- The last two weeks experienced positive total inflows as a market recovery unfolded after the Federal Reserve signaled it would not continue with the interest rate hiking cycle for the time being.

- For the two weeks ended January 23, more than $21 billion was poured into mutual funds, compared with negative flows of $34 billion in the prior two-week period. Bonds experienced the biggest inflows, more than $13 billion, while equities saw positive flows of around $7.5 billion. Bonds reversed an eight-week streak of negative flows, while equities had seen 13 weeks of outflows before the January 9 week, when it experienced $3 billion in inflows.

- At the World Economic Forum in Davos, globalization was praised by the Chinese Vice President Wang Qishan, while outgoing German Chancellor Angela Merkel called for a quick return to normal monetary policy.

- Merkel’s comments came shortly before the Fed made a dramatic reversal on monetary policy guidance, dashing hopes that the policymakers would increase interest rates twice this year.

- The U.S. government shutdown ended, at least for a short while, after President Donald Trump signed a bill to reopen the government. Trump did not receive funding for a wall across the Mexican border.

- Amid global trade worries, the U.S. job market could not be in better shape. The U.S. economy added 304,000 jobs in February, beating estimates of 165,000. However, the figure for December was abruptly revised down from 312,000 to 222,000. Meanwhile, wages increased by 0.1% in January, below expectations of 0.3% growth. Wages rose 3.2% annually.

- The unemployment rate continued to rise as the government shutdown put people out of work. The jobless rate advanced to 4% from 3.9%.

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, visit our News page here.

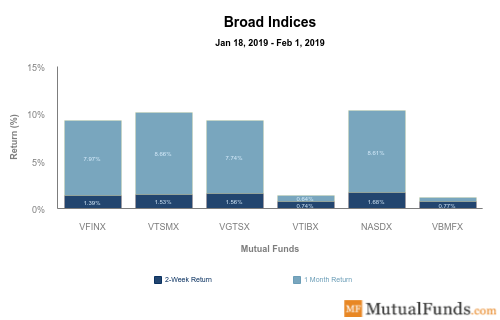

Broad Indices

- Technology stocks fund (NASDX) was the best performer for the past two weeks, jumping 1.68%. Technology stocks were within a whisker of becoming the best performers for the rolling month, up 8.61%.

- On the other side of the spectrum, Vanguard’s international bonds fund (VTIBX) was the worst performer, rising just 0.74%.

- For the rolling month, however, Vanguard’s total bond market fund (VBMFX) posted the weakest gains, up 0.38%.

- The best performer for the rolling month is the Vanguard’s broad market fund (VTSMX), advancing 8.66%.

Be sure to check out our previous edition of the scorecard here.

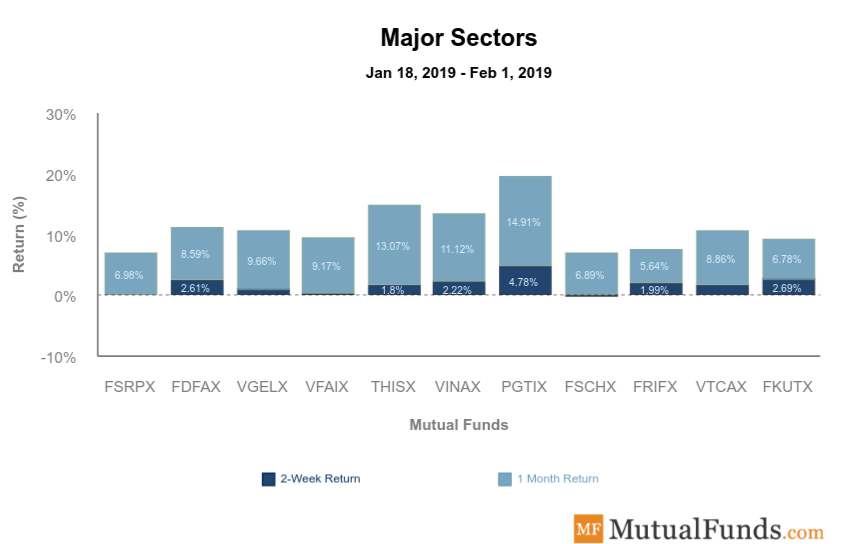

Major Sectors

- Sectors were all up with one exception.

- T.Rowe’s technology fund (PGTIX) is by far the best performer both for the week and the rolling month, up 4.78% and 14.91%, respectively.

- Fidelity’s chemicals fund (FSCHX) declined 0.15%, after taking the spot of the best performer in the previous scorecard.

- The Fidelity’s real estate fund (FRIFX) increased by 5.64% for the rolling month.

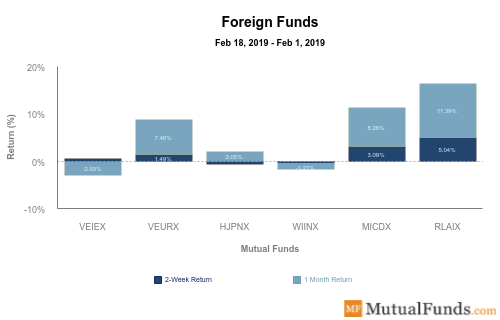

Foreign Funds

- Foreign funds were mixed.

- T.Rowe Price’s Latin American fund (RLAIX) again posted the best performance both for the week and the rolling month, up 5% and 11.39%, respectively.

- Hennessy’s Japanese fund (HJPNX) fell 0.6%, becoming the worst performer for the past 2 weeks.

- For the rolling month, Vanguard’s emerging markets fund (VEIEX) fell the most from the pack, down nearly 3%.

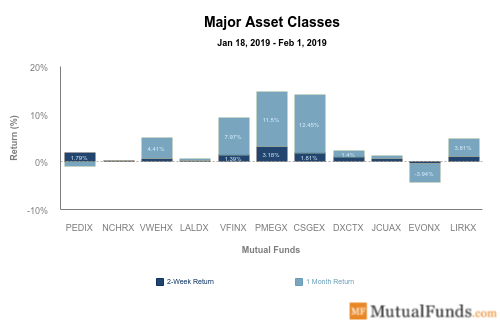

Major Asset Classes

- As an asset class, managed futures (EVONX) continued to be the worst performer from the pack, falling 0.34% and 3.94% for the past two weeks and rolling month, respectively.

- T.Rowe Price’s mid-cap fund (PMEGX) gained 3.18% for the past two-week period and was close to becoming the best performer for the rolling month as well.

- BlackRock’s small-cap fund (CSGEX) is up 12.45% for the past four weeks, the best performance from the pack.

The Bottom Line

Be sure to sign up for your free newsletter here to receive the most relevant updates.