We’re talking about tontines.

The contracts originally designed to fund wars during medieval times are attracting serious attention from the financial planning and defined benefit community. With lower costs than annuities, less risk for issuers, and the potential for decades’ worth of growing income, tontines may be coming to a benefit plan or brokerage near you.

To learn more about retirement topics, visit our Retirement Channel.

What Exactly Is a Tontine?

The key difference is that with a tontine, it’s a pool of investors. Here, a group of investors contribute lump sums and pool their money together. Like an annuity, they get dividend payouts for life. The kicker with tontines is that as each member of the pool dies, the person’s dividend is divided among the living members. When the last investor dies, the tontine ends and the pool of money goes toward the issuer/insurance company. Another tontine variation involves no dividend payments and the last survivor gets the entire pot of money minus fees.

Tontines were originally created by the English government in 1693. King William needed a cheap and easy source of funding to finance his war against France. Here in America, tontines were a popular way to finance retirement during the late 1800s through the Great Depression. At one point, more than 7.5% of the nation’s wealth was tied to tontine investments. However, as the Roaring 1920s were fraught with corporations, Ponzi schemes, and no regulations, many Americans in these vehicles were taken advantage of and lost their savings. As such, the vehicle lost favor and, in some cases, became illegal to operate.

Better Than an Annuity

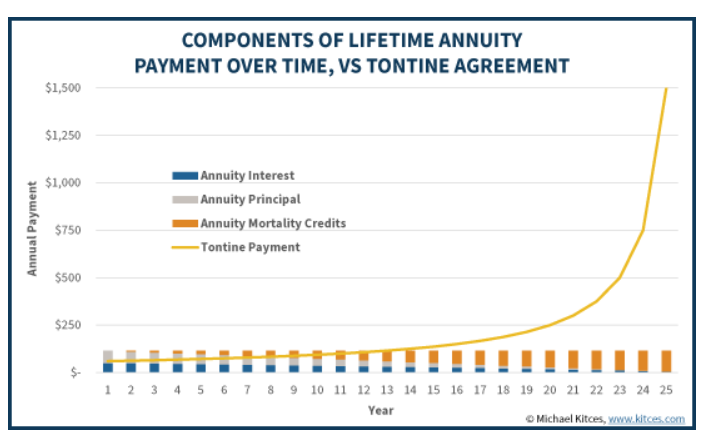

Finance blogger Michael Kitces offers an example of how this works. A group of 25 investors each contribute $1,000 to a tontine that offers to pay 6% annually. Each year, the tontine produces $1,500 worth of dividends that are divided among the participants ($1,500/25), or in this case $60. However, if after a few years there are only 20 living members ($1,500/20), the per-person dividend increases to $75. And so forth.

Kitces offers this chart to show how a tontine payout would compare to a traditional immediate lifetime annuity. As you can see, there is a point when the vehicle becomes more lucrative for surviving members and overcomes the issue of outliving your money. It also eliminates one major worry about annuities: living long enough to break even on the investment.

Source: Kitces.com

Tontines produce higher payouts due to one major factor: costs. In an annuity, the issuance company takes on a lot of risk—that not everyone will die according to their mortality crediting scheme—and the cost of taking on that risk isn’t free. As a result, payouts via an annuity will always be less than the risk-free rate of a bond.

However, in a tontine, the risk is shared among the investors. The issuer is simply a recordkeeper and fees are minimal due to the lack of ‘risk’ they must undertake. As a result, investors can get higher initial payouts and increasing payouts without the additional costs of riders as with an annuity.

According to the Washington Post, these factors will allow for initial payouts 10-20% larger from a tontine investment versus an annuity.

Check out our Portfolio Management Channel to learn more about managing your portfolio.

Taking a Hard Look at Tontines

The structure is starting to enter the financial lexicon and the world of retirement planning. And there are some lingering questions about their legality. However, many problems stemming from tontines in the 1900s are no longer issues given how regulated the insurance industry is these days. As such, many insurance companies are taking a hard look at the product again.

Internationally, both the U.K. and Canada have begun allowing employers to offer Variable Pension Life Annuities in their plans, which is just a fancy way of saying tontine.

The Bottom Line

Don’t forget to explore our recently launched model portfolios here.