Last year was a year bond investors hope to forget. So far, 2023 hasn’t been a great year either. While the mantra has become to buy bonds because of their current yields, the continued Fed tightening policies and uncertainty have continued to wreak havoc on prices. To that end, is there an alternative to fixed income? Many investors have found substitutes to fixed income allocations in liquid alternative funds and strategies.

The question is whether or not this truly has merit.

The data is mixed at best. With many liquid alts funds designed to provide a return above cash, many funds have fallen flat due to fees. For many investors, these types of ‘cash-plus’ funds may not prove to be worthy portfolio additions.

What Exactly Is a Liquid Alternative?

Liquid alternatives aren’t really an asset class. They are investment strategies that go beyond traditional ones. These can use stocks, bonds, derivatives, and other asset classes to deliver non-correlated returns. They may employ short positions in various asset classes, betting on futures, using leverage, spread betting, etc., to meet their mandates.

Historically, high-net-worth investors, university endowments, pension plans, and other institutional investors have dabbled in alts through hedge funds and other dedicated vehicles. Since the financial crisis, liquid alts have come to the masses via mutual funds and ETFs. And they’ve quickly gathered a following among advisors and investors alike.

Part of that following has come from their ability to generate steady returns no matter what the market event. Not all liquid alts are alike, but many fall within the category of ‘cash-plus.’ These funds are designed to produce steady bond-like returns in excess of the current yield on cash.

Historically, over the long haul, they’ve done a decent job of doing just that. According to investment manager Allspring—formerly Wells Fargo’s investment unit—over the last two decades, investors adding a 20% weighting of liquid alts to a 60/40 stock/bond portfolio improved returns reduced overall volatility and reduced the maximum losses of the portfolio. 1

Not So Fast

Given liquid alts’ ability to generate steady returns, many investors still reeling from the bond rout of last year and the mixed return picture this year have started to seriously consider them for a portfolio. However, they may want to rethink that stance. According to a September 2023 report by Morningstar, liquid alts still fall flat for many investors.

The reasons are vast for the underperformance. One main part comes down to costs.

Liquid alts remain some of the most expensive mutual funds and products to own. These days, investors can score index products for virtually free. Standard active management costs around 0.65%. But for alts, we’re talking upwards of 4%. That’s a huge hurdle to climb.

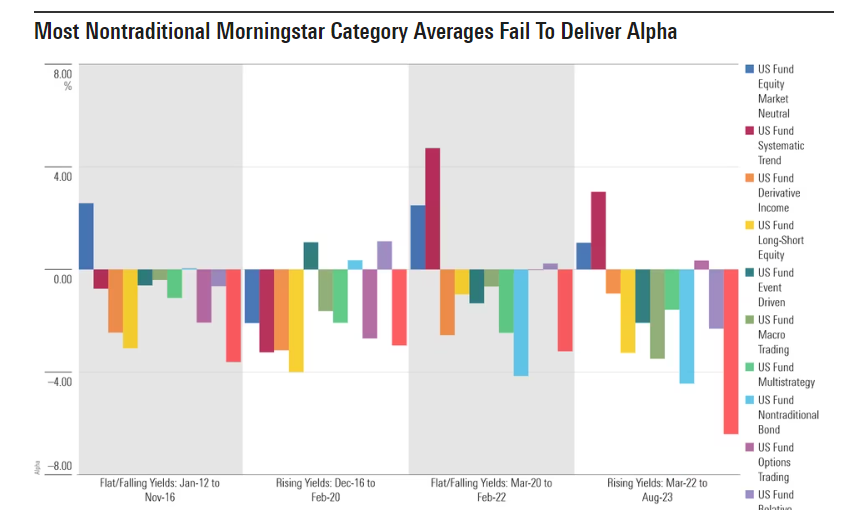

In theory, these types of cash-plus strategies should do better now that cash is actually paying something. After all, many liquid alts use T-bills and other cash instruments as collateral for their strategies. However, data suggests that this isn’t the case. Isolating the returns of T-bills via the ICE BofA U.S. 3 Month Treasury Bill index, Morningstar shows that many liquid alternatives have fallen flat on delivering an additional return over cash.

This chart from Morningstar shows the broad categories of alts and the inability of their managers to deliver extra alpha in excess of cash.

Source: Morningstar

It’s interesting to note the two categories that do deliver are stock trend/focused strategies.

Better Than Bonds?

The counter argument is that data suggests that liquid alts are better than bonds, as in the Bloomberg U.S. Aggregate Bond Index. According to Goldman Sachs, diversified liquid alternatives have outperformed the Bloomberg U.S. Aggregate Bond Index during rising rate environments. Looking at the last six periods in which the Fed raised rates, the HFRI Fund of Funds Index—which is a diversified basket of different liquid alts strategies—managed to beat the Agg by between 3 and 25 percentage points during rising rate environments. 2

Moreover, liquid alts had a low beta (0.1) and a low correlation (0.1) to the main bond benchmark. This echoes research conducted by other investment managers like BlackRock.

Which Is Right?

The question for investors is: Which side is right? Technically, they both are. Liquid alts do better than bonds in rising rate environments. But so does cash and cash beats nearly all varieties of alts.

The answer may be that ‘cash-plus’ makes more sense for most portfolios. And if you are concerned with hedging your fixed income risk, cash and short-term T-bills make a better play. The added plus of cash plus simply isn’t there, particularly after adding in fees.

That could mean avoiding some of the liquid alternative mutual funds and simply sticking to T-bills, money market funds or ETFs like the SPDR Bloomberg 1-3 Month T-Bill ETF. You’ll get a far better return during rising rate periods.

What could work over time and may offer actual ‘cash plus’ return could be the new crop of liquid alternatives ETFs. Like many areas of the market, packaging alts in an ETF has helped reduce fees. And with a lower fee hurdle, these funds could actually deliver on a ‘cash-plus’ strategy. However, like Morningstar’s chart shows, returns of these ETFs and their strategies are also all over the place. However, their lower fees do make it easier for them to beat the return on cash. This is something their mutual fund counterparts have failed to do.

Liquid Alternatives ETFs

These funds were selected based on their exposure to various liquid alternative strategies and are sorted by their YTD total return, which range from -4.1% to 40%. They have expenses between 0.50% and 1.41%, and assets between $70M to $985M. They are currently yielding between 0% and 7.6%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| PFIX | Simplify Interest Rate Hedge ETF | $255.09M | 39.9% | 1.11% | 0.50% | ETF | Yes |

| FTLS | First Trust Long/Short Equity ETF | $731.72M | 11.5% | 1.61% | 1.41% | ETF | Yes |

| WTMF | WisdomTree Managed Futures Strategy Fund | $158.69M | 7.6% | 4.56% | 0.65% | ETF | No |

| QAI | IQ Hedge Multi-Strategy Tracker ETF | $595.19M | 5.8% | 1.89% | 1% | ETF | No |

| CTA | Simplify Managed Futures Strategy ETF | $161.9M | 3.6% | 5.5% | 0.75% | ETF | Yes |

| FMF | First Trust Managed Futures Strategy Fund | $154.71M | 2.5% | 2.5% | 0.95% | ETF | Yes |

| KMLM | KFA Mount Lucas Managed Futures Index Strategy ETF | $296.62M | 2% | 4.93% | 0.90% | ETF | Yes |

| ARB | AltShares Merger Arbitrage ETF | $73.63M | 2% | 4.09% | 0.77% | ETF | No |

| RLY | SPDR SSgA Multi-Asset Real Return ETF | $502.68M | -0.45% | 5.48% | 0.50% | ETF | Yes |

| MNA | IQ Merger Arbitrage ETF | $466.96M | -0.7% | 0% | 0.77% | ETF | No |

| DBMF | iMGP DBi Managed Futures Strategy ETF | $985M | -4.1% | 7.59% | 0.85% | ETF | Yes |

Overall, cash-plus strategies may not deliver the kinds of returns that investors are looking for. Complexity and high fees make them a losing portfolio piece when it comes to rising rate environments and cash returns. Ultimately, investors may be better suited elsewhere.

The Bottom Line

After last year’s bond rout, investors have been drawn to alternatives to find fixed income exposure. However, they may want to keep looking. So-called cash-plus strategies don’t really deliver more than just holding cash and T-bills in constrained bond environments. All in all, their high fees don’t make them worth it.

1 Allspring (March 2023). Liquid Alternatives—Why Now

2 Goldman Sachs (April 2022). Liquid Alternatives: Why Now?