Fund managers make the high level decisions and balance asset classes to achieve specific investment outcomes for investors, such as generating an income in retirement or minimizing risk.

Let’s take a look at the evolution of these strategies, different types and some pros and cons to keep in mind.

Learn more about mutual funds here.

The Rise of Multi-Asset Strategies

Three of the four primary asset classes can be sliced and diced into several sub-asset classes (cash is the exception):

- Stocks can be categorized by market capitalizations, growth versus value, sectors or geographies.

- Bonds can be categorized by duration, credit quality, geography and currency exposure.

- Alternatives can be categorized based on their hedging strategies, unique asset classes or correlations.

There are different financial institutions that offer multi-asset strategies. The strategies are employed for both institutional investors that may be interested in alternative assets as a way to diversify a conventional portfolio, and individual retail investors, who might invest in multi-asset strategies via mutual funds to reach their retirement goals.

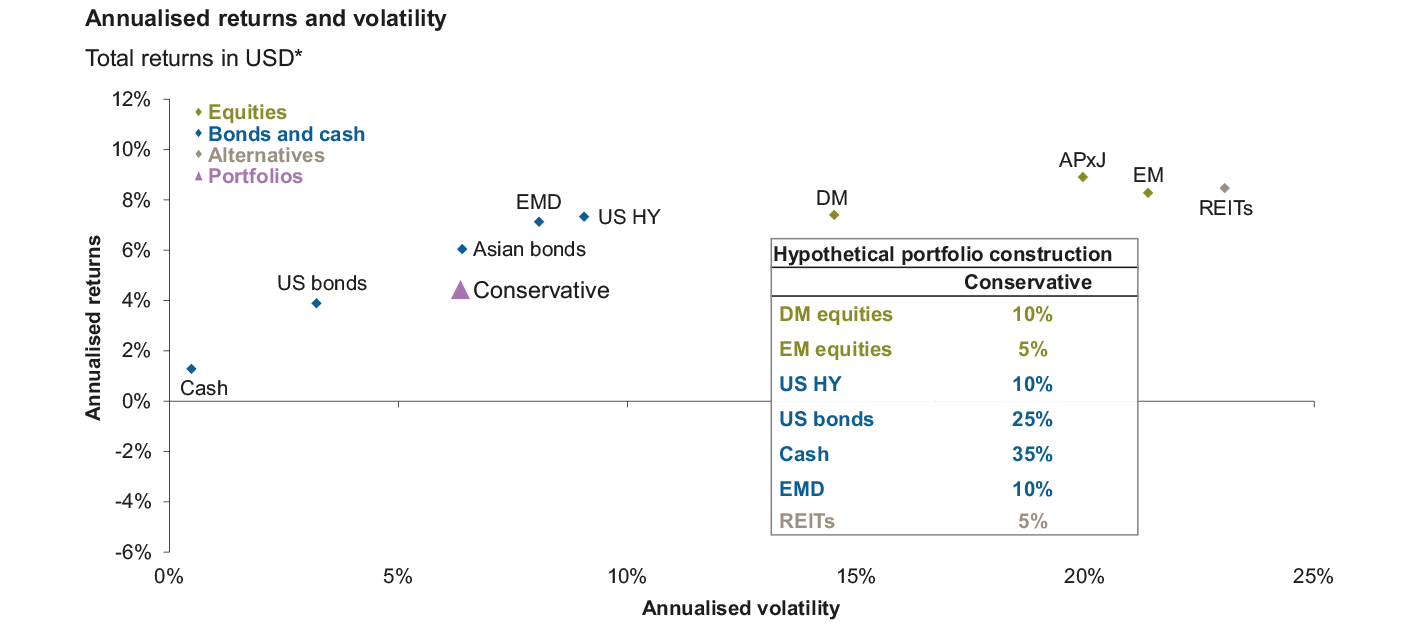

Let us consider an example of how multi-asset strategy might be beneficial to investors. A conservative multi-asset strategy could be an attractive option for risk-averse investors. The strategy might preferentially weight government and investment grade bonds that have less volatility than stocks or high-yield bonds. If any low-volatility opportunities arise, the fund could even add allocation to certain equities or fixed income sectors.

Types of Multi-Asset Strategies

- Global Macro: Global macro strategies aim to deliver consistent returns by capitalizing on relative mispricing with offsetting long and short positions across equity, fixed income, currency and commodity markets around the world. The strategy works best against a backdrop of geopolitical uncertainty and rising volatility, but may underperform when the domestic economy is outperforming internationally. For example, the Dunham Dynamic Macro Fund (DAAVX) invests in a wide range of asset classes around the world to generate better risk-adjusted returns.

- Target Risk: Target risk strategies are designed to create a specific risk profile, such as conservative, moderate or aggressive. The strategy works best for investors that wish to prioritize investments by risk rather than return, such as investors that are in retirement and wish to preserve capital rather than pursue growth. It may not be ideal for investors that are more interested in returns than risk. For example, the Vanguard LifeStrategy Conservative Growth Fund (VSCGX) prioritizes current income over long-term growth with less exposure to the stock market.

- Target Date: Target date strategies are designed to grow assets over a specified period of time toward a specific goal. Often times, these funds are named by the year in which the investor plans to begin utilizing the assets (e.g. by retirement date). The asset allocation is a function of a specified timeframe rather than risk tolerance, which means they may not be ideal for risk-averse investors. For example, the Fidelity Freedom Index 2050 Fund (FIPFX) invests in an asset allocation that’s specifically tailored towards investors retiring in 2050.

Pros and Cons of Multi-Asset Strategies

Pros

- Hands-off Approach: Multi-asset strategies eliminate the need for investors to adjust their own asset allocations over time, which can ensure they’re on track to meet their goals.

- Expert Management: Expert investment managers can navigate economic cycles to reduce risk and improve alpha rather than focusing exclusively on total returns.

- Diversified Risk: Multi-asset strategies offer more diversification than index investing, which could translate to more peace-of-mind for investors.

Cons

- Higher Expenses: Most multi-asset strategies involve greater expenses than index funds or other alternatives given the need for more hands-on analysis and trading.

- Lower Returns: Multi-asset strategies may underperform index funds in bull markets. In some cases, bull markets could last years or decades.

Don’t forget to learn more about strategic asset allocation here.

The Bottom Line

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.