Key Takeaways

• Many of the new entrants offer semi-transparent strategies approximate to successful mutual fund products. CFRA thinks active equity ETF demand will increase as investors better understand the tax-efficiency and liquidity benefits.

• Davis Advisors has proven the benefits of offering ETF and mutual fund versions of similar strategies. The firm has $900 million across four ETFs in less than four years, led by Davis Select Worldwide (DWLD).

Fundamental Context

While equity ETFs represent 54% of the active ETF offerings available, this year equity funds make up 82% of the active launches. This recent wave of equity products is driven by three segments: Buffer ETFs, fully transparent active, and semi-transparent active.

Buffer ETFs, also known as defined outcome ETFs, offer guardrails and provide investors with downside protection against some market losses in exchange for a cap on the upside. Innovator Management and First Trust have continued to expand and refresh their respective buffer ETFs, such as Innovator S&P 500 Buffer ETF – March (BMAR) and FT CBOE Vest U.S. Equity Buffer ETF – February (FFEB). These funds cap both the downside and upside, using options.

Meanwhile, both established ETF providers and new entrants launched equity ETFs that, like ARKK, disclose holdings daily. For example, investors know the top two positions for newly launched JPMorgan International Growth ETF (JIG) in early August were Alibaba (BABA) and Taiwan Semiconductor (TSM).

The third growing segment of actively managed ETFs are semi-transparent as they reveal the full holdings only periodically and with delay. In August, T. Rowe Price launched four such ETFs that are tied to well-known active mutual funds strategies, including T. Rowe Price Dividend Growth ETF (TDVG). TDVG is managed by Thomas Huber, the long-time manager of CFRA five-star rated T Rowe Price Dividend Growth (PRDGX), which focuses on companies that are expected to raise dividend payments. T Rowe Price has not yet disclosed the ETF holdings, but we know that Microsoft (MSFT) was the mutual fund’s largest as of June 2020.

These semi-transparent ETFs join American Century Focused Dynamic Growth (FDG 62), Clearbridge Focus Value ETF (CFCV 27), and Fidelity Blue Chip Growth (FBCG 23) and others that launched in 2020 from established actively managed mutual fund firms seeking to offer their stock selection skills to an ETF audience. CFRA thinks while the assets have been limited in the first few months, investors favoring active management from these firms will find the tax-efficiency and liquidity of the ETF structure to be appealing.

Davis Advisors provides a strong example of the benefits of offering an ETF alternative. Davis Advisors entered the ETF business with fully transparent ETFs in January 2017 and manages $900 million across four active equity ETFs. According to Dodd Kittsley, National Director at Davis Advisors, the ETFs have the same investment discipline, research, team and portfolio managers with substantially similar holdings to more established mutual funds. However, the mutual fund versions of the strategies include private placements, less liquid securities, and often have higher cash positions than the ETFs.

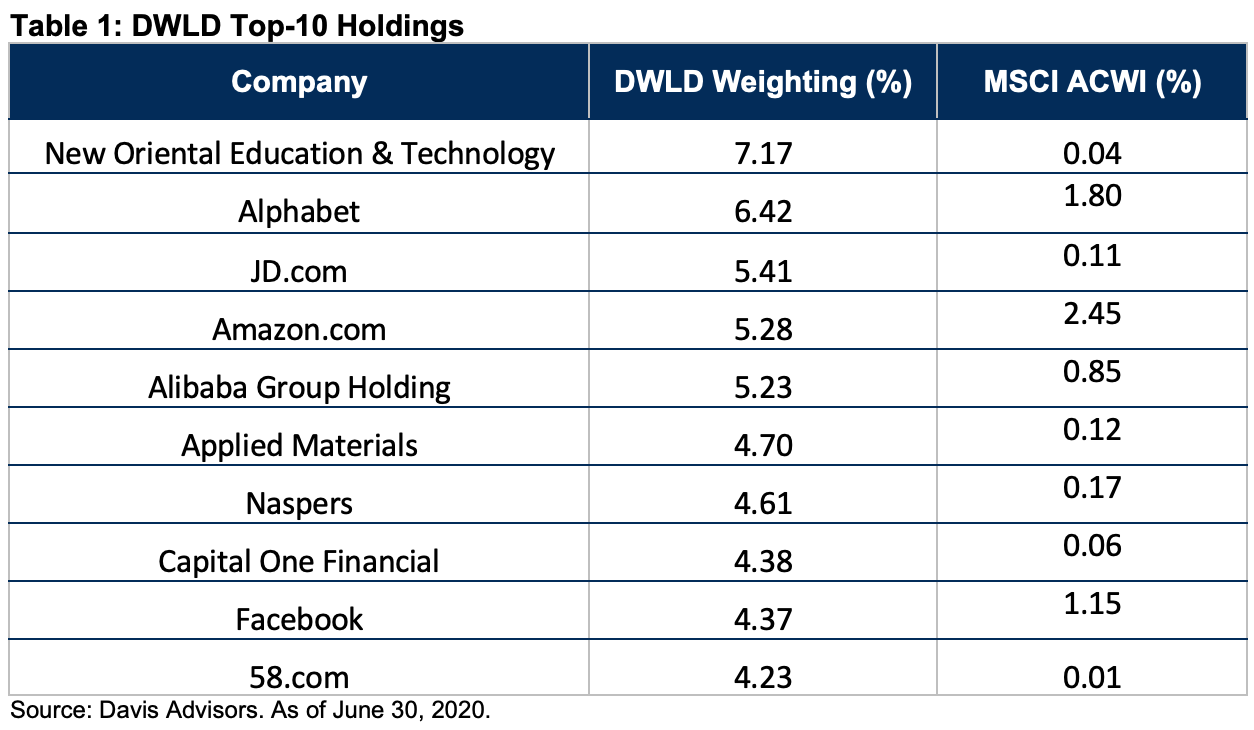

Kittsley added that the Davis approach is long term in nature with low turnover making full transparency less of a concern, but the ETFs and mutual funds are benchmark agnostic. For example, CFRA four-star rated Davis Select Worldwide ETF (DWLD) and five-star Davis Global (DGFYX) had top-10 positions in New Oriental Education & Technology (EDU) and JD.com (JD), which combined were 0.15% of the MSCI All Country World Index at the end of June 2020. CFRA rates ETFs and mutual funds independently from one another using different fund-specific metrics.

We think some investors are willing to pay a moderate premium for active management if they receive a different portfolio than when replicating an index and the growing suite of active ETFs will provide options. CFRA will be participating in an active equity ETFs webinar on August 20. To attend this event please register by clicking here or by contacting cservices@cfraresearch.com.

Conclusion

Todd Rosenbluth is Senior Director of ETF and Mutual Fund Research at CFRA

Contact CFRA

1 New York Plaza, 34th Floor

New York, NY 10004

USA

P: +1-800-220-0502

cservices@cfraresearch.com

www.cfraresearch.com