- Toward the end of October, outflows from mutual funds intensified, with $28.7 billion withdrawn during the week ended October 31 and $12.7 billion pulled out in the week prior.

- The lion’s share of outflows occurred in the realm of bond funds, with nearly $25 billion withdrawn over the two weeks. Equity mutual funds suffered less of a severe blow, as roughly $11 billion were pulled out. Large-cap equities was the only category that experienced inflows during the period, less than $300 million.

- The U.S. Democrats gained control of the House of Representatives for the first time in eight years, in a blow to President Donald Trump’s agenda of cost cuts and repealing the Affordable Care Act. Republicans won the Senate.

- The U.S. Federal Reserve maintained interest rates at 2.25%, but strongly signaled a rate hike will come in December, with a few more to follow next year. A recent market rout and an abrupt uptick in inflation have not convinced policymakers to withhold their fire, indicating they are pleased with the current environment.

- The U.S. jobs market is strong and improving. In October, the economy added 250,000 jobs versus the 194,000 expected by analysts. The unemployment rate stood flat at 3.7%, while average hourly earnings increased by 0.2%.

- Rising energy prices have taken inflation in the Eurozone above the European Central Bank’s target. Consumer prices in Europe were up 2.2% in October, largely due to rising prices for energy, food and alcohol. Stripping the volatile items, including energy, inflation was up just 1.1%.

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our news page here.

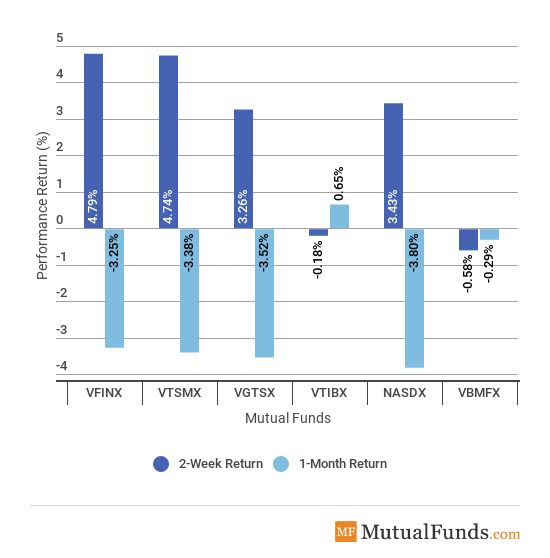

Broad Indices

- Large-cap equities were favored by investors over the past week, with the broad Vanguard 500 Index (VFINX) surging 4.79%, the best performer.

- Meanwhile, bond funds were beaten up. Vanguard Total Bond Market Index Fund Investor Shares (VBMFX) declined 0.58%.

- For the rolling month, technology-focused Nasdaq 100 (NASDX) is the worst performer, with a loss of 3.8%.

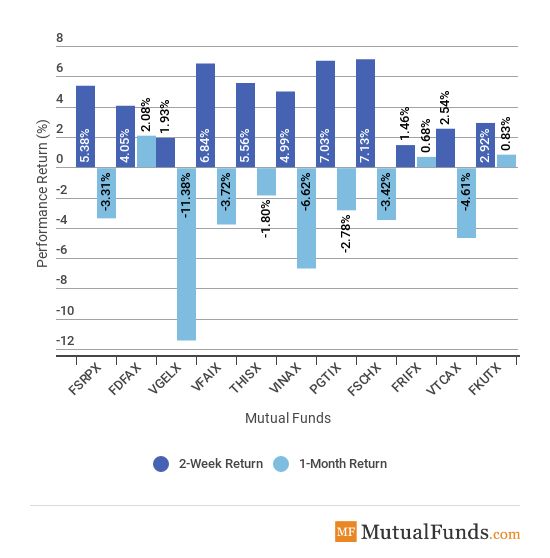

Major Sectors

- Chemicals were the best performers for the past two weeks, with Fidelity’s Select Chemicals (FSCHX) advancing 7.13%. In part, the strong performance was thanks to DowDuPont’s blowout earnings for the third quarter. DowDuPont makes up nearly a fourth of the index.

- On the other side of the spectrum, Fidelity Real Estate Income Fund (FRIFX) was up 1.46%.

- For the rolling month, the energy fund (VGELX) continued to be the worst performer, down as much as 11.4%.

- Meanwhile, consumer staples (FDFAX) were the best performers for the rolling month, with an advance of more than 2%.

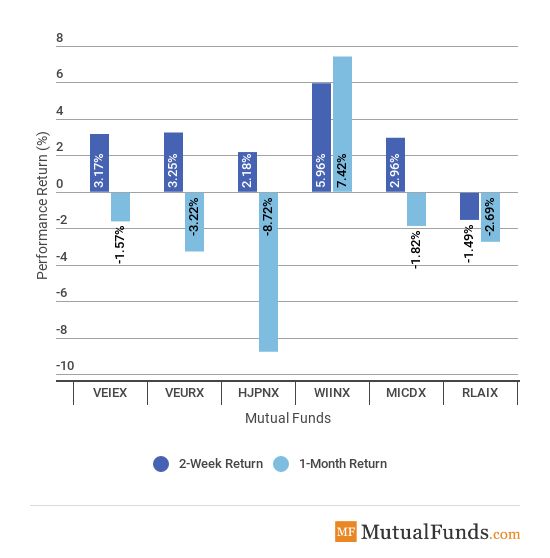

Foreign Funds

- India (WIINX) was by far the best performer for the past fortnight, up as much as 6%, as market sentiment improved and foreign outflows diminished in intensity. The strong fortnightly performance propelled Indian equities to the best performer spot for the rolling month as well, up 7.42%.

- After weeks of gains, Latin American Equities (RLAIX) back down for the past fortnight, being the only loser with a drop of 1.49%.

- For the rolling month, the Japanese stock market tracker, Hennessy Japan Investor Fund (HJPNX) remains the worst performer, down 8.72%. Bank of Japan admitted that it will not be able to achieve its goal of 2% inflation in the near future and downgraded economic forecasts.

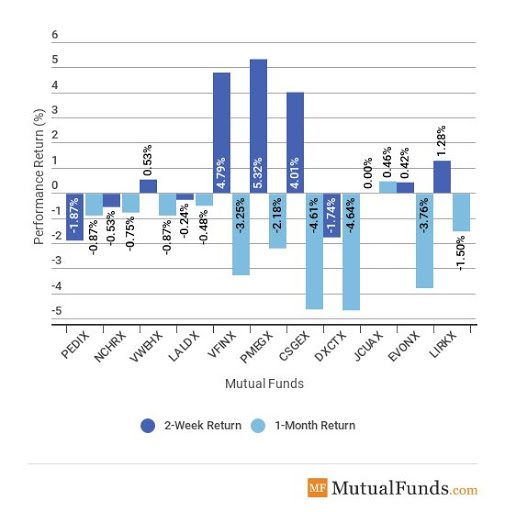

Major Asset Classes

- T.Rowe’s Mid-Cap Equity Growth Fund, (PMEGX) posted the strongest gains these past two weeks, jumping 5.32%. Technology, industrials and healthcare stocks make up more than half of the index, with Textron, Microchip Technology and Teleflex having the biggest individual weighting.

- PIMCO’s Extended Duration Fund, (PEDIX) declined 1.87% for the past two weeks, making it the worst performer.

- For the rolling month, John Hancock Multicurrency Fund (JCUAX) remains the best performer, with a tepid advance of 0.46%.

- Commodities (DXCTX) suffered the most severe blow for the rolling month, tumbling 4.6%.

The Bottom Line

Be sure to sign up for your free newsletter here to receive the most relevant updates.