Thanks to the high-interest rate environment, income seekers have a lot of choices these days to get yield into their portfolios. A variety of bond types and fixed income asset classes are paying yields not seen in over a decade. The ‘income’ in fixed income is certainly back.

But what about those investors looking for more? Are there pockets of bond strength that could potentially lead to capital gains and a strong total return?

The answer is yes. Convertible bonds are often ignored by investors. However, now could be the best environment for them in years. Building on last year’s strength, converts have plenty of gas left in the tank. And with more firms issuing them to take advantage of their lower borrowing costs, the sector continues to get stronger.

Lowered Borrowing Costs

Convertibles are a weird hybrid and often have been ignored by both issuing firms and investors alike. On the surface, they act just like normal bonds. They are issued with a coupon, par value, and have a high place on the bankruptcy ladder. That’s the normal part.

What’s weird is that tucked inside that bond is a hidden stock option. As their name implies, convertible bonds can be exchanged into shares of a firm’s underlying stock if certain conditions are met. So, if a firm issues a convertible bond and their stock takes off, they can do the conversion, and now bondholders have equity and the firm doesn’t owe any more on the bond issue.

However, because of the potential upside of the equity option, convertible bonds often come to market with lower coupon rates—often 1 to 3 percentage points lower—than straightforward corporate or high-yield bonds.

That fact has given the sector a resurgence in our high-rate environment. Historically, convertible bonds were issued by smaller firms or those with already heavy debt loads. These types of firms weren’t able to get favorable terms in the normal bond market and, with lower credit ratings, junk or floating rate debt would be way too expensive. These days, a variety of firms have started to look at convertibles as a way to save on rising interest rate costs. For example, Uber just recently issued a convertible bond with a coupon of less than 1%.

All in all, data from LSEG shows that issuance of convertible debt jumped by 77% in 2023 to over $48 billion worth of new bonds. 1

The best part is that a wide slug of new convertible bonds has come from investment-grade issuers. With the ability to save 2% to 3% in interest expense, many firms that need to roll over debt over the next few years are expected to tap the convertible market to save money.

A Stock Rebound

One puzzle piece is that issuance is rising and getting better. The second is that investors have been treating convertibles more like bonds rather than focusing on their equity potential. Delta is a measure of convertible bond price sensitivity to moves in the underlying equities. Right now, according to Lord Abbett, much of the sector has a delta of below 0.40, making it behave more like bonds.

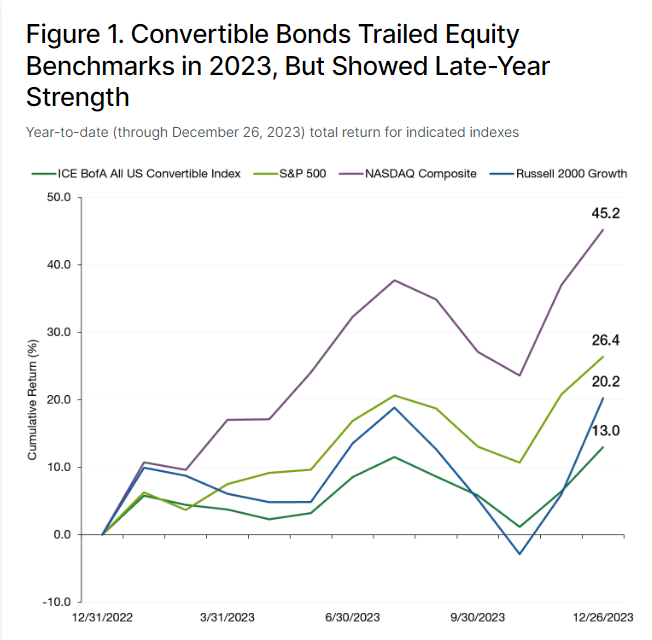

Remember, a convertible bond’s return/value is also tied to underlying stock value. And right now, many converts are trading for below the recent surge in stocks. Looking at the total returns for the major convertible bond market versus various stock market indices, converts have underperformed in a big way. This chart shows the underperformance.

Source: Lord Abbett

This seems counterintuitive as converts should be surging along with equities. After all, more and more converts are starting to trade ‘in-the-money’ or can be converted to stock.

However, the range boundness of the sector continues to be driven by fear and overall worries about the global economy and the higher for long rate message of the Fed. According to Lord Abbett, this has continued to put a lid on their returns.

But once the pressure builds… watch out.

The delta of the sector remains near post-financial lows. This is attractive on a return front. Historically, once the Fed cuts interest rates, convertible bonds take off as equity prices hit this inflection point that pulls up convertibles, leading to potentially high total returns. While the Fed has dragged its heels, it has promised two cuts this year and several in 2025. This could ignite the fire in the sector and provide a strong total return.

In the meantime, the bond-like characteristics should protect investors from any volatility in the equity markets while they wait for a snap-back. It’s not often that the convertible market has such a good equilibrium. And now, the credit quality of the sector has only gotten better with more investment-grade firms joining the party. That’s good news for the sector and the overall potential for investors.

Adding Some Convertible Bonds

With the potential for strong total returns in the new year and down the road, investors may want to add some converts to their portfolios. That’s easier said than done, at least when it comes to adding individual issues. Like many non-traditional bonds, converts can be hard to buy on an individual basis. However, numerous ETFs cover the asset class, both active and passive.

Convertible Bond ETFs

These funds were selected based on their assets under management and represent the largest convertible bond ETFs. They are sorted by their one-year total returns, which range from 8.9% to 14.4%. They have expenses between 0.20% and 0.95% and assets under management between $24M and $3.5B. They are currently yielding between 1.4% and 2.1%.

| Ticker | Name | AUM | 1-Yr Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| ICVT | iShares Convertible Bond ETF | $1.5B | 14.4% | 2% | 0.20% | ETF | No |

| CWB | SPDR Bloomberg Convertible Securities ETF | $3.44B | 12% | 2.1% | 0.40% | ETF | No |

| QCON | American Century Quality Convertible Securities ETF | $24.09M | 10.9% | 1.7% | 0.33% | ETF | Yes |

| FCVT | First Trust SSI Strategic Convertible Securities ETF | $93.17M | 8.9% | 1.4% | 0.95% | ETF | Yes |

For investors looking for convertible bonds, now could be the halcyon days. Going forward, the surge in stock prices and the potential for the Fed to cut are huge wins for the sector. Adding in attractive valuations and it’s a recipe for strong gains.

The Bottom Line

Convertible bonds are often ignored by investors. That’s a real shame, as these days the sector is having a renaissance. Strong issuers along with surging equity prices make convertible bonds a big win for portfolios.

1 FT.com (January 2024). US companies dive into convertible debt to hold down interest costs

2 Lord Abbett (January 2024). The Road Ahead for the Convertible Bond Market