- Nearly $20 billion were withdrawn from all types of mutual funds in the eight days through November 28, a continuation of the downtrend. Add the $17 billion in outflows recorded in the prior week, and the total outflows since the last scorecard stand at $37 billion.

- No asset class was spared this time around, with equity funds the biggest loser as outflows totaled nearly $18 billion for the two weeks ended November 20. Meanwhile, hybrid funds, which consist of a mix between bonds and stocks, saw the least amount of outflows, around $5.9 billion. Finally, bond mutual funds experienced over $12 billion in outflows.

- On the macro arena, China’s temporary truce with the U.S. was the biggest news, with investor hopes high that a trade war would be averted. The 90-day standstill to allow the parties to reach a mutually beneficial deal was followed swiftly by the arrest of a top Huawei executive in Canada. The unexpected move raised tensions on the political arena and weakened chances for a deal.

- The OPEC has agreed to cut global oil supply by 1.2 million barrels per day in a desperate bid to prop up plummeting prices. The cuts will last for six months, and the breakdown for each country was not disclosed. Russia, which is not part of OPEC, also agreed to the cuts, with one delegate saying the country and other non-OPEC members will reduce output by 400 million barrels.

- The European Union and Britain sealed a Brexit agreement only to reopen talks after it became clear there were not enough votes in the British Parliament to ratify the accord. The EU signaled openness on providing additional assurances to facilitate ratification but would not reopen the treaty.

- As the U.S. economy expanded by an annualized 3.5% in the third quarter, the Federal Reserve indicated that interest rates are just below their neutral point, a level that neither encourages nor discourages economic activity. Chair Jerome Powell’s comments triggered bets the American central bank would pause hiking interest rates.

Click here to read our previous edition of the scorecard.

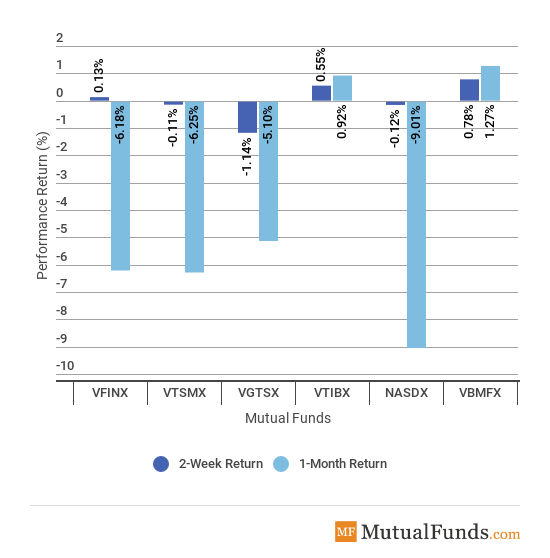

Broad Indices

- As equities resumed their slide in the past two weeks, bonds were favored by investors, Indeed, Vanguard’s Total Bond index (VBMFX) advanced as much as 0.78% in the two weeks ended December 7, the strongest performance from the pack. The fund, which invests about 30% in corporate bonds and 70% in government bonds, is also the best performer for the rolling month with a rise of 1.27%.

- International stocks (VGTSX) declined 1.14% for the past two weeks, the worst weekly performance.

- Meanwhile, technology-heavy (NASDX) was the worst performer for the rolling month with a stunning drop of more than 9%.

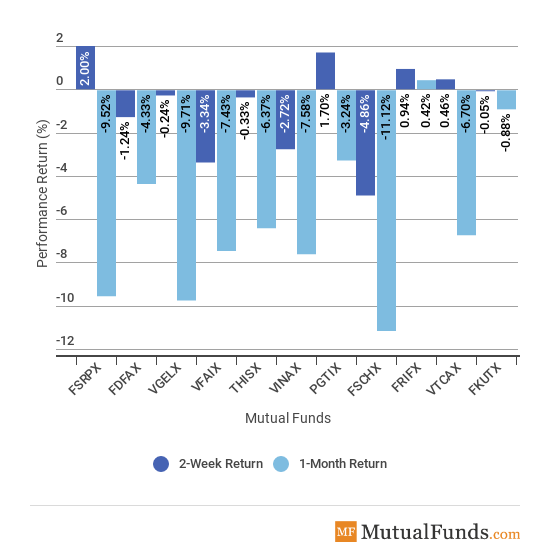

Major Sectors

- Sectors were mixed.

- The retail sector (FSRPX) is the best performer for the past two weeks, recovering some of the huge losses recorded recently. Indeed, retail stocks remain down 9.5% for the rolling month, among the worst performers.

- The chemicals sector (FSCHX) fell 4.86% for the past two weeks, with DowDuPont among the biggest detractors. The chemicals industry is also the worst performer for the rolling month, with a drop of 11.12%.

- For the rolling month, the real estate sector (FRIFX) was the only riser, up a tepid 0.42%.

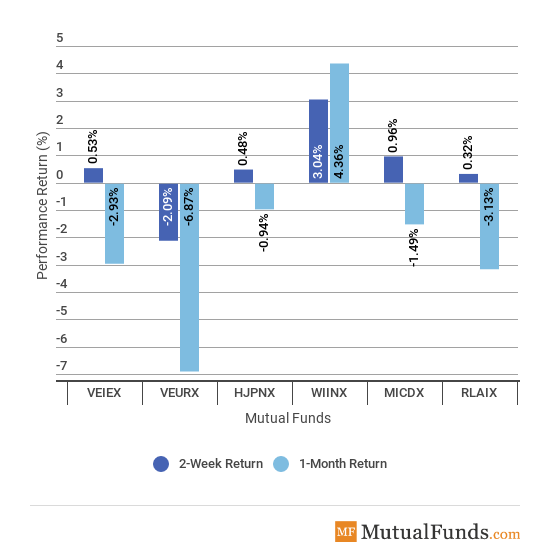

Foreign Funds

- India (WIINX) continued its impressive performance over the past two weeks, rising more than 3% amid a global market sell-off. Combined with the strong performance in the prior weeks, India is by far the best monthly performer, surging 4.36%.

- On the other side of the spectrum are European stocks (VEURX). As a result of renewed Brexit tensions and the slowing economy, Europe-wide stocks dropped more than 2% for the past two weeks. The recent decline was decisive to the index becoming the worst performer for the rolling month, down 6.87%.

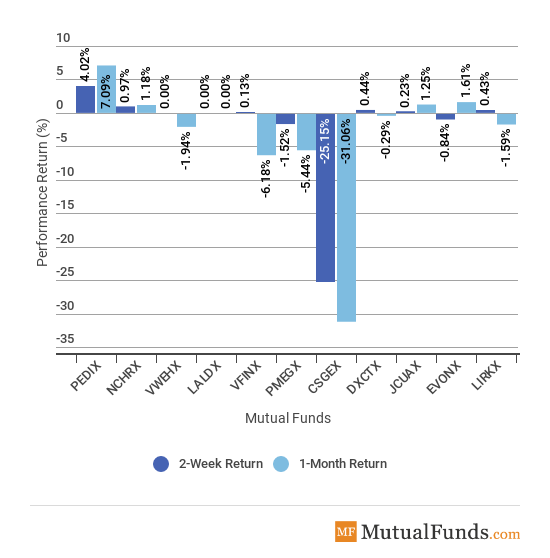

Major Asset Classes

- PIMCO’s bond fund (PEDIX) was the best performer both for the two weeks and the rolling month, as abruptly falling Treasury yields boosted the instrument. PEDIX jumped more than 4% for the past two weeks and is up 7% for the rolling month as investors cheered Fed Chair Powell’s comments that rates are close to their neutral level.

- Meanwhile, BlackRock’s small-cap fund (CSGEX) tumbled more than 25% for the past two weeks and 31% for the rolling month, representing the worst performance for both periods.

The Bottom Line

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, follow our news page here.