Mutual Fund Split

Be sure to read about adjusted NAV here.

Like stock splits, mutual fund splits are expressed as a ratio, such as 2:1 or 4:1. In a 4:1 split, the number of shares outstanding is quadrupled and the price per share is reduced to a quarter of its value.

To illustrate, imagine that you own 100 shares of a mutual fund at a NAV price of $40 per share. After the fund undergoes a 4:1 split, you now own 400 shares at a NAV price of $10 per share. In both cases, the value of your shares is $4,000. To account for the cost basis after the split, you would need to increase your position by the split rate (i.e., 4:1) and maintain your original total cost and holding period. You would also need to decrease your per-share costs by the magnitude of the split.

The Rationale Behind a Mutual Fund Split

This was confirmed by a well-known Wharton study, which showed that fund splits enhance the marketability of a mutual fund and succeed in bringing in new money.

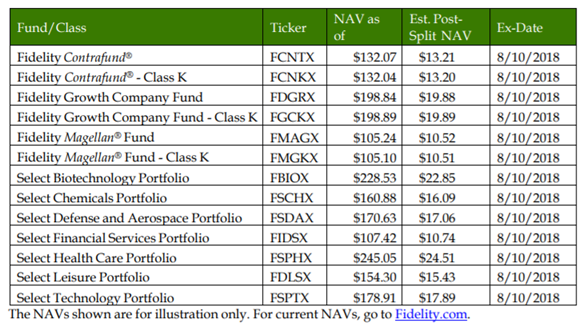

In August 2018, Fidelity Investments announced share splits on 13 mutual funds by a magnitude of 10:1. As you can see by the following chart, the NAVs were lowered significantly as a result of the new policy.

To learn more about other funds by Fidelity, check out the fund company page here.

A lower NAV is theoretically more attractive to individual investors, but since share-splitting has no impact on future gains, any benefit that is derived from this policy is purely psychological. That said, share splits make sense for mutual funds whose NAV has appreciated significantly over the years. By introducing a share split, investors may have more flexibility to buy shares in full rather than at a fraction.

Be sure check our News section to keep track of the recent fund performances.

The Bottom Line

Sign up for our free newsletter to get the latest news on mutual funds.