- The flow picture largely remained unchanged in the past two weeks, with capital withdrawn from equity funds and plowed into bonds.

- Total estimated outflows for the two weeks ended September 19 was $7.2 billion, lower compared to the prior two weeks. As usual, equity funds experienced outflows of more than $9.5 million, while bonds saw over $5 billion in inflows. Hybrid funds, which consist of both equities and bonds, experienced outflows of $2.8 billion. Taxable bonds were also in vogue, seeing around $5 billion in inflows.

- The U.S. and Canada have finally reached a trade deal to replace NAFTA. The new agreement, which also includes Mexico, governs more than $1 trillion in trade and will last 16 years. The deal will be reviewed every six years.

- The trade dispute between China and the U.S. has escalated, with both countries slapping additional tariffs on each other’s imports. U.S. was first to target $200 billion worth of Chinese imports with a 10% tariff. China struck back, imposing levies on $60 billion U.S. imports.

- The U.S. Federal Reserve has increased interest rates to 2.25%, in a widely expected move. The U.S. central bank exacerbated confidence in the economy and indicated another hike was possible this year, followed by three additional ones in 2019.

- Bank of Japan, meanwhile, kept its monetary policy steady, as expected, and committed to keeping interest rates low for a long period of time.

- Check out our previous edition of scorecard here.

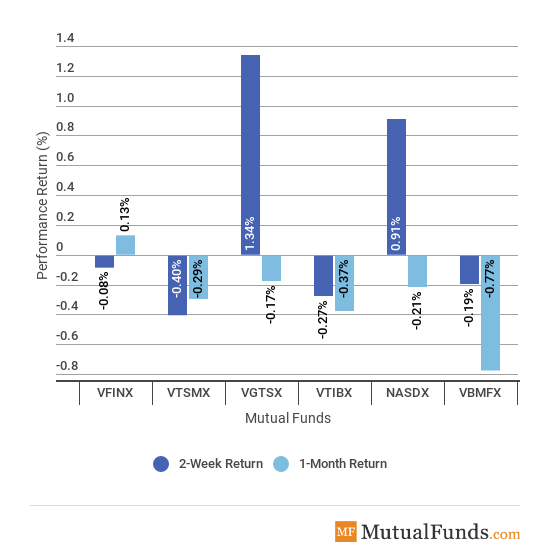

Broad Indices

- International equities (VGTSX) and technology stocks (NASDX) were the only assets that recorded positive performance over the past two weeks, up 1.34% and 0.91%, respectively.

- Meanwhile, the U.S. market shed some gains these past two weeks, with the overall market (VTSMX) falling 0.40%.

- The S&P 500 (VFINX) remains the only gainer for the rolling month, up 0.13%.

- Likely as a consequence of rising interest rates, overall bond market (VBMFX) were the worst performers for the rolling month, declining 0.77% for the past 30 days.

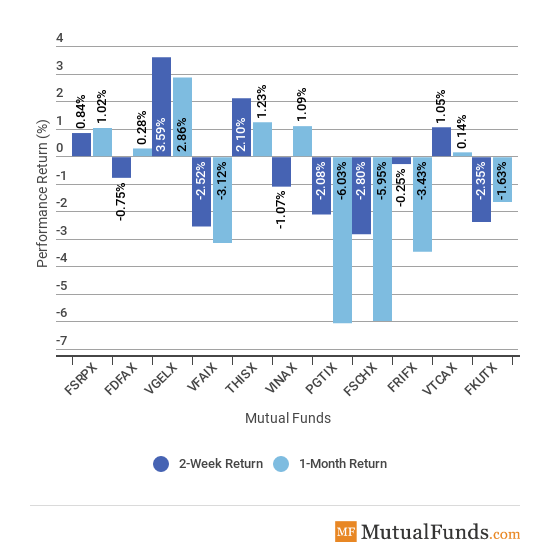

Major Sectors

- The energy sector (VGELX) was the best performer for the past two weeks on strong demand for oil and energy. The fund gained as much as 3.59%, propelling it to the top performer status for the rolling month, up 2.86%.

- The materials sector (FSCHX) dropped 2.80% in the past two weeks, the biggest loss from the pack.

- Meanwhile, T.Rowe’s global technology benchmark (PGTIX) was the main loser for the month with a decline of more than 6%.

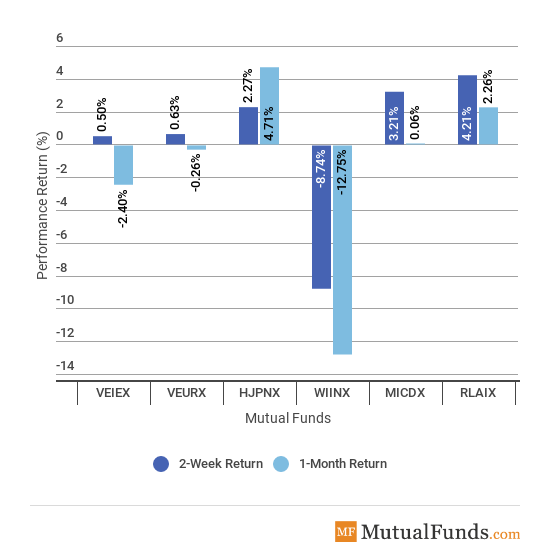

Foreign Funds

- Latin America (RLAIX) gained as much as 4.21% for the past two weeks, as investors viewed the battered equities as undervalued.

- On the other side of the spectrum, India (WIINX) lost more than 8% due to fears of contagion from a potential bankruptcy in its shadow banking sector. Unsurprisingly, India is also the worst performer for the rolling month with double-digit losses.

- Japanese equities (HJPNX) soared 4.71% in the past 30 days, representing the best performance from the pack.

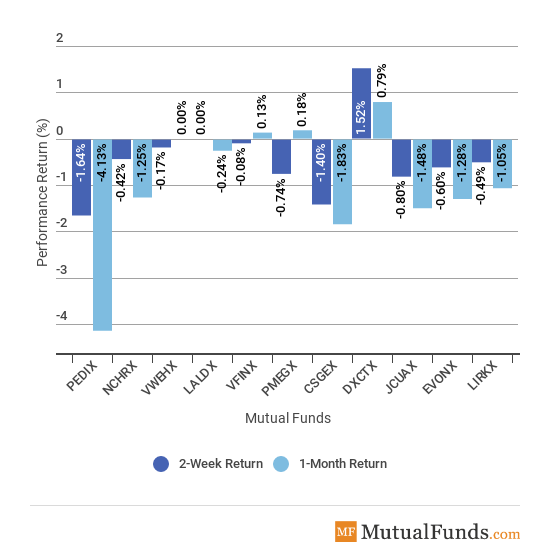

Major Asset Classes

- PIMCO’s long-term bonds fund (PEDIX) was the worst performer for the past two weeks, as the Federal Reserve raised interest rates again. Long-term bonds also underperformed for the rolling month, down 4.13%. To learnhow rising interest rates can impact mutual funds, read here.

- The commodities fund (DXCTX) was by far the best performer for the past two weeks, up 1.52%. With a gain of just 0.79%, Direxion’s commodity-focused vehicle is the best performer for the rolling month.

The Bottom Line

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our News page here.