The humble individual retirement account or IRA is a wonderful vehicle for retirement savers. The account has plenty of special features that make savings a breeze. However, not all IRAs are the same. And the main versions of the account – traditional or Roth – have several key differences that do matter when it comes to retirement.

How do you know which one is right for you? Read on to find out.

Signup for our free newsletter to get the latest news on mutual funds.

The IRA Basics

The Roth and traditional IRAs also allow you to contribute the same amount each year. Currently, contribution limits for 2018 are set at $5,500 per person, per year. That number rises to $6,000 in 2019. For those individuals aged 50 or older, the government allows investors additional catch-up contributions. This bumps the annual limits up to $6,500 for 2018 and $7,000 for 2019. Additionally, investors have until April of the following year to make their contributions for the current year. So you have until April of 2019 to max out your IRA for 2018.

Perhaps the biggest benefit of both IRAs comes down to taxes. All trades, dividends and interest income that occurs within the account is outside Uncle Sam’s grasp. That changes once withdrawals are made and depends on the kind of IRA an investor owns.

Want to learn more about IRAs? Click here.

Traditional IRAs

The beauty of a traditional IRA is that you can save on taxes today. Depending on your tax situation, investors may be able to deduct some or all of their contribution to a traditional IRA to reduce their current taxable liability. The deduction begins to phase out based on current income, tax filing status and the availability of a workplace retirement plan to you or your spouse.

However, the benefit of saving on taxes today does come with a catch; you’ll need to pay those taxes when you withdraw later on in retirement. Investments in traditional IRAs grow tax-deferred. However, when you start pulling cash from the account, Uncle Sam wants his cut, and as a result traditional IRA withdrawals are counted as ordinary income. Worst still is that if you withdraw any funds before age 59½, there is an additional 10% tax penalty on the account. And unfortunately, Uncle Sam won’t let you defer taxes forever. At age 70½, investors are forced to take required minimum distributions (RMDs) from these accounts and pay taxes on them.

Click here to learn about 401(k) retirement plans.

Roth IRAs

The Roth is beneficial in another way as well. If you need to withdraw money early for some reason, any contribution amounts made to a Roth – minus any interest or capital gains – are able to be withdrawn tax-free.

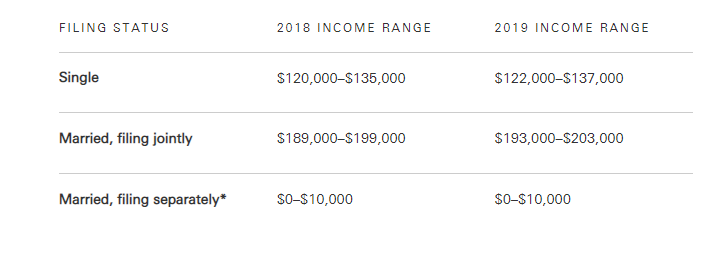

The kicker is, not everyone can take advantage of the power of the tax-free Roth IRA. Eligibility to contribute to a Roth is based on your income and begins to phase out as you hit the top of certain brackets. Looking at your tax filing status and so-called modified adjusted gross income (MAGI) determines the phase out. This chart from Vanguard shows the limits on income when it comes to a Roth.

The Bottom Line

All in all, the humble IRA account is a great addition to any savings, regardless of tax bracket.

Be sure check out our News section to keep track of the recent fund performances.