With yields surging, bonds have quickly become the go-to asset class for many investors. The 4% to 5% yield that investors can get in bonds certainly trumps the current malaise of the stock market. Moreover, bonds with their par values paid at maturity provide plenty of safety to portfolios.

However, investors may want to rethink that safety aspect. It turns out that bond quality is starting to slip.

According to alternative asset and credit manager Apollo Global, bonds aren’t as good as they once were. Credit risks are rising, even for the safest of bond issuers. With that, investors only have a limited time to score top-rated bonds before it’s too late.

Rising Rates Start to Hurt Bonds

We all know the Federal Reserve has been hiking rates for more than a year as it looks to slow the economy and combat inflation. This tightening is expected to continue with the Fed predicted to raise rates at least one more time this year and potentially a few times in early 2024. For bond investors, this has led to mixed emotions.

After the big 13% drubbing bonds took last year, investors are now able to score some hefty yields across the fixed income universe. In fact, as of writing, the yield on the 10-year Treasury bond hit 5%, a feat not seen since 2007. Investors have responded with bonds now becoming a main driver of portfolio returns, particularly when equities have become so volatile with the rising rate environment.

But according to hedge fund and alternatives manager Apollo Global, this may not be the best course of action. Those high yields aren’t just coming as part of the higher rate environment, but credit quality is starting to reflect the deteriorating nature of the bond market.

Rising Bankruptcies

The ultimate point of the rate hikes is to make borrowing expensive and saving a more lucrative option. The borrowing aspect is now starting to hit companies and the bond market pretty hard. Thanks to a decade of low rates, many firms, as well as national and local governments, have feasted on cheap debt.

According to Apollo Global’s economist Torsten Sløk, this fact is coming to roost.

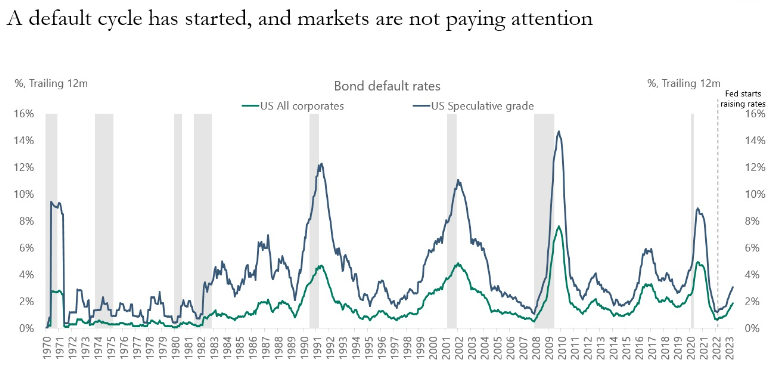

Already, the Fed’s hikes are starting to increase bankruptcy filings among the most hard-up firms. While companies like Bed, Bath & Beyond and Yellow Trucking have made the headlines, over 400 firms have now filed for bankruptcy this year. According to Moody’s, that’s doubled the default rates for the lower-rated firms to 3.8%, up from 1.4% a year ago.

In a recent blog post, Sløk provides the following chart. You can clearly see the uptick in filings amid the recent rate hike.

Source: Apollo Global

The issue is what comes later. According to Sløk, the Fed has no plans to stop rate hikes anytime soon. That’s a problem for firms on the risky end of the credit spectrum. Many have chosen to raise debt via leverage loans, whose coupon payments rise with rate hikes. As rates rise, these borrowers will face even larger debt payments. At the same time, refinancing may not be an option considering regular junk bonds are at such high yields.

For Apollo Global, this could send the default rate for junk debt as high as 6% before the end of the year. Moody’s predicts that if economic conditions worsen, that number could rise as high as 15.6% next year. 1

Credit Ratings Slip Too

So, the answer is to bet on quality, right?

Well, it is not so simple either. It turns out that quality is starting to become hard to find. Looking at issuances of both investment-grade corporate bonds and high yield debt, Apollo Global’s data shows that A & BBB bond and CCC & lower debt issuances are rising. These are the lowest categories for both IG and HY credit, respectively. At the same time, the various ratings agencies have started to downgrade many firms, put them on ‘credit watch’ or warn of slowing cash flows with regard to their debt burdens. 2

Even the U.S. government is facing debt woes. Over the summer, Fitch downgraded U.S. Treasury debt on rising balances and the debt ceiling/congressional inaction. At the same time, Apollo Global summarizes the surge in Treasury bond yields doesn’t just have to do with rising rates, but also the U.S. government’s surging debt balances. Bondholders are simply demanding more return to hold debt issued by the Federal government.

Caution Is Needed

Overall, bonds may not be as safe as many investors think they are. Credit quality is slipping and default rates/bankruptcies are rising. This is without a major economic event. The simple act of raising rates is enough to start impacting their safety and quality. This puts investors in a pickle with regard to their portfolios. The Fed will keep marching forward with regard to rate hikes, putting bond portfolios at risk.

The secret to navigating this environment today and tomorrow could be focusing on the best quality you can and short-term debt. Betting on the best of the best will help reduce credit risk, while default rates for the shortest-termed debt are generally lower than longer-termed ones. But that might not be a panacea either, particularly if rollover risk is there.

Quality might be the easiest route. The iShares Aaa – A Rated Corporate Bond ETF allows investors to bet on the top tiers of investment-grade corporate bonds. The Goldman Sachs Access Investment Grade Corporate Bond ETF could be a good choice as well. The ETF is a smart-beta ETF that uses Goldman’s in-house credit research that focuses on quality bond issuers. Betting on the SPDR Portfolio Short Term Treasury ETF could provide both quality and short-term needs.

While it’s generally preferable to avoid floating rate and junk bonds during periods like this, the bond types are yielding very juicy amounts. The issue is making sure you own the best bonds of the type. The VanEck IG Floating Rate ETF tracks only floating rate bonds of investment-grade quality, while the Invesco High Yield Bond Factor ETF is actively managed to find high-quality junk bonds amid the dwindling credit environment.

Quality Bond ETFs

These funds were selected based on their YTD total return, which range from 0.2% to 7.6%. They have expenses between 0.03% to 0.39% and have assets of between $40M and $5.8B. They are currently yielding between 3.9% and 7.2%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| IHYF | Invesco High Yield Bond Factor ETF | $41.4M | 7.6% | 7.2% | 0.39% | ETF | Yes |

| FLTR | VanEck IG Floating Rate ETF | $1.23B | 5.6% | 6.4% | 0.14% | ETF | No |

| SPTS | SPDR Portfolio Short Term Treasury ETF | $5.821B | 2% | 4.1% | 0.03% | ETF | No |

| GIGB | Goldman Sachs Access Investment Grade Corp Bd ETF | $608.5M | 0.98% | 4.6% | 0.14% | ETF | No |

| QLTA | iShares Aaa - A Rated Corporate Bond ETF | $921.9M | 0.22% | 3.9% | 0.15% | ETF | No |

Ultimately, fixed income investors need to focus on the top tiers of quality and not take risks with their portfolios. The current environment is only getting worse.

The Bottom Line

Bonds aren’t the safe haven we think they are amid the new higher rate environment. According to Apollo, defaults are set to rise and credit quality is slipping. That’s a big problem for investors. Focusing on the best of the best is the key going forward.

1 Apollo (August 2023). A Default Cycle Has Started

2 Apollo (Sep 2022). Credit market outlook