Find out about the most important criteria for selecting a mutual fund here.

Professional Money Management Tricks That Can Benefit You

One trait that money managers have, and that most investors do not possess, is the ability to judge their holdings dispassionately. Instead, managers evaluate the risk versus return potential for each position individually, based on both fundamental and quantitative data. Similarly, investors should review their holdings at least once a year, if not on a more regular basis, and use the same disciplined method.

When beginning the review process, an investor should begin with the positions that have the largest gains or declines. Look at each position with fresh eyes and evaluate how the position will perform going forward, not just at how it has done. Investors should evaluate a position’s future upside potential and if it will continue its upward momentum. Just because a stock has done well in the past does not mean it will continue to do so forever.

Another element of reviewing a portfolio like a money manager is to step back and look at the portfolio as a whole. Start by looking at the allocation from an asset class perspective. If stocks have had a great run over the last few years, that portion of the portfolio might be higher than the originally intended allocation. For example, it is very common for a 50% equity / 50% bond portfolio to shift to a 60% equity / 40% bond portfolio in a bull market. Although the stocks have gained quite a profit, this would increase the overall risk of the portfolio and should be rebalanced back to its original 50% equity / 50% bond mix.

Check here to know more about when portfolio managers should ideally rebalance their portfolios.

In addition to reviewing a portfolio’s overall asset allocation, investors should look at the portfolio from both an asset class type and sector perspective. Investors should regularly review how much of the portfolio is in large-cap, mid-cap, small-cap, and international and emerging market stocks. The equity portion can also be broken down by sectors, like technology, consumer discretionary or finance as an example. Many professional money managers examine their portfolio’s asset class types and sectors as a tactical way to manage the portfolio and ensure maximum performance.

Every November and December, mutual fund managers are very active in looking at the fund’s holdings and figuring out ways to tax harvest before December 31. This tax harvesting could incur capital gain distributions to shareholders, which in the end could hurt total overall performance.

Investors in taxable accounts should do the same with their individual portfolios. Any capital gains during the year can be offset by selling losses. For example, if a stock had a $5,000 capital gain, an investor has until December 31 of the same calendar year to offset those taxable gains with losses made on other holdings within the portfolio. In this case, selling a stock that currently has a loss of $5,000 would completely neutralize the tax liability. If the investor were to sell losing holdings that were in excess of the portfolio’s capital gains, the losses can be carried forward for future years.

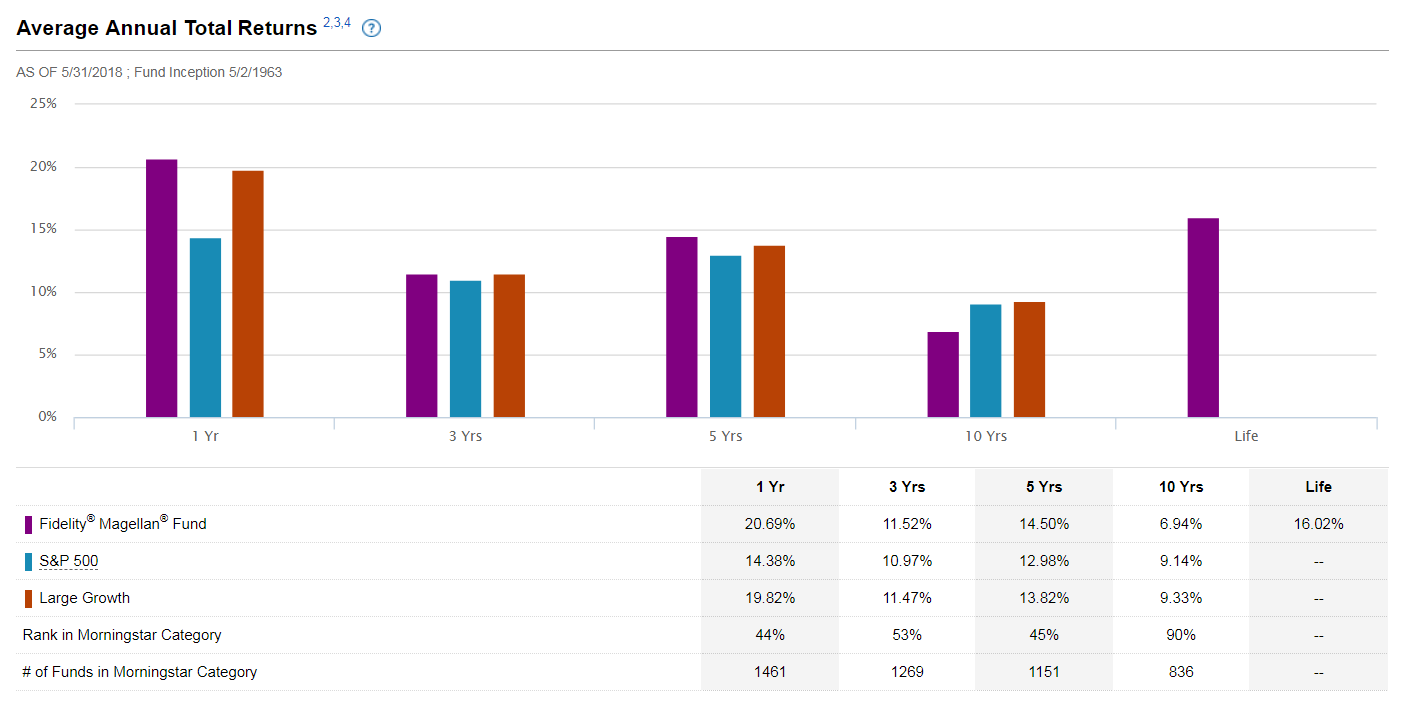

Money managers are usually judged and sometimes paid on how their fund compares with its benchmark. For example, most large-cap funds are often compared to the S&P 500 Index. In addition to an index, mutual funds are often categorized into a group with other funds that have a similar composition and strategy, such as Large Cap Growth. The Fidelity Magellan Fund (FMAGX) is a large-cap growth fund that has both the S&P 500 and Large Growth Index as its benchmarks. From a performance perspective, the Fidelity Magellan Fund has underperformed both benchmarks on a 10-year basis. However, the fund outperformed the benchmarks in the five-year, three-year and one-year averages.

To learn more about other funds by Fidelity, check out the fund company page here.

Finally, the last strategy that professional money managers use is to constantly examine their own portfolio strategy or investment philosophy. Money managers are disciplined with this because it is often dictated by the fund’s prospectus. For example, a large-cap growth fund money manager might be restricted from buying bonds or even mid- and small-cap stocks in the fund. Money managers might also employ a certain investment philosophy, such as top-down or bottom-up investing.

Check out our previous take on how to decode a mutual fund prospectus to gain more insights.

A very common issue with investors is that they tend to incorporate ideas from various sources like financial shows or from articles on the Internet. Although these methods might sound promising and might have worked for the source’s original contributor, it might not work for the investor. Typically, the most successful investors have a set discipline and stick with it over the long term.

Want to know about a simple and convenient investment vehicle that can help you achieve a certain financial goal in future? Target date funds might come to your rescue. Click here to visit our dedicated section on this type of funds and learn more about them.

The Bottom Line

Be sure to check our News section to keep track of recent fund performances.

Sign up for our free newsletter to get the latest news on mutual funds.