With the Federal Reserve raising rates, building a fixed income portfolio may have just gotten a bit easier. With yields high, many investors feel they don’t need to venture outside the world of Treasuries and investment-grade corporate bonds. After all, why take on extra risk when you can get 4.5% to 6% in relatively safe assets? But investors who do so may be missing plenty of opportunities.

Especially when it comes to municipal bonds.

It turns out municipal bonds can serve as the perfect complement to U.S. credit in a portfolio. Offering better credit quality, higher after-tax yields, and other diversification benefits, investors who simply buy the Bloomberg Aggregate Bond Index (Agg) or choose corporate bonds are seriously missing out on bigger opportunities.

Buy the Agg and Move On?

These days, investors don’t have to do much to get good yields. Thanks to the current round of monetary tightening, investment-grade bonds are yielding levels not seen in over a decade. Today, investors can simply buy Agg and score a yield north of 4.54%. Heck, even high-yield savings accounts are paying close to 5% interest these days.

With investment-grade bonds and high-yield saving accounts paying so much, investors don’t have to step outside the realm of Treasuries and corporate bonds to score good income. Many investors have limited their exposure to a variety of other credit types.

However, according to Bank of New York Mellon Corp subsidiary Insight Investment, investors are selling themselves short if they don’t include municipal bonds in their investment conversations. Munis can offer several advantages to corporate bonds with regard to portfolio construction. Investors who simply buy the Agg or look only at investment-grade corporate bonds to diversify away from Treasuries are selling themselves short.

And they give big reasons why.

Better Credit Quality

There’s a lot of gray area when it comes to what qualifies as investment-grade. Numerous ratings still fit within the definition. However, the levels within that gray area are affected differently during changes to credit conditions.

When comparing munis to corporate bonds, more munis have higher ratings, with the Bloomberg Municipal Bond Index having an average credit rating of Aa2/Aa3, while the Bloomberg US Corporate Investment Grade Index has an average rating of A3/Baa1.

This is important when credit conditions shift such as the current environment. The slow growth and more difficult financial landscape have historically shifted corporate bonds into a more neutral-to-negative stance. Nonetheless, munis with their taxing ability remain strong.

Lower Default Rates

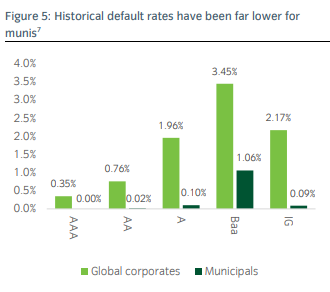

The better credit quality feeds into another advantage of munis over corporates – and that’s lower default rates. Looking at data from 1970 to 2021, Insight Investment found that investment-grade municipal bonds experienced a cumulative default rate of only 0.09% within ten years of issuance. That number jumps to 2.17% for investment-grade corporate bonds for the same time period. Moreover, munis have shown fewer defaults than investment-grade corporate bonds across the four credit rating bands that make up investment grade. This chart from Insight Investment highlights the lower default rates of munis. 1

Source: Insight Investment

Higher Yields

When it comes to income, municipal bonds may have the upper hand once again, and that’s because after-tax yields are very attractive for the sector. The Bloomberg Municipal Bond Index yields around 3.5%. At first blush, this is lower than its investment-grade corporate bond sister. However, thanks to the ability of munis to pay that yield tax-free for most investors, the after-tax yield jumps to 5.87% for someone in the highest tax bracket.

The math works out for investors in lower tax brackets as well, with Insight Investment showing that muni bonds are trading at comparable spreads to corporate bonds versus Treasuries. Where it gets interesting is that munis have had historically lower volatility than corporate bonds. So, investors either get greater or similar income without all the “jumpiness.”

Better Long-Term Income Potential

With the Fed potentially cutting rates in the near future, munis have another big advantage over corporate bonds – and that’s their duration. Duration is essentially a measure of the sensitivity of a bond’s price to changes in interest rates. When rates are cut, investors quickly look to lock in high income for as long as they can. Traditionally, municipal bonds have been long-term funding methods for states and local governments, which shows up in their durations. Right now, the Bloomberg Muni Index has a duration of 8.13 years versus 7.15 years for the Bloomberg US Corporate Investment Grade Index.

With a longer duration, muni bond prices should rise more than corporates when the Fed eventually decides to cut rates. This should provide a significant capital gain advantage for the bond type.

Two Other Big Muni Wins

Finally, municipal bonds have two other big wins over corporate bonds: diversification and ESG benefits.

When looking at other major bond varieties, municipal bonds offer a very low correlation. For example, munis offer just a 0.69 correlation to the Agg and only a 0.08 correlation to the S&P 500. Those are both much lower than corporate bonds.

Then there is ESG to consider. Municipal bonds naturally have many environmental, social, and governance attributes.

According to Insight Investment, “municipal projects largely impact both the physical and social fabric of US society with investments in roads, bridges, water and sewer systems, hospitals, schools, universities, and affordable housing.” Because they are used by states and local governments to fund these sorts of ventures, munis have the ability to trade at premiums versus other bonds. This can lead to additional capital gains for muni holders.

Adding Municipal Bonds to Your Portfolio

It may seem like a compelling or easy idea to simply buy the Agg or add corporate bonds as a compliment to Treasuries. But investors are truly missing out if they don’t include municipal bonds to their mix. In the end, munis may offer a host of better benefits than corporate bonds alone.

To that end, adding munis makes a ton of sense. Insight Investment’s recommendation would be to use municipal bonds alongside investment-grade corporate bonds and Treasuries to build a solid core of bonds. Luckily, ETFs can make that an easy purchase. With one ticker, investors can easily add a wide swath of munis to a portfolio.

Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their YTD total return, which ranges from -0.6% to 0.2%. They have expense ratios between 0.05% to 0.65% and assets under management between $1.2B to $36B. They are yielding between 1.9% and 3.6%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMB | First Trust Managed Municipal ETF | $1.9B | 0.2% | 3.2% | 0.65% | ETF | Yes |

| SUB | iShares Short-Term National Muni Bond ETF | $8.7B | 0.1% | 2% | 0.07% | ETF | No |

| MUB | iShares National Muni Bond ETF | $36B | -0.3% | 2.9% | 0.05% | ETF | No |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.3B | -0.1% | 3.6% | 0.35% | ETF | Yes |

| VTEB | Vanguard Tax-Exempt Bond ETF | $34B | -0.5% | 3.1% | 0.05% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $1.2B | -0.5% | 2.6% | 0.19% | ETF | Yes |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | -0.6% | 1.9% | 0.20% | ETF | No |

All in all, municipal bonds shouldn’t be ignored by investors. While it is easy to simply buy the high-yielding bond benchmark, munis can offer better diversification, higher yields, and other potential benefits to a portfolio.

Bottom Line

With the Fed tightening over the last year, bond investors can simply buy the Agg to score a high yield. However, that approach might not be the best choice for your portfolios, especially since municipal bonds offer so many benefits over corporate bonds. With high yields, diversification, and other wins, munis can be a smart core complement in a fixed income portfolio.

1 Insight Investment (August 2023). How US municipal bonds can complement US credit exposure