First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $150 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this edition, we take a closer look at trending retirement income funds for investors. As the category name implies, the primary objective of retirement income funds is to generate income for investors who are soon to be, or currently, retired from the workforce. They are also more commonly known as target-date funds because the allocation of assets between equities and bonds changes as the fund matures from a greater weight in equities early on to more conservative fixed income assets as it reaches its set target date.

These funds invest in a basket of assets that includes equities, bonds, cash, and other fixed income products. The primary objective is to provide a steady, predictable income stream while mitigating risk.

Our breakdown of each fund includes key aspects such as one-year performance, performance from inception, fund expenses, investment strategy, and management team to give you an overview of how these funds hold up against their peers.

Be sure to check out the Retirement Income Funds page to find out more about the other funds in this category as well.

Trending Funds

Below, we take a look at the top performing funds in this category.

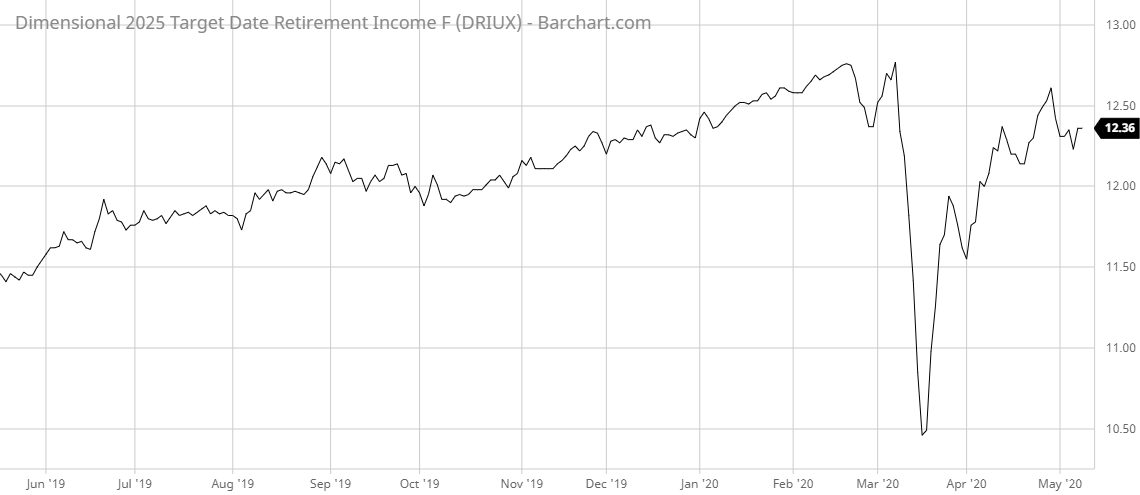

1. Dimensional 2025 Target Date Retirement Income Fund (DRIUX)

The number one mutual fund on this week’s list is a target-date fund, DRIUX, offered by Dimensional. It provided an exceptional trailing one-year total return of 10.29% and a total return of 7.26% since the fund’s inception in November 2015. The low 0.21% expense ratio is on par with other target-date mutual funds.

The overall investment strategy of the fund is to allocate assets to other mutual funds to achieve an allocation that matches the investor’s retirement date of 2025. It seeks to slowly change its holdings from equities to a greater weight in fixed income products over the course of 15 years (2040). The final allocation is set to be 15% to 25% in equities and 75% to 85% in fixed income products. It uses the S&P STRIDE Glide Path 2025 Index as its benchmark.

Jed S. Fogdall is the fund’s primary portfolio manager who has been managing the fund since November 2015. He is the Co-Head of Portfolio Management and Vice President of Dimensional. He is assisted by five other managers.

The portfolio holdings are broken down into three main categories: global equity, global fixed income, and inflation protected bonds. As a fund of funds, it invests in a basket of mutual funds to achieve its stated goal.

Want to know more about portfolio rebalancing? Click here.

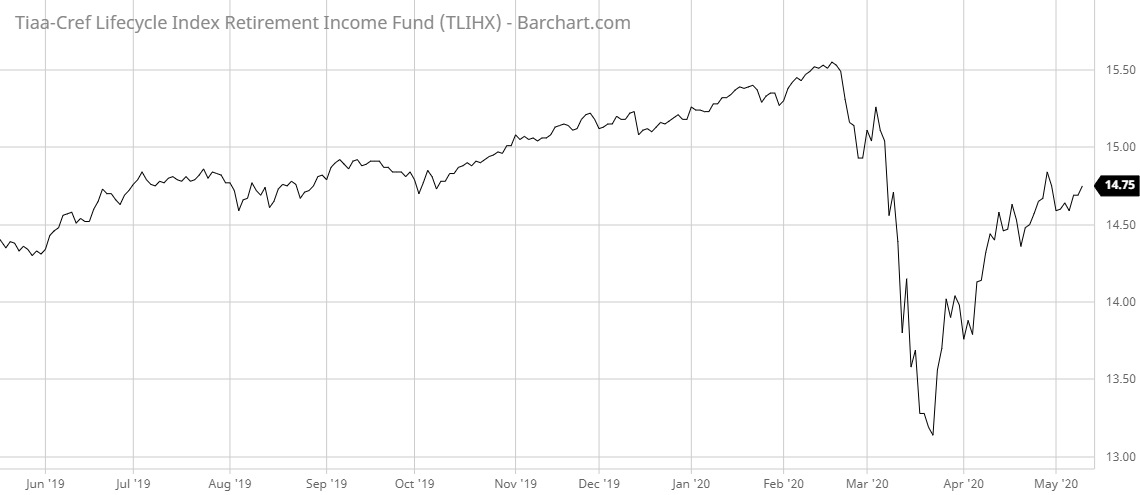

Our second-place retirement income fund is an index fund by TIAA-CREF, TLIHX. It generated a trailing one-year total return of 4.27%. The low expense ratio of 0.18% is a bargain for investors, placing it on the lower end of the retirement income fund category.

The investment strategy of the fund is to hold asset weights to no more than 10% more or less from a 60% equity funds and 40% fixed income funds allocation. It is benchmarked to the S&P Target Date Retirement Income Index.

John Cunniff, CFA, and a managing director with TIAA, is the portfolio manager of the fund and has been managing the fund since September 2009, along with Hans L. Erickson, a managing director.

The current holdings of the fund are broken down as follows: U.S. equities (28%), international equities (12%), fixed income (40%), short-term fixed income (10%), and inflation-protected assets (10%).

Find out about the funds suitable for your portfolio by using our free Screener.

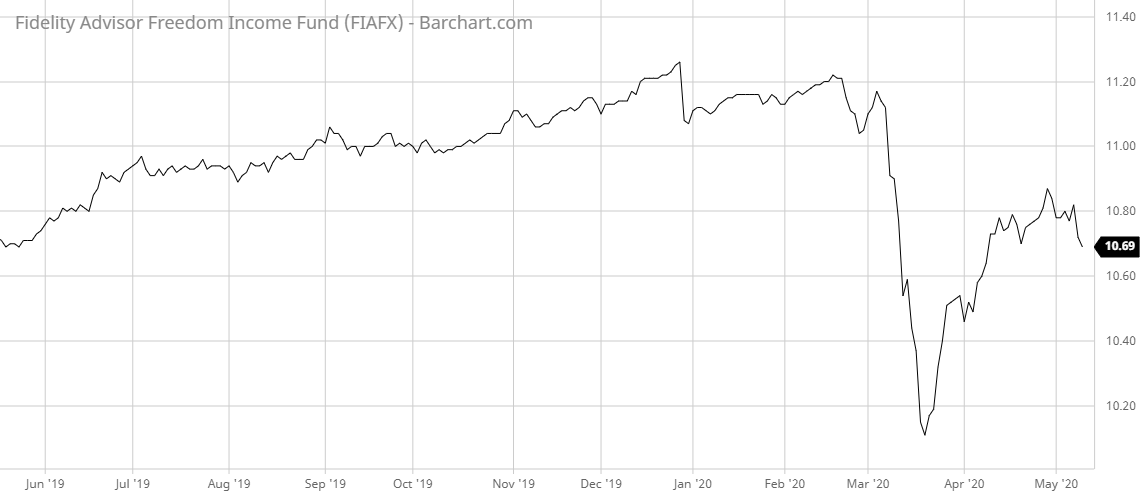

Rounding out this week’s list is Fidelity’s FIAFX with a trailing one-year total return of 3.84%. The 0.47% expense ratio is relatively high compared to its peers.

The fund’s stated investment strategy is to keep a portfolio allocation that correlates to a retirement date of mid-2020. Target allocations are specified as follows: 10% in domestic equity funds, 10% in international funds, 60% in bond funds, and 20% in short-term funds. Weights are variable up to a 10% difference. The fund is benchmarked to the Bloomberg Barclays U.S. Aggregate Bond Index.

The fund is co-managed by Brett F. Sumsion, CFA, and Andrew Dierdorf, CFA. While Andrew has been managing the fund since June 2011, Brett joined him in January 2014. Both are portfolio managers in Fidelity’s Global Asset Allocation group.

The fund’s portfolio holds other mutual funds, primarily funds offered through Fidelity. The allocation of the portfolio is currently stated to be: 9% in domestic equity funds, 10% in international funds, 55% in bond funds, and 26% in short-term funds.

Learn more about different Portfolio Management concepts here.

The Bottom Line

Our expert analysis of the top three funds will give you insight to choose the best retirement income fund that ensures an income stream that lasts as long as you intend it to so you can focus on the things that matter to you.

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of May 7, 2020