How NAV is Calculated

Want to know more about how NAV is calculated? Click here.

All asset additions and subtractions to the fund are reflected in the fund’s NAV. If a stock held by the fund pays a dividend, the dividend is added to the fund’s net assets and results in a rise in the NAV.

Management fees and expenses that are charged periodically by the fund decrease the NAV. Dividend and net realized capital gains distributions paid out to shareholders decrease the fund’s NAV as well by the amount of the distribution.

How Total Return is Calculated

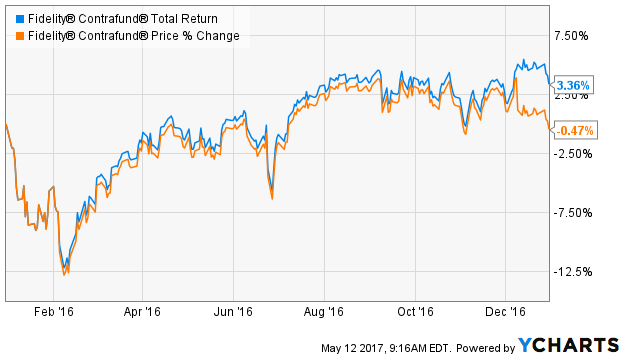

It’s important to look at a fund’s total return and not just any one component of the total return in isolation. Dividend seekers may focus just on a fund’s yield, but many high-performing funds don’t pay a dividend at all. Investors looking only at a fund’s NAV may assume that the fund has posted a loss if the NAV has declined when, in reality, the fund has delivered a positive total return once dividend distributions are considered.

In case if you are wondering whether mutual funds are right for you, you should read about why mutual funds, in general, should be a part of your portfolio.

The Difference Between NAV and Total Return

But Contrafund made both dividend and capital gains distributions during the year. Even though those distributions were taken out of the fund’s assets (and reflected in a lower NAV), they are still part of the shareholder’s total return. In total, the fund distributed $3.46 per share in capital gains and $0.29 per share in dividends. Add those to the equation and shareholders of Contrafund actually enjoyed a total return of around 3.4% on the year.

Factors Affecting NAV and Total Return

- Dividend and Capital Gains Distributions – As illustrated above, fund distributions result in the biggest difference between NAV and total returns. Funds are required to distribute dividends and net capital gains to shareholders on at least an annual basis and many funds make these distributions regularly.

- Sales Charges – Total returns are often listed with and without sales charges. Commissions get taken right off the top before an investment is even made.

- Fair Value and Swing Pricing – A fund’s NAV can be adjusted using fair value pricing if security prices within the fund are stale. Swing pricing can adjust an NAV if there are large purchases or redemptions within the fund.

The Bottom Line

Be sure check our News section to keep track of the recent fund performances.