With investors always looking for a way to beat the market, can behavioral finance-oriented funds help? Let us find out.

In case you are wondering whether mutual funds are right for you at all, you should read why mutual funds, in general, should be a part of your portfolio.

The Biggest Behavioral Errors Made by Investors

- Herd mentality – This concept is also known as ‘following the crowd.’ We go along with what the crowd is doing because it’s more comfortable and easier to rationalize. When everybody is buying stocks, like they did during the dot-com bubble, it’s easier to decide that it must be the right choice if everyone is doing it. Investors kept buying for fear of missing out on further gains instead of recognizing that tech stocks were wildly overvalued

- Confirmation bias – This occurs when you choose to give greater weight to information that confirms your own beliefs, and minimize that to which you disagree. An investor might read a report that puts a buy rating on a stock that he or she owns and conclude that it’s correct, while ignoring one that suggests the stock should be sold, leading to an imbalance of accepted data.

- Loss aversion – This is the implication that the pain felt when taking a loss is greater than the joy experienced in making a profit. This often leads to investors refusing to take a loss on an investment, and saying things such as, “I’ll sell it when it gets back to where I bought it.” Investors in this situation might hang on to potentially poor investments for longer than they should, resulting in additional losses.

How Behavioral Finance Shows Up in Mutual Funds

Behavioral finance shows up in contrarian strategies, such as the Fidelity Contrafund (FCNTX), which look for companies whose value the manager believes are not fully recognized by the public. Momentum funds, such as the AQR Large Cap Momentum Fund (AMOMX), try to exploit the fact that investors like to buy stocks that are showing an upward price trend.

How Have Behavioral Funds Performed?

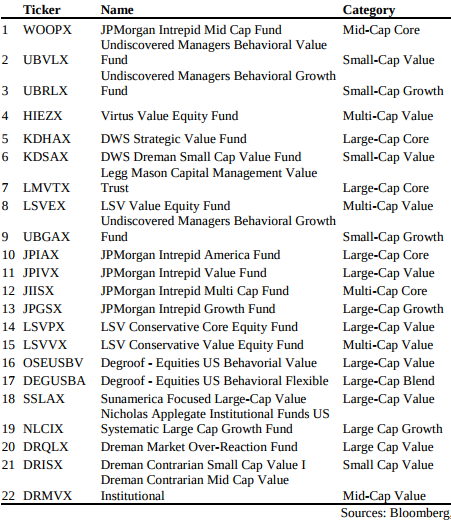

The authors of this 2013 study about the performance of behavioral funds found that, while they outperform active funds in general, they failed to deliver superior risk-adjusted returns. A second study, also from 2013, came to a similar conclusion, finding that there is no evidence of outperformance by behavioral funds on a risk-adjusted basis. The group of 22 funds examined delivered less alpha, as measured by the Sharpe ratio and Treynor ratio, than the broader market, while exhibiting greater risk. Moreover, behavioral funds also failed to produce superior returns around the time of the financial crisis, when opportunities to exploit mispricings should have been at their greatest.

Learn more about why investors are fleeing actively managed funds.

Behavioral Funds at Play

The J.P. Morgan Intrepid Value Fund (JIVAX) is another example of a behavioral fund, which focuses on value, quality and momentum factors to drive returns. It has been a relatively average performer over its life, earning a 3-star rating from Morningstar.

Check out this article that dispels some of the myths surrounding active management.

The Bottom Line

Be sure to check our News section to keep track of recent fund performances.