Let’s look at how non-savers can catch up, why existing investors should stay the course, and some tips to keep in mind.

To learn more about retirement topics, visit our Retirement Channel.

Lower Your Cost Basis

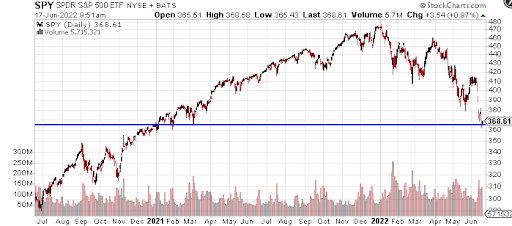

Today’s market is back down to December 2020 levels. Source: StockCharts.com

At the same time, research has made it clear that market timing is a bad idea. In other words, you should avoid waiting for the market to bottom-out before making new retirement contributions. That’s because if you had missed just five of the best days per year over the past 20 years, you’d have a 44% lower return than buying and holding!

Those already saving for retirement – but behind the curve – should also keep investing to benefit from dollar-cost averaging. By buying stocks at lower valuations, you lower your overall cost basis and create an opportunity for more significant future gains. In other words, you buy at the market tops and bottoms to even out returns.

Check out our Portfolio Management Channel to learn more about managing your portfolio.

5 Ways to Close the Gap

Here are a few tips to keep in mind:

- Max Out Your 401(k) First – Employer 401(k) plans have higher contribution limits than IRAs, and many employers match a certain percentage of your salary. These matches are “free” money that boosts returns beyond what the market offers.

- Save 10% for Retirement – Most experts recommend saving at least ten percent of your earnings over 40 years to maintain the same standard of living in retirement. However, financial advisors or robo-advisors can help you determine a specific number.

- Right-Size Your Risk – Increasing risk can help boost returns, but you should ensure that your portfolio remains within your risk tolerance threshold. In general, younger investors can afford to take more significant risks given their long time horizons.

- Put Savings on Autopilot – The best way to stick with your retirement savings plan is to automate withdrawals from your bank account or your employee paycheck.

- Consider I-Bonds – Series I Savings Bonds provide a nearly 10% annual yield given the high level of inflation, making them an attractive risk-free option. These bonds may be especially compelling for investors nearing or in retirement.

The Bottom Line

Don’t forget to explore our recently launched model portfolios here.