- The first week of January finally saw positive inflows in mutual funds across the board. More than $3 billion were plowed into long-term mutual funds in the week ended January 9, with equities leading the way.

- The last week of 2018, however, was not as fruitful. The January 2 week experienced outflows of $37 billion, bringing the two-week flow at negative $34 billion. While equities saw more than $8 billion in outflows for the two-week period, bonds fared worse, as more than $20 billion was withdrawn from the asset class.

- In a largely expected move, British Parliament voted against a Brexit deal negotiated by Prime Minister Theresa May, likely paving the way to a delay of Brexit or an exit on better terms for the business community. Another referendum on Brexit is also increasingly likely.

- The U.S. labor market has been unusually strong, with the economy adding 312,000 jobs in the last month of the year. Meanwhile, hourly earnings rose by 0.4% compared with 0.3% expected by analysts.

- Leading indicators, however, such as purchasing managers’ indexes, have dropped across the board. U.S. non-manufacturing PMI dropped by 3 points to 57.6. The U.S. consumer sentiment dropped to a two-year low of 90.7 in January compared with 97.0 expected by economists.

- Inflation has also been weak, dropping in the U.S., Eurozone and the UK European consumer price index (CPI) came in at 1.6%, the lowest from the pack, while UK CPI was the highest at 2.1%. The U.S. CPI stood at 1.9% in December.

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our News page here.

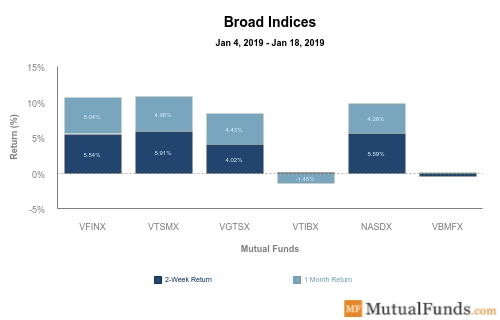

Broad Indices

- The U.S. stock market (VTSMX) was the best performer from the pack with a strong advance of 5.91%.

- Meanwhile, the bond market (VBMFX) was the only faller with a decline of 0.48%.

- For the rolling month, the S&P 500 (VFINX) rose more than 5%, becoming the best performer.

- International bonds (VTIBX) were again the worst performers from the bunch for the rolling month, shedding 1.45%.

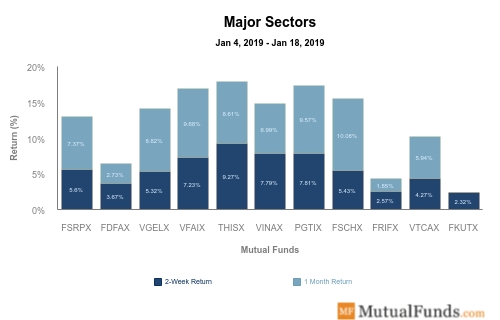

Major Sectors

- Sectors were all up.

- T.Rowe’s healthcare mutual fund (THISX) powered ahead over the past two weeks, advancing 9.27%.

- For the rolling month, however, Fidelity’s chemicals fund (FSCHX) surged more than 10%, taking the top performer spot.

- Meanwhile, utilities (FKUTX) posted the weakest performance both for the past two weeks and the rolling month, up 2.32% and flat, respectively.

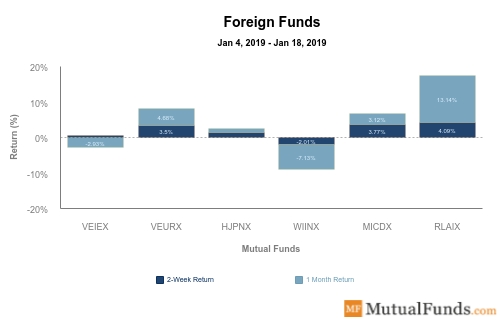

Foreign Funds

- Latin American equities (RLAIX) are having a great start to the year, outperforming their foreign counterparts by a large margin. T.Rowe’s Latin America-focused mutual fund is up 4.09% and 13.14% in the past two weeks and rolling month, respectively.

- At the other end of the spectrum is India (WIINX), which dropped 2% and 7.13% for the past two weeks and rolling month, respectively, amid concerns about a global economic slowdown.

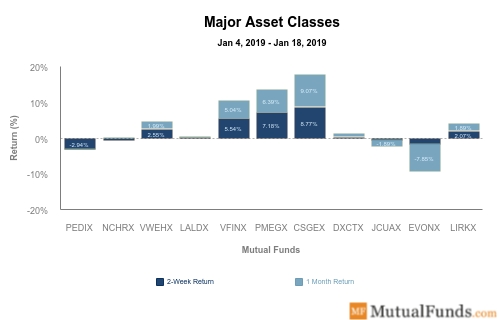

Major Asset Classes

- PIMCO’s long-term bonds fund (PEDIX) was the worst-performing asset class, falling by 2.94% over the past two weeks, as investor optimism about equities improved.

- BlackRock’s small-cap stock fund (CSGEX) was by far the best performer, rising 8.77% for the past two weeks and 9% for the rolling month. The gains come as the U.S. labor market is strong, although sentiment has been declining across the board.

- Managed Futures (EVONX) were the biggest fallers for the past month, losing 7.85%.