Exchange-traded funds, or ETFs for short, are very similar to mutual funds in that they are a diversified portfolio of investments with professional management. ETFs were first introduced to the United States in 1993 and have been steadily growing in popularity, with currently $3.4 trillion in total assets as of 2017.

Investors should understand the differences between ETFs and mutual funds, as well as index ETFs and index mutual funds so that they can correctly assess the best way to help them achieve their goals.

Tracking an Index

Conversely, mutual funds are typically actively managed with a professional money manager making trades throughout the course of the year. The manager’s goal is to not only outperform its peers but also to outperform its corresponding index, like the S&P 500. For instance, the American Funds Growth Fund of America (AGTHX) is designed to outperform the S&P 500. Over the last 10 years, the fund has averaged 8.48% and underperformed the S&P 500’s return of 9.14%. However, AGTHX outperformed in the three year at 11.07% versus 10.97% and the five year at 13.45% versus 12.98%.

In an effort to compete with ETFs, mutual funds have also been entering the passive management space and drastically lowering internal expense ratios. For instance, Vanguard has a mutual fund version of SPY called the Vanguard 500 Index Admiral (VFIAX). The fund is passively managed and is designed to track the S&P 500.

Differences in Fees and Sales Charge

Typically, mutual funds are actively managed and thus involve higher expense ratios, averaging from 0.30% to over 2.00%. The Growth Fund of America listed above has an expense ratio of 0.64%, which is over seven times higher than the expense ratio in SPY. However, the Vanguard 500 Index Admiral fund, which is designed to mimic the S&P 500 just like SPY, actually has a lower expense ratio at 0.04%. Although the 0.05% difference might sound minimal, it actually affects performance. Over the trailing five years, VFIAX has outperformed SPY with 12.94% versus 12.85%. VFIAX has also outperformed in almost every timeframe except during the last one month.

Mutual funds, on the other hand, have a more complex situation, depending on the share class. The A share class of a mutual fund usually has an upfront load, ranging from 2.00% to 6.00%. There is also a C share that has a 1.00% upfront fee and a higher expense ratio since the charge is considered a level-load. The Growth Fund of America A share has a starting upfront sales charge of 5.75%. The Vanguard VFIAX does not have an upfront sales charge but has a minimum purchase of $10,000. Vanguard does offer the same fund, called the Vanguard 500 Index Investor Share (VFINX), at a lower minimum of $3,000, but then the expense ratio is 0.14% instead of 0.04%.

Difference in Structure and Taxation

One benefit that ETFs have over mutual funds is the taxation. Both ETFs and mutual funds are subject to capital gains and losses, depending on the holding period when they are bought or sold. However, mutual funds carry an additional tax for their shareholders in the form of capital gain distributions. Mutual funds are required to pass on their capital gains to shareholders at least once a year.

The Growth Fund of America, for example, issued its shareholders a long-term capital gain of $3.23 per share on December 20, 2017. This distribution is equal to 6.5% of the fund’s total NAV. However, index funds tend to have much smaller or no capital gains distributions since there is very little trading in the underlying fund. As a result, a fund like the VFIAX has not had a capital gain distribution since 1999.

Trends in Mutual Funds and ETFs

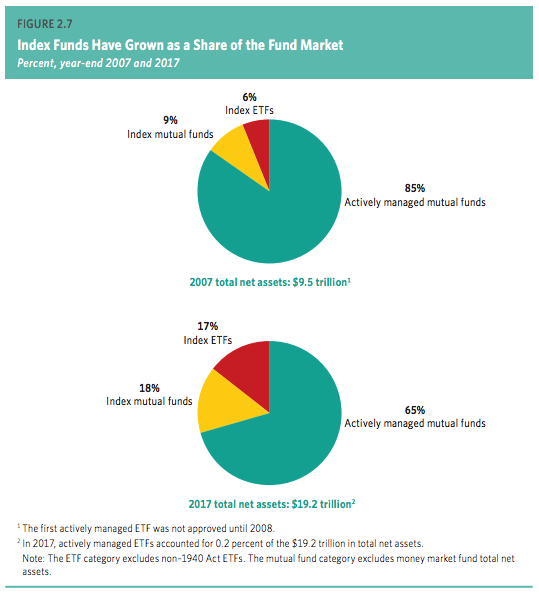

Index mutual funds have been a focus of large growth in the mutual fund world, as index funds have grown from representing 9% of total funds in 2007 to 18% in 2017. Equity mutual funds had a total market share of 13.6% of all mutual fund assets in 2008. As of the end of 2017, equity mutual funds now represent 26.6% of all mutual fund assets. One of the main reasons why mutual funds continue to maintain popularity over ETFs is that mutual funds are typically the investments available within an employer-sponsored retirement plan, such as a 401(k). Of all U.S. households that own mutual funds, 64% own mutual funds within an employer-sponsored retirement plan.

ETFs have been exponentially growing in popularity, as there were 728 ETFs in 2008 and now the number is close to 2,000. In fact, 2017 was a record year for issuance of new ETFs with 471 new issues coming to the marketplace. When compared to mutual funds, ETFs have a much higher concentration in equities, with over 81% of total assets. Most ETFs are invested in large-cap domestic equities, which currently make up 27%. Bonds and hybrids make up only 16% while commodities make up 2%. Bond ETFs are significantly less popular because bond investors typically use a bond index as a benchmark, but rarely invest in a bond index. Equity ETFs can mirror the comparable stock index with relative ease. Bond indexes are comprised of thousands of different bonds, which can be very cumbersome and expensive for most individual ETFs.

That said, some argue that in the wake of the 2008 / 2009 financial crisis, millenials have a propensity to invest in ETFs, as the great Mutual Fund vs. ETF debate rages on.

Performance

However, another useful measure for investors is to use the tracking error, a measure to track exactly how a fund’s performance compares to the index; the smaller the tracking error, the better.

Be sure to check our News section to keep track of recent fund performances.

Key Considerations

Mutual index funds and ETFs are also great ways for an investor with a smaller initial purchase amount. Mutual funds can be started with as little as $100 and ETFs can be purchased one share at a time. Purchasing one of these is a much more risk-averse investment that is diversified among many holdings, instead of purchasing one stock with the same amount of money.

ETFs can also be used in taxable accounts since they are much more tax efficient than mutual funds. An investor in a high income tax bracket will only be taxed when the ETF is bought, sold or issues a dividend, unlike a mutual fund that could potentially issue a capital gain distribution.

The Bottom Line

Sign up for our free newsletter to get the latest news on mutual funds.