Many fixed income assets ebb and flow with the economy. Changes to data, recessionary potential, and corporate profits can have a real effect on bond prices. Perhaps nowhere is this effect greater than in the world of high yield and junk bonds. These bonds made to less-than-stellar borrowers directly feel the pinch of economic activity. So, when things are dicey, their risks grow.

But right now, the current economic environment could be flashing a big ‘buy’ signal.

Recessionary risks are starting to fade. While economic data has begun to slip, the economy is chugging right along. The Federal Reserve may achieve its soft landing and guide the economy lower without pushing it into a full-blown recession. And that makes junk bonds and their yields very attractive indeed.

Cloudy, But Not Stormy

To be honest, the Federal Reserve has a very tough job. Making sure the economy is growing without overheating is a small needle to thread. Historically, the Fed has induced recessions, overtightening too much and tipping the scale into contraction.

This is why so many analysts and pundits are currently waiting with bated breath in the current environment. It’s no secret that the Fed has raised interest rates to levels not seen in decades to combat rising inflation. Those higher rates have encouraged saving over spending and have made borrowing expensive for many enterprises and individuals. Naturally, economic data has slipped, with a variety of consumer, manufacturing, and housing metrics starting to move lower.

And yet, the economy is still moving right along. Inflation remains above the Fed’s target, while consumer spending remains strong. Measures of labor activity are bullish, while new onshoring demand has kept measures of manufacturing activity still in the expansion ranges.

Despite the current clouds, the Fed may actually be achieving its goal of a soft landing, guiding the economy lower without plunging it into a full-blown recession. According to Goldman Sachs, the economy now has an 85% chance of hitting a soft landing and avoiding a recession in the next year. 1

High Yield Bonds Start to Look Good

The growing potential for a soft landing could be the best buying opportunity for high yield bonds. That’s according to a new paper from investment manager Capital Group. Looking at historical data and credit spreads, investors may have a limited window to buy junk for the maximum return potential.

Part of the reason why high yield could be a great buy is that some of their risk is now off the table. High yield bonds are issued to non-investment-grade issuers. There’s a much greater risk of default for these bonds than the U.S. government, the State of Texas, or Walmart. Investment-grade issuers still have plenty of levers to pull even if the economy gets dicey. But for junk issuers, dwindling economic data directly impacts their ability to repay their bonds and coupon payments. With a soft landing now being the most likely outcome, defaults should be low. Based on spreads, defaults for junk bonds should only be around 3% this year, which is within the normal 30-year average. 2

Speaking of those spreads, according to Capital Group, now could be the best time to pounce. Looking at the popular Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, investors currently can score an 8.53% yield. That’s about a 4% or 400 basis points difference versus safe Treasury bonds. That’s close to the 20-year spread average of 450 bps to 500 bps. What’s more, spreads have rarely been over that amount and only in times of extreme crisis have been above 800 basis points.

With the economy going forward, Capital Group estimates that spreads could narrow as investors begin to buy junk bonds to take advantage of their current high yields. That gives investors a limited window to take advantage of the higher income available on these bonds.

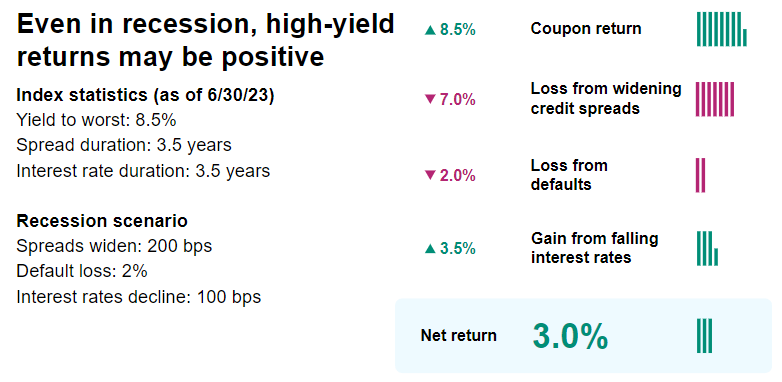

What’s more is that even if a recession starts, high yield bonds could still have the ability to generate a positive return on the year based on current spreads and yields. If the Fed is forced to cut rates to avoid recession, Treasury yields could fall across the curve by roughly 100 basis points. This would push up bond prices and, with a duration of 3.5 years for the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, this would result in an increase of 3.5% to junk bond prices. Even when factoring in defaults and losses from widening credit spreads, investors should be left with a positive 3% return from the asset class.

This chart sums up their thought process.

Source: Capital Group

Adding Some High Yield Debt

For investors, high yield bonds could offer the best of both worlds in the current economic environment. If the Fed is able to achieve a soft landing, which seems more likely every day, then the bonds’ current high yields and potential for appreciation should provide a great return to portfolios. Default rates shouldn’t be any more than historical norms and investors are fairly compensated for the risks of the asset class.

Even if the Fed misses the mark and is forced to act to avoid a hard landing, the current high yield of these bonds offers plenty of positive return potential. Gains from falling rates and coupon returns should outweigh default and widening credit spread losses.

This interesting window of opportunity is a buying chance for investors., which could suit them well in either scenario.

Given the difficulties in buying and researching individual high yield bonds, a broad approach is best, either through indexed or active management. ETFs remain a great low-cost way to purchase these bonds, offering diversification and access to the sector’s high yields.

Junk Bond ETFs

These funds were selected based on their exposure to junk bonds. They are sorted by their YTD total return, which ranges from 0.1% to 2.8%. They have expenses between 0.05% and 1.02% and assets under management between $0.55B and $15.2B. They are currently yielding between 5.2% and 9%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SRLN | SPDR Blackstone Senior Loan ETF | $4.6B | 2.8% | 9% | 0.70% | ETF | Yes |

| USHY | iShares Broad USD High Yield Corporate Bond ETF | $9.4B | 2.2% | 7% | 0.08% | ETF | No |

| SPHY | SPDR Portfolio High Yield Bond ETF | $1.36B | 2.1% | 8.0% | 0.05% | ETF | No |

| JNK | SPDR Bloomberg High Yield Bond ETF | $8.51B | 1.9% | 6.7% | 0.40% | ETF | No |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | $15.2B | 1.8% | 6.2% | 0.49% | ETF | No |

| HYLB | Xtrackers USD High Yld Corporate Bd ETF | $3.93B | 1.7% | 6.2% | 0.20% | ETF | No |

| PHB | Invesco Fundamental High Yield Corp Bd ETF | $0.55B | 1.4% | 5.2% | 0.50% | ETF | No |

| HYLS | First Trust Tactical High Yield ETF | $1.54B | 0.1% | 6.3% | 1.02% | ETF | Yes |

In the end, high yield currently offers a strong starting yield and great play on the potential soft landing. With the economy grinding forward, the asset class’s strong return potential is very compelling.

The Bottom Line

With the potential for a soft landing now growing, high yield bonds offer a unique asset class to profit. Thanks to their high yields and the potential for lower defaults, junk bonds could see big gains as the economy grinds forward. Even if that doesn’t happen, investors are being compensated for their risks and should produce strong returns in a recession.

1 Business Insider (March 2024). The US has an 85% chance of avoiding a recession in the next year, Goldman Sachs’ chief economist says

2 Capital Group (March 2024). Case for high yield sharpens as severe recession fears fade