After a record bull market run and eleven years’ worth of economic expansion, we may finally be headed towards the dreaded “R” word. We’re talking about recession.

Thanks to the COVID-19 pandemic, social distancing and other measures to stop the spread of the coronavirus, the world’s economy is starting to stall. A variety of data has dipped lower and analysts/economists are now bracing for sharp drops to GDP growth. The truth is, we may already be in a recession.

Which brings us to dividends stocks.

Dividend stocks have long been a great recession fighter for portfolios as their steady payouts cushion losses. But not all dividend stocks perform well during periods of recession. And in fact, many are downright poor. For investors, finding the right sectors to own during this period is critical.

Our Best Dividend Stocks List has 20 of the highest-rated stocks using our proprietary rating system. Go Premium to find out the entire list.

Steady Payouts…

There’s a reason why dividend investing has been a powerful long-term tool for portfolios. And much of that comes from their inherent recession-fighting nature. When we invest, there are two elements that make up our return. One is capital appreciation. The other is dividends – and interest income. The key for fighting recessions comes from the second part.

As capital appreciation becomes scarce and investors sell stocks during recessions, dividends pick up the slack. After all, getting a steady cash-in-hand return of 2 to 4% can go a long way to reduce losses and even produce gains in sideways/flat markets. The best part is that dividends tend to be less volatile than price appreciation. And the proof is in the pudding.

Since World War II, there have been 11 recessions and bear markets. Looking at the S&P 500 and steadfastness of dividends, the average dividend cut during these recessions was a measly 0.5%. Kicking out outlier events, such as the world wars and credit crisis/banks being forced to cut dividends, we are still only looking at an average dividend reduction of about 2%. This compares to an average stock market decline of 32%.

So, with dividend payouts being less volatile, dividend stocks tend to be less volatile as well. By buying firms like utility Dominion (D ) or Coca-Cola (KO), investors can simply smooth out their ride and get a better return versus the market during a recession.

…But Not Always Equal

The problem is, it’s not always that way. The data presented in the previous section is, well, an average. Your mileage may vary depending on your portfolio. And we don’t have to go far to see the wide-spread carnage that a recession can do to dividend payouts.

According to S&P, as of the end of March 2020, 13 stocks within the S&P 500 announced dividend cuts/suspensions. There was roughly a net-indicated dividend change of negative $5.5 billion. The last time we went negative was back in 2009, when the credit crisis ramped up. The victims have been varied, including top leaders like Boeing (BA) and Ford (F ) as well as smaller names like luxury goods provider Tapestry (TPH) and restaurant Texas Roadhouse (TXRH ).

Be sure to check here how the airline industry dividends are being affected by the COVID-19 crisis.

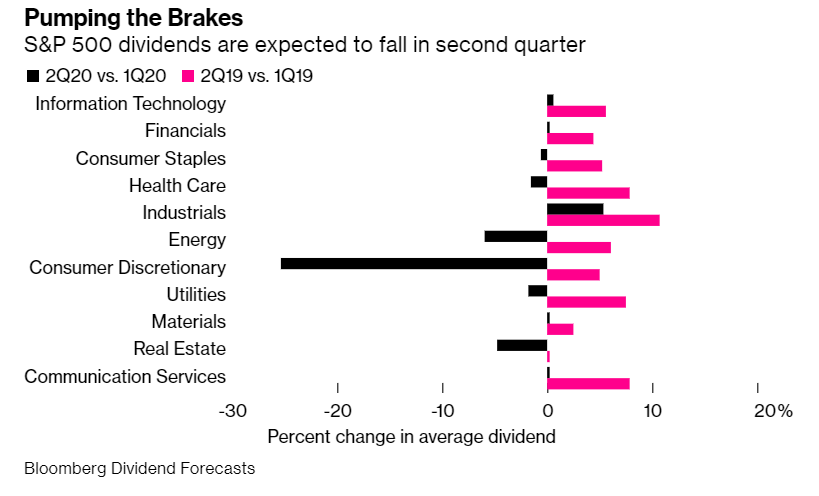

And more could be in store, as companies look to preserve cash during the COVID-19-inspired downturn in the economy. Just take a look at this chart from Bloomberg and you get a sense of the magnitude of pending dividend cuts.

Source: Bloomberg

There is something interesting about the above chart that underscores a vital point. Not all sectors tend to cut dividends during recessions. While dividend growth may slow across the board, severe cuts tend to happen in certain sectors. And this makes sense.

As consumers and businesses are forced to deal with lower cash flows/earnings during recessions, certain purchases go out the window. We don’t need to buy extra clothes from Macy’s (M ), which hurts revenues, and without cash coming in, you can’t hand out cash back to investors. Discretionary firms, basic materials, energy and even real estate stocks have historically been some of the biggest dividend cutters during recessions. This should hold true during the current crisis period as well.

And, already, that’s been the case with the first round of dividend cuts/suspensions. Consumer discretionary and energy firms have dominated led by the likes of Kohl’s Corp. (KSS ) and Schlumberger Ltd. (SLB ), respectively.

Preparing Your Portfolio

Yes, dividend stocks are great recession fighters and can help reduce losses/boost returns during periods of uncertainty. But only if you bet right. In the current state of affairs, it might make sense to prune your portfolio of sectors that focus on non-essential items. A discretionary firm, such as Harley-Davidson (HOG ), is far more likely to cut its dividend than a boring utility stock.

The flipside would be to look at sectors with high rates of cash flows, margins and balance sheet health. We’re talking about tech, industrials and consumer staples. Here, there should be adequate health to keep payouts going through the current malaise. For example, Apple (AAPL ) is in a much better position to raise its dividend this quarter based on its high cash balance while consumer giant Procter & Gamble (PG ) already raised its dividend this quarter.

The key is to focus on balance sheet health and overall “quality” metrics: Eliminate potential problems now before the cuts start piling up.

The Bottom Line

Dividends are great tools to help fight recession but the toolbox can vary in effectiveness. Not all sectors and stocks are able to fight the tide of a downturn in the same way. And those that can’t have historically been pretty bad at doing so. For investors, that means getting rid of discretionary-styled stocks whose sole lifeblood depends on spending/economic health. In the end, by focusing on strong names, investors can actually get a portfolio that does its job during a downturn.

Follow Dividend.com’s Education section to get answers to all your dividend specific questions.