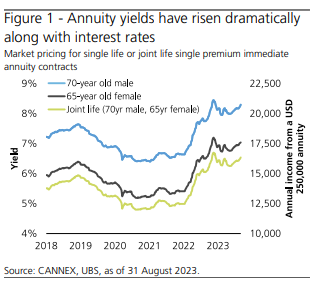

For starters, annuities are finally paying real income again. Annuity yields are tied to prevailing interest rates since many insurance companies backstop their claims with bonds. And now with yields high, annuity payments are on the rise. According to the firm’s data, a family can lock-in 36% more income today than they could just three years ago. This chart from the investment bank shows the current surge higher and extra ‘oomph’ these products can provide.

Lower Future Returns

As annuities are paying more, the potential for other asset classes to underperform is growing, namely when it comes to equities. As the economy continues to drag along, stocks have started to reach very lofty levels. Today, the broader market is trading at a 20.8x valuation. That’s very expensive when compared to historical measures.

According to UBS, that means investors are already baking a lot of future growth into stocks right now. And with that, that implies just a 3.4% annual return rate for the next decade. 1

That’s a huge deal for investors in many stages of their retirement journeys. For those gearing up to retirement, portfolios may not be able to grow as large as needed to support longevity risk issues. At the same time, those in retirement may be faced with running out of money as withdrawal rates are higher than growth. Or perhaps, they won’t be able to withdraw as much as needed given the lower returns.

An annuity with its base of income can provide the required spending a saver needs to live their life.

It’s Expensive to Manage Longevity Risk Yourself

With longevity risk growing for many investors, it’s important to have a plan to manage that risk. Typically, investors seek to do this in one of three ways. This includes delaying retirement, reducing spending, and adopting a more conservative portfolio. However, doing so can be very expensive to do on your own.

For example,to simply live off bonds and dividends without touching principal, it takes a very large nest egg. Even with rates as high as they are, a $1 million portfolio in 10-year Treasury bonds would still only generate $45,000 per year. And while that’s not a bad chunk of change, that might not be enough for the average retiree. This would require a larger nest egg.

Meanwhile, health considerations and the ability to enjoy retirement when younger might make delaying a poor decision. Likewise, reducing spending may not make sense or be possible without seriously impacting your life.

However, UBS surmises that adding an annuity could increase the ‘safe spending rate’ for a family in retirement by anywhere from 3% to 28%.

Adding an Annuity

Giving the potential to reduce the two major risks—longevity and sequence risk—investors may want to consider adding an annuity to their portfolios. Blending a part of their portfolio to gain a base of income to cover basic expenses and then using the rest for wants could provide the best outcome for life in their golden years.

There are numerous annuities out there. Ultimately, buying income now or in the future is a great way to make a portfolio last through retirement. The devil remains in the details. Focusing on a cheap and strong provider is the best course of action. The highest yield or income may not be the best if the product is littered with fees. Shopping around is key.

Fixed Deferred Annuity Providers

These issuers were selected based on their issuer rating, which ranges from A to A++. The lowest minimum investment required ranges from $5,000 to $25,000.

| Insurer | AM Best Rating | Lowest Minimum Investment |

|---|---|---|

| New York Life | A++ | $5000 |

| TIAA | A++ | $5000 |

| Prudential | A+ | $5000 |

| Nationwide | A+ | $10000 |

| Pacific Life | A+ | $25000 |

| Lincoln Financial | A | $10000 |

Registered Index-Linked Annuities (RILA) Providers

These issuers are selected based on their credit rating., which ranges from A to A+.

| Insurer | Credit Rating (A.M. Best) | Option of Indices/Funds |

|---|---|---|

| Allianz | A+ | S&P 500 | Russell 2000 |

| Prudential | A+ | S&P 500 Index | Russell 2000 Index | MSCI EAFE Index | Nasdaq-100 Index | Dimensional International Equity Focus Index | AB 500 Plus Index |

| Nationwide | A+ | S&P 500 Index | Russell 2000 Index | MSCI EAFE Index | Nasdaq-100 Index |

| AXA Equitable | A | S&P 500 Price Return index | Russell 2000 Price Return Index |

| Brighthouse | A | S&P 500 Index | Russell 2000 Index | MSCI EAFE Index | Nasdaq-100 Index |

| Lincoln | A | About 30 different active mutual funds |

The Bottom Line

Annuities could be the answer investors are looking for. According to UBS, they can help reduce the two biggest risks facing investors: sequence of withdrawal risk and longevity issues. With three main reasons supporting their analysis, investors should seriously consider adding an annuity to their portfolio.

1 UBS (September 2023). Three reasons to seek annuity income