- Unsurprisingly, the flow picture worsened dramatically over the past few weeks, as a market sell-off quickly unfolded. Nearly $18 billion was withdrawn from mutual funds over the two weeks ended October 17. One important aspect to emphasize is the fact that bond funds experienced outflows after weeks of inflows, while equity funds have regained favor with investors.

- Equity mutual funds experienced outflows of around $3.8 billion for the two weeks ended October 17. Worth noting, flows for the five days ended October 17 were slightly positive at $111 million.

- The flow picture in bonds deteriorated rapidly, with all bond funds seeing nearly $9 billion in outflows for the two weeks ended October 17. This is the first time bond funds experienced outflows for two consecutive weeks since the end of 2016.

- The market rout intensified after the U.S. Federal Reserve struck a hawkish tone at its September meeting, as revealed by the minutes published two weeks ago. The Fed appears oblivious to President Donald Trump’s comments that the central bank should not raise interest rates.

- Across the Atlantic, the European Central Bank left its monetary policy unchanged. President Mario Draghi said the Eurozone economy still needs a great degree of monetary policy accommodation, but warned that stimulus withdrawal will not be delayed despite a string of disappointing economic data.

Click here to read our previous edition of scorecard.

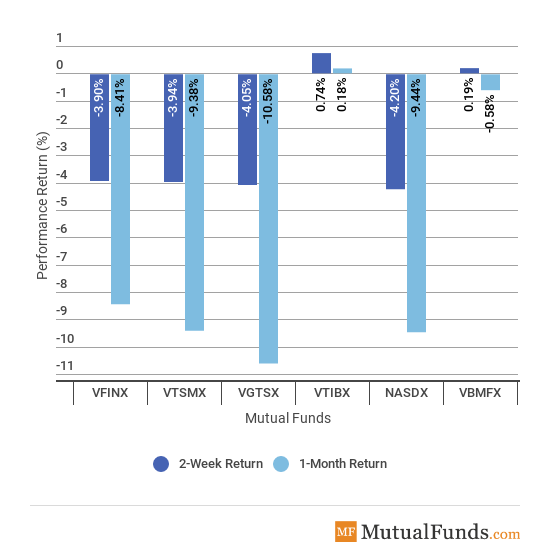

Broad Indices

- Technology-focused Nasdaq 100 (NASDX) was again the worst performer for the past two weeks, losing as much as 4.2% amid a worsening market rout.

- Low volatility instruments have continued to outperform. Vanguard’s International Bond Fund (VTIBX) grew 0.74% for the two weeks ended October 26, bringing monthly performance into positive territory at 0.18%. The international bond fund is the best performer both for the week and the rolling month.

- Vanguard’s international Stock Index (VGTSX) was the most hit for the rolling month, losing as much as 10.6%.

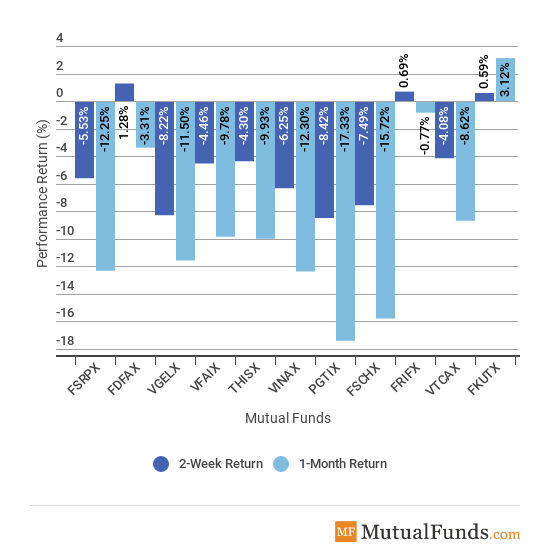

Major Sectors

- Amid a broad market sell-off, consumer staples are providing a buffer. Fidelity’s Consumer Staples Fund (FDFAX) gained 1.3%, helped by strong earnings reported by Procter & Gamble.

- Global technology stocks (PGTIX), meanwhile, are again the worst performers, with an abrupt decline of 8.42%. For the rolling month, T.Rowe’s global technology benchmark is down more than 17%, representing the worst performance.

- Utilities (FKUTX) are the only gainers for the rolling month, up 3.12%.

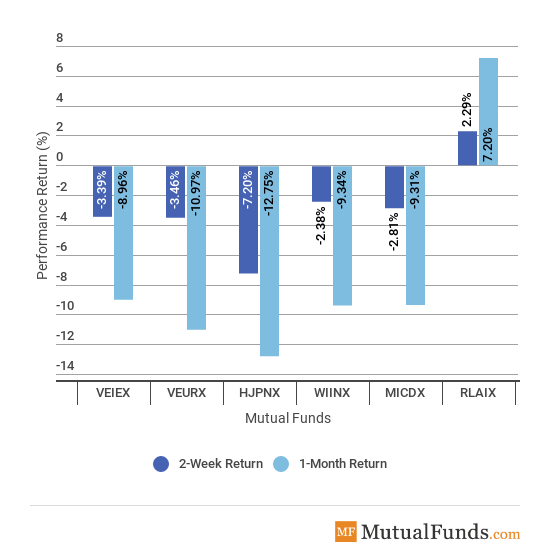

Foreign Funds

- Latin America (RLAIX) again came out the biggest winner from the pack, advancing 2.3%, even as Brazil’s far-right candidate won the presidential election. Jair Bolsonaro’s victory was widely expected, and although his overall views are regarded as extreme, he won markets over with a promise to implement liberal economic reforms. Latin America’s equities are also the only gainers for the rolling month, up 7.2%.

- Japanese stock market tracker, Hennessy Japan Investor Fund (HJPNX), is the worst performer both for the week and the rolling month, down 7.2% and 12.75%, respectively. The sell-off was in part driven by foreign investors.

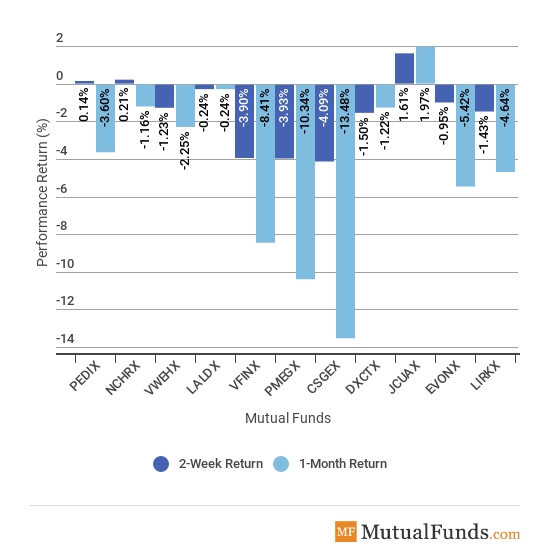

Major Asset Classes

- John Hancock’s Multicurrency Fund (JCUAX) is continuing its strong performance into the past two weeks, edging up 1.61%. The currency fund’s performance for the rolling month is the only bright spot in a bath of red. The fund is up nearly 2% for the past 30 days.

- Meanwhile, small-cap stocks were hammered. BlackRock’s Small Cap Growth Fund (CSGEX) posted the worst performance both for the week and the rolling month, down 4.09% and 13.48%, respectively.

The Bottom Line

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our news page here.