In this article, we’ll examine five of the largest funds and their strategies, holdings, fees and performance.

In case if you are wondering whether mutual funds are right for you at all, you should read why mutual funds, in general, should be a part of your portfolio.

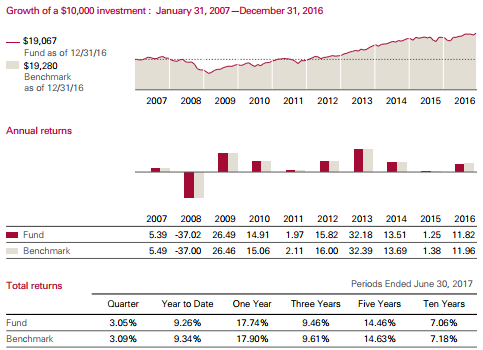

Vanguard Total Stock Market Index VTSMX

- Managers: Gerard C. O’Reilly, Walter Nejman

- Share Classes: Investor, Admiral, Institutional, Institutional Plus, Institutional Select

- Expense Ratio per Share Class: 0.15%, 0.04%, 0.035%, 0.02%, 0.01%

- Assets Under Management: $ 603.60 billion as on September 26, 2017

In 1992, Vanguard created the Total Stock Market Index fund with the goal of investing in the entire stock market universe. It invests in large-, mid- and small-cap stocks across all sectors and styles, and represents nearly 100% of the investable U.S. stock market. The fund tracks the CRSP U.S. Total Market Index.

Since it’s a market-cap-weighted index, the portfolio as a whole still skews heavily towards large-caps. The heaviest weightings in the fund currently go to financials (20%) and technology (18%), with healthcare, consumer services and industrials each getting 13% of fund assets. The fund manages a total of nearly $600 billion.

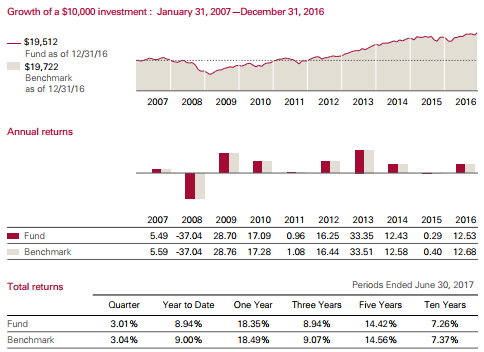

Vanguard 500 Index VFINX

- Managers: Donald M. Butler, Scott E. Geiger

- Share Classes: Investor, Admiral, Institutional, Institutional Plus, Institutional Select

- Expense Ratio per Share Class: 0.15%, 0.04%, 0.035%, 0.02%, 0.01%

- Assets Under Management: $341.20 billion as on September 26, 2017

Despite the Vanguard Total Stock Market Index fund topping this list, the S&P 500 still remains the most popularly tracked benchmark in the marketplace. Vanguard’s 500 Index fund is the clear leader in this space, with $568 billion in assets across all share classes of the fund. Designed to provide long-term growth by focusing mostly on large companies, the fund is one of the oldest index funds in existence, having launched back in 1976. The majority of retail investors opt for the lower-cost Admiral share class, which charges just 0.04% annually, making it one of the cheapest mutual funds available. Technology, financials and healthcare, the three largest sectors in the fund, make up roughly half of the portfolio.

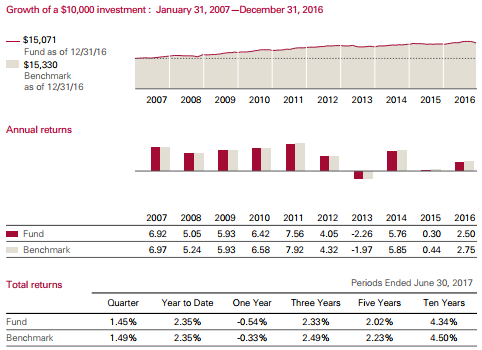

Vanguard Total International Stock Index VGTSX

- Managers: Michael Perre, Michelle Louie

- Share Classes: Investor, Admiral, Institutional, Institutional Plus, Institutional Select

- Expense Ratio per Share Class: 0.15%, 0.04%, 0.035%, 0.02%, 0.01%

- Assets Under Management: $299.50 billion as on September 26, 2017

Investing overseas provides individuals with additional growth opportunities, but those opportunities come with added risk. The Vanguard Total International Stock Index fund seeks long-term growth by focusing on large, stable companies, primarily from the world’s developed markets. Nearly 75% of the fund’s investments come from the European and Asian regions, while 20% is invested in emerging markets. Japan (17%), the United Kingdom (13%) and Canada (7%) are the largest individual country holdings.

Be sure to check out the emerging market regions that might be offering the best opportunities at the moment here.

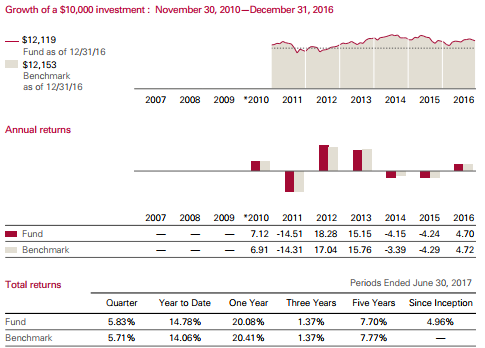

Vanguard Total Bond Market Index VBMFX

- Manager: Joshua C. Barrickman

- Share Classes: Investor, Admiral, Institutional, Institutional Plus, Institutional Select

- Expense Ratio per Share Class: 0.15%, 0.04%, 0.035%, 0.02%, 0.01%

- Assets Under Management: $188.80 billion as on September 26, 2017

The Vanguard Total Bond Market Index fund is designed to provide investors with broad exposure to all areas of the fixed income markets. It invests in a mix of roughly two-thirds government and treasury securities and one-third corporate bonds. The fund can invest in securities both short- and long-term, but sticks to only investment-grade bonds.

Take a look at our list of bond funds here.

American Funds Growth Fund of America AGTHX

- Managers: Christopher D. Buchbinder, Barry S. Crosthwaite, J. Blair Frank, Joanna F. Jonsson, Carl M. Kawaja, Michael T. Kerr, Ronald B. Morrow, Donald D. O’Neal, Martin Romo, Lawrence R. Solomon, James Terrile, Alan J. Wilson

- Share Classes: A, C, F-1, F-2, F-3, R-1, R-2, R-2E, R-3, R-4, R-5, R-5E, R-6

- Expense Ratio per Share Class: 0.66%, 1.46%, 0.71%, 0.44%, 0.33%, 1.43%, 1.42%, 1.13%, 0.98%, 0.68%, 0.39%, 0.56%, 0.33%

- Assets Under Management: $166.60 billion as on September 26, 2017

The Growth Fund of America is the only actively managed fund on the list. It looks for long-term growth of capital by having the flexibility to invest wherever the best growth opportunities exist. That flexibility extends to foreign investments, where the fund can invest up to 25% of assets, as well as bonds. The fund’s managers are currently finding the greatest opportunities in technology and consumer staples, which comprise nearly half of the fund’s assets. Top individual holdings include Amazon, Alphabet, Microsoft and Broadcom.

Check out the list of emerging market funds here. Also be sure to check out our list of international equity funds here to broaden your research.

The Bottom Line

Be sure check our News section to keep track of the recent fund performances.