And investors have bought hard into that mantra. Low-cost passive/index investing is quickly overtaking more expensive active management in a big way. That’s a huge problem if you’re an investment manager that specializes in stock picking or active funds.

But active managers may have found a way to stay competitive on the fee front with passive index funds and ETFs. The answer may lie within so-called performance-based or fulcrum fees.

For investors, these new fulcrum fees could be the answer to getting the best of active management without one of its biggest issues.

Follow our Education section to learn more about mutual funds.

An Outdated Model

However, investors have grown to dislike this relationship – especially with these high fees usually causing underperformance for most active funds. With that, investors have started to flee active mutual funds in a big way. Trillions of dollars have left stock- and bond-picking asset managers over the past decade and have found their way into low-cost and passive ETFs/index funds. Last year alone, more than $207 billion fled from active U.S. equity mutual funds.

To put it bluntly, in the era of 0.05% or even free expense ratios for index ETFs/mutual funds, many active shops are beyond scared.

Learn all about fund management fees here.

In order to keep investors and assets in-house, many have looked for ways to reduce expenses on their funds. To that end, they’ve actually started to tap an old, yet not widely used, performance-based fee schedule dubbed “fulcrum fees.”

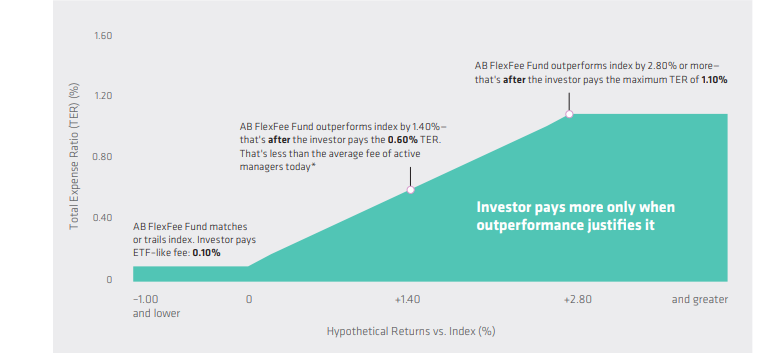

Fulcrum fees first got their start in the 1970s, and in the mid-1980s, the Securities and Exchange Commission allowed performance-based fees to be charged on retail client funds. The basic gist of fulcrum fees is that investors pay very little in terms of fees if a mutual fund ties or underperforms its benchmark. But if the active manager beats by a certain margin, i.e. the “fulcrum,” then the expense ratio increases on the mutual fund.

The following graph from AllianceBernstein’s AB FlexFee lineup highlights exactly how a fulcrum fee relationship works.

The idea is that investors won’t have to pay for mediocrity anymore, but they can benefit from strong active management. You simply pay for the outperformance rather than index-hugging or underperformance. Fund managers benefit in that they don’t see assets flee out the door to low-cost ETF and index rivals like BlackRock or Vanguard. In the end, fulcrum fees may be a win-win for everyone involved.

Be sure check out our News section to keep track of the recent fund performances.

A Few Caveats

For one thing, the fulcrum varies from fund manager to manager. Just how much will an investment manager need to beat an index in order to earn their higher fees? As we stated in the example above, FFLYX needs to clear 1.40% in outperformance before the extra fee kicks in. But the Sextant Growth Fund (SSGFX) only needs to clear 1% before its fulcrum starts. Allianz GI PerformanceFee Structured US Equity Fund (APBRX), which also uses options, the fulcrum is set at 250 basis points.

Secondly, how is that outperformance measured? Most funds use a 12-month timeframe. However, some use 3- or 5-year benchmarks. This means investors may be paying for current underperformance because of previous outperformance. That’s not necessarily that great, and again, hurts bottom lines.

Finally, is a fund using an appropriate benchmark? There are no hard and fast rules about what a fund is required to benchmark at. There are countless measures even with small-caps alone. Investors need to be careful that a fund manager hasn’t potentially set the bar too low in order to earn their higher fees. A fund holding nothing but fast-moving small-caps benchmarked to the entire market tracking Russell 3000 doesn’t make too much sense. Likewise, a global portfolio benchmarked to the U.S.-focused S&P 500 is pretty pointless.

A good read of the fund’s prospectus will shine light on any of these issues and help determine which fulcrum fee fund is right for you.

The Bottom Line

Sign up for our free newsletter to get the latest news on mutual funds.