Data compiled by Bloomberg shows that about 20% of Puerto Rico’s debt is being held by mutual funds in the form of uninsured bonds. Although this is smaller than the numbers compiled three years ago, it clearly shows that smaller mutual fund investors still hold considerable stake in the bankrupt territory. As a result, several mutual funds with an exposure to Puerto Rico debt are about to enter a bankruptcy battle. As one could imagine, investors are keen on knowing their potential losses as well as the likelihood of losses resulting from their fund’s exposure.

Muni Bond Market Exposed

Oppenheimer is the top holder of Puerto Rican debt, with its Rochester Fund Municipals Fund exposed to $1.39 billion. Its Rochester High Yield Municipal Fund holds more than $741 million and its Rochester Limited Term New York Muni Fund another $712 million. Despite its exposure to Puerto Rico, the Rochester High Yield Municipal Fund was the best performing municipal fund of the last three years as per Bloomberg.

As of May 2017, OppenheimerFunds Inc. is the biggest holder of Puerto Rican debt with $6.3 billion. Franklin Resources Inc. is second at $3.1 billion. UBS Asset Managers and Goldman Sachs Group Inc. each hold about $1.4 billion and $1.2 billion, respectively. New York-based AllianceBernstein was a step ahead, having offloaded nearly all of its Puerto Rico debt holdings through 2015. This suggests the investment manager was aware of the crisis long before it threatened Puerto Rico’s solvency.

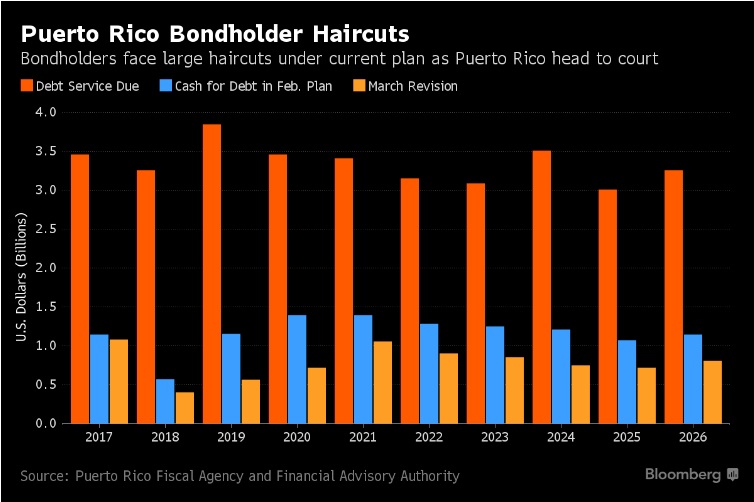

Despite being exposed to a highly volatile bankruptcy proceeding, the impacted funds are likely to recover given the strategies they’ve developed to either counteract the default or reduce its impact. This suggests they are in a position to absorb the losses. Although bondholders have taken a hit, they likely won’t be completely wiped out, given that Puerto Rico has offered general-obligation bondholders at least 70 cents on the dollar. This figure jumps to 90 cents if the territory’s finances rebound.

The controversial 70% haircut was approved by a seven-person Oversight Board on March 11. The plan outlines a method for boosting cash flow and reducing expenses, while also aiming to satisfy GO bondholders, who account for roughly 17% of Puerto Rico’s debts.

In case you are wondering whether mutual funds are right for you at all, read about why mutual funds, in general, should be a part of your portfolio.

Key Considerations for Investors

In the case of Puerto Rico, negative news headlines have been circulating for some time. Investors mistakenly assumed that the island wouldn’t go broke, and in a heap of speculation decided to scoop up swathes of government debt when others fled the scene. Although the bankruptcy filing was a surprise to many, bondholders were aware of the law Congress passed a year earlier, which allowed bankruptcy-like proceedings.

The Bottom Line

Be sure check our News section to keep track of the recent fund performances and to monitor latest developments in the Puerto Rico debt saga.