Stocks surged this week on the back of some encouraging economic data.

Inflation has been a stubborn foe for the last year or so, but the trend of sharply rising prices seems to have finally ended. The CPI dipped to 3.2% year-over-year in October, lower than estimates of 3.3% and well below last month’s reading of 3.7%. This gave investors confidence that the Fed’s path and plan was working and that the central bank will continue to keep rates steady. Expectations of a rate cut for 2024 rose, sending the broader markets surging with investors looking towards growth stocks. Other data on the week showed that the economy was cooling, with monthly retail sales dipping for the first time in seven months. The October number dipped by 0.1%, partly dragged down by lower spending on motor vehicles. This was below forecasts of a 0.2% gain. Warnings from retail giant Walmart showed that the consumer economy is weakening. However, building permits and housing starts data surprised higher, muting stock market gains towards the end of the week.

The Thanksgiving holiday will bring a shortened trading week for investors. However, there still will be several important data points on the week. This includes the latest FOMC meeting minutes, which will be revealed on Tuesday. After last week’s pause and the recent downtick in inflation, investors will be keen to hear exactly what the Fed has in store for its direction on interest rates and its overall take on future monetary policy. While Fed Chair Jerome Powell has expressed that more rate hikes could be in store, it will be interesting to hear the exact mindset of the Fed and if rate cuts are on the table anytime soon. Elsewhere, investors will see the release of month-over-month durable goods orders on Wednesday. While the number surged to 4.7% in September thanks to strong demand for transportation equipment, analysts now expect the figure to decline by 2.8% for October. Initial jobless claims will also be a major data point on Wednesday, expecting to clock in at 226,000 for the week ending November 18. This expected number would continue to indicate a strong labor market. Meanwhile, existing home sales for October are likely to show a continued downtrend seen over the last few months and are expected to fall by 1.3% when it is released on Tuesday.

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

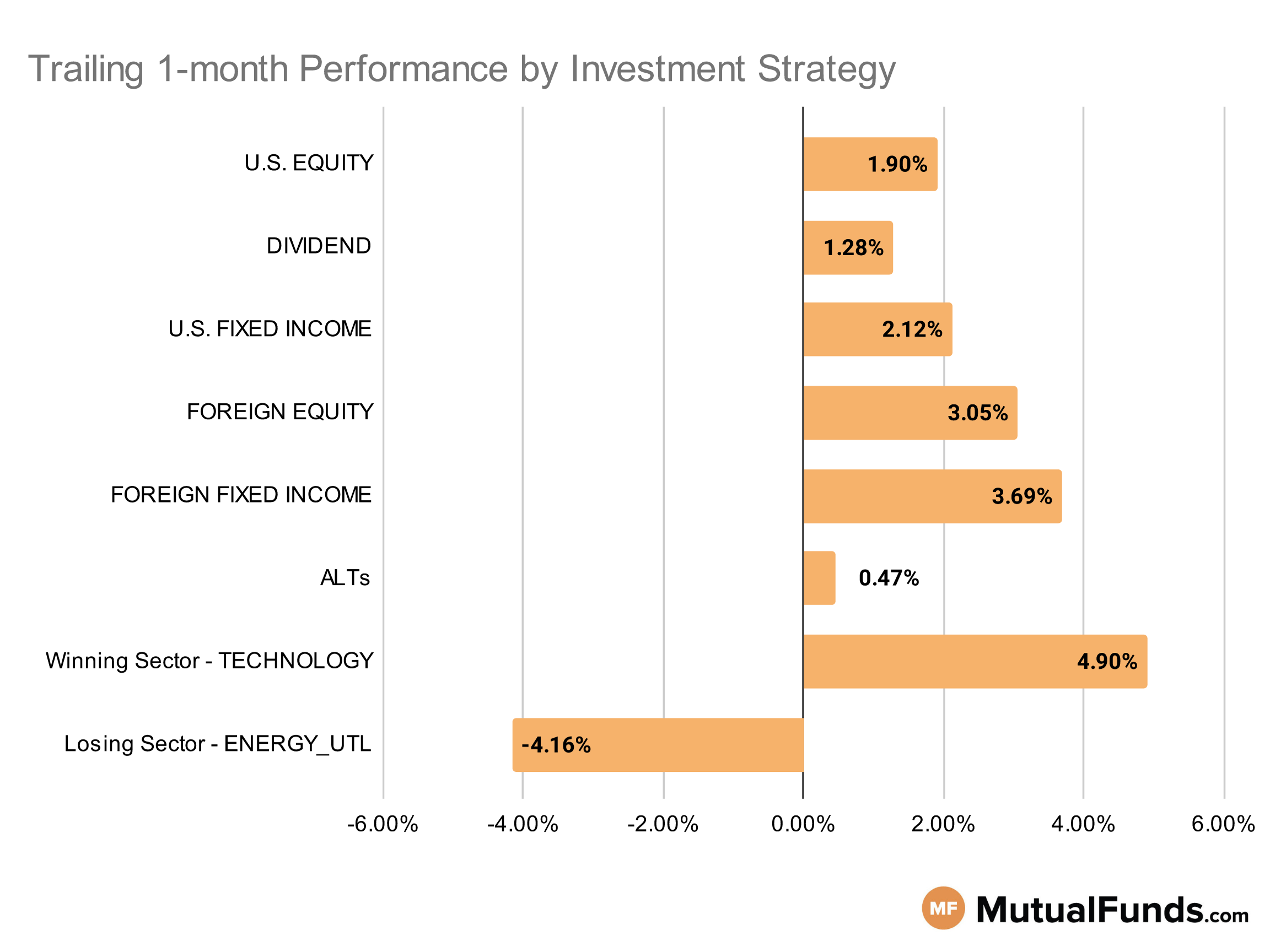

Overall, the U.S. stock markets continued their upward trajectory for the rolling month.

Strategies focused on home construction, technology, are foreign equities posted some of the best performances for the rolling month. Meanwhile, energy-focused strategies struggled.

U.S Equity Strategies

Large-cap growth strategies continue to perform better than their mid and smaller-cap counterparts.

Winning

- Touchstone Sands Capital Select Growth Fund (TSNCX) , up 9.53%

- MainStay Winslow Large Cap Growth Fund (MLRTX), up 7.35%

- Invesco Dynamic Large Cap Growth ETF (PWB) , up 6.89%

- iShares Morningstar Growth ETF (ILCG), up 4.92%

Losing

- SPDR® S&P 400 Mid Cap Growth ETF (MDYG) , down -0.49%

- iShares S&P Mid-Cap 400 Growth ETF (IJK), down -0.53%

- Jackson Square SMID-Cap Growth Fund (JSMVX) , down -3.44%

- Virtus KAR Small-Cap Growth Fund (PXSGX), down -4.99%

Dividend Strategies

Several small can mid-cap dividend strategies posted positive performance for the rolling month, while some high dividend strategies lost ground.

Winning

- Delaware Ivy Mid Cap Income Opportunities Fund (IVOYX) , up 3.69%

- Ivy Mid Cap Income Opportunities Fund (IVOSX), up 3.65%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV) , up 3.47%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), up 3.35%

Losing

- HCM Dividend Sector Plus Fund (HCMNX) , down -0.76%

- iShares Core High Dividend ETF (HDV), down -1.54%

- WisdomTree U.S. High Dividend Fund (DHS) , down -1.81%

- DWS CROCI Equity Dividend Fd (KDHSX), down -1.84%

U.S. Fixed Income Strategies

In US fixed income, long-duration strategies posted gains while floating and convertible bond strategies struggled.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX) , up 8.37%

- PIMCO Extended Duration Fund (PEDPX), up 7.62%

- SPDR® Portfolio Long Term Corporate Bond ETF (SPLB) , up 5.53%

- iShares 10+ Year Investment Grade Corporate Bond ETF (IGLB), up 5.23%

Losing

- Miller Convertible Bond Fund (MCIFX) , down -0.91%

- iShares Floating Rate Bond ETF (FLOT), down -2.54%

- AlphaCentric Income Opportunities Fund (IOFCX) , down -3.79%

- ProShares Short 20+ Year Treasury (TBF), down -4.87%

Foreign Equity Strategies

Mexican and Brazilian equity strategies posted positive performances unlike Chinese equity strategies, which continued to struggle.

Winning

- iShares MSCI Mexico ETF (EWW) , up 11.39%

- iShares MSCI Brazil ETF (EWZ), up 9.89%

- Franklin International Growth Fund (FNGZX) , up 8.1%

- Brown Capital Management International Small Company Fund (BCSVX), up 7.51%

Losing

- DFA International Value III Portfolio (DFVIX) , down -0.24%

- Lord Abbett Developing Growth Fund (LADVX), down -0.7%

- Horizon Kinetics Inflation Beneficiaries ETF (INFL) , down -1.78%

- KraneShares Bosera MSCI China A ETF (KBA), down -1.95%

Foreign Fixed Income Strategies

Emerging market bond strategies continue to post positive performance for the rolling month.

Winning

- Ashmore Emerging Markets Total Return Fund (EMKIX) , up 6%

- Fidelity Advisor® New Markets Income Fund (FNMIX), up 5.15%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC) , up 5.04%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), up 4.39%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) , up 3.86%

- Invesco International Bond Fund (OIBIX), up 2.87%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , up 1.83%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 1.09%

Alternatives

Among alternatives, preferred stock strategies continue to post strong performance while certain commodity strategies struggled.

Winning

- SPDR® ICE Preferred Securities ETF (PSK) , up 6.89%

- Invesco Preferred ETF (PGX), up 6.74%

- Columbia Contrarian Core Fund (SMGIX) , up 3.8%

- Fidelity Advisor® Mortgage Securities Fund (FIKUX), up 3.52%

Losing

- PIMCO TRENDS Managed Futures Strategy Fund (PQTIX) , down -4.43%

- AlphaSimplex Managed Futures Strategy Fund (AMFAX), down -4.71%

- iShares S&P GSCI Commodity-Indexed Trust (GSG) , down -7.77%

- ETFMG Alternative Harvest ETF (MJ), down -11.87%

Sectors

Among the sectors, home construction and technology continued to outperform others, while energy strategies struggled.

Winning

- iShares U.S. Home Construction ETF (ITB) , up 12.87%

- ARK Next Generation Internet ETF (ARKW), up 11.49%

- Putnam Global Technology Fund (PGTYX) , up 9.06%

- T. Rowe Price Global Technology Fund (PRGTX), up 8.38%

Losing

- Vanguard Energy Index Fund (VENAX) , down -8.93%

- Fidelity® Select Energy Portfolio (FSENX), down -8.94%

- Invesco DB Oil Fund (DBO) , down -13.51%

- United States Oil Fund, LP (USO), down -13.64%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.